With reports that Klarna have sold shares in a secondary deal that now values the company at $2.25 billion, they are due to shoot up the valuation charts and are set to become Europe's 4th highest valued (and the world's 42nd) VC-backed private company.

With Spotify easily Europe's most valuable VC-backed private company right now with a $8.53 billion valuation, incredibly, Sweden (and, even more accurately, Stockholm) are now home to two of Europe's biggest private companies.

But who else is flying the flag for Europe when it comes to building highly-valued VC-backed private tech businesses, and where do they come from?

Using WSJ's 'The Billion Dollar Startup Club', GP Bullhound's research report on European 'Unicorns' and our own proprietary dataset, I took a look at how Klarna's latest valuation will shake up the order of Europe's top highly-valued companies and where they subsequently rank on a global scale.

1. Spotify (Sweden) valued at $8.53 billion.

Global ranking: 14th

Total funding: $1.1 billion (valuation is x 7.75 total funding)

Spotify became Europe's most valuable private tech company when they raised a massive $526 million Series G in what was Europe's biggest round in 2015 so far, and one of only two $500 million+ rounds that Europe has seen this year (OneWeb was the other). The mega-round propelled their valuation to $8.53 billion, well beyond any other private European tech company.

Investors: Abu Dhabi Investment Council, Accel Partners, Baillie Gifford, Coca-Cola, Creandum, D.E. Shaw, Digital Sky Technologies, Discovery Capital Management, Fidelity Investments, Founders Fund, Goldman Sachs Group, GSV Capital, Halcyon Asset Management, Kleiner Perkins Caufield & Byers, Landsdowne Partners, Li Ka Shing Foundation, Northzone Ventures, Rinkelberg Capital, Senvest Capital, Technology Crossover Ventures, P. Schoenfeld Asset Management, TeliaSonera, Wellington Partners.

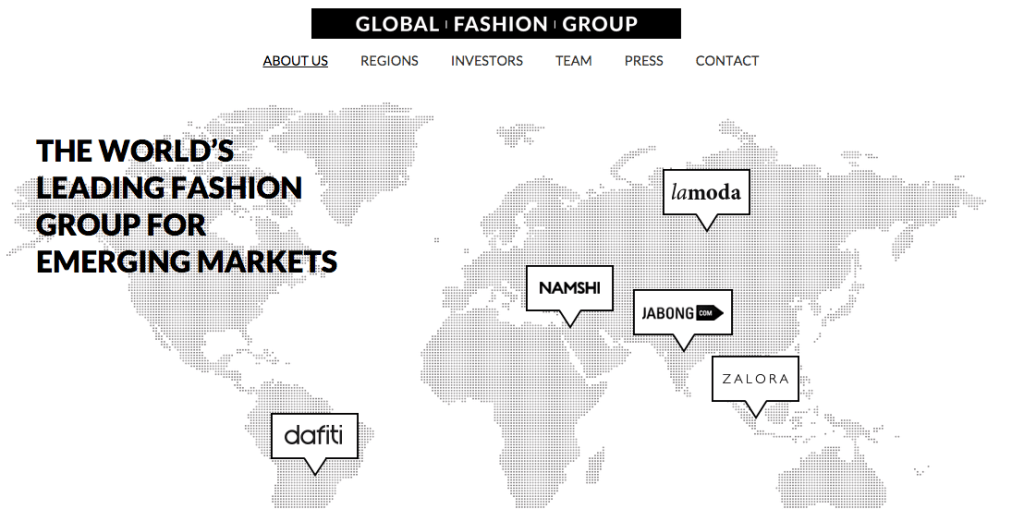

2. Global Fashion Group (Germany) valued at $3.4 billion

Global ranking: 24th

Total funding: $1.5 billion (valuation is x 2.27 total funding)

Global Fashion Group was formed around a year ago as a joint venture between Rocket Internet and Kinnevik, and was the coming together of a number of fashion focused businesses backed by the two. An internal fundraising round last month, gave them a post-money valuation of $3.4 billion.

Investors: Kinnevik, Rocket Internet, Access Industries, Summit Partners, Verlinvest, Ontario Teachers’ Pension Plan, Tengelmann Ventures.

3. Delivery Hero (Germany) valued at $3.1 billion

Global ranking: 27th

Total funding: $1.3 billion (valuation is x 2.38 total funding)

Ahead of a possible IPO late this year/early next, Delivery Hero raised $110 million from two unnamed private US investors at a post-money valuation of $3.1 billion in June. Having raised well over $1 billion already, don't be surprised if they raise again before the expected IPO.

Investors: Anchorage Capital Group, Insight Venture Partners, Kite Ventures, Kreos Capital, Luxor Capital, Point Nine Management, Putnam Investments, ru-Net Ventures, Rocket Internet, Team Europe Ventures, Tengelmann Ventures, Vostok Nafta Investment.

4. Klarna (Sweden) valued at $2.25 billion

Global ranking: 42nd

Total funding: $299 million (valuation is x 7.53 total funding)

It appears that 'company insiders' have sold secondary shares worth $80 million to Northzone, Wellington Management and Wellcome Trust. This secondary transaction would value the company at $2.25 billion, which means its valuation has risen by approximately 61% since it raised $100 million at a $1.4 billion valuation last year.

Investors: Atomico, DST Global, General Atlantic, Harvest Growth, Institutional Venture Partners, Northzone, Partners Group, Sequoia Capital, Wellcome Trust, Wellington Management.

5. Adyen (The Netherlands) valued at $1.5 billion

Global ranking: 59th

Total funding: $500 million (valuation is x 3 total funding)

In what was the second biggest round in Europe in 2014, Adyen raised $250 million at an impressive $1.5 billion valuation at the end of last year. This round actually accounted for nearly half of the venture capital that companies from The Netherlands raised in 2014, meaning they truly are flying the flag for both The Netherlands and Europe. We recently interviewed Adyen CEO Pieter van der Does.

Investors: Felicis Ventures, General Atlantic, Index Ventures and Temasek Holdings.

6. FanDuel (United Kingdom) valued at $1.3 billion

Global ranking: 68th

Total funding: $363 million (valuation is x 3.58 total funding)

Despite the US trying to claim FanDuel as one of its own due to its US product focus and their presence there, FanDuel is very much a European company, having been founded in Edinburgh, Scotland in 2009. Their $275 million Series E last month brought their total funding to $363 million, and their valuation to $1.3 billion.

Investors: Kohlberg Kravis Roberts, Google Capital, Time Warner Investments, Shamrock Capital Advisors, NBC Sports Ventures, Bullpen Capital, Pentech Ventures and Comcast Ventures.

7. Infinidat (Israel) valued at $1.2 billion

Global ranking: 72nd

Total funding: $230 million (valuation is x 5.22 total funding)

Infinidat were pretty much flying under the radar until they announced they'd raised $150 million, giving them a $1.2 billion valuation. Going public is firmly in their sights, and they've even stated that this funding round may be enough to see them through until their planned IPO.

Investors: TPG Growth, MII Ltd.

8. Home24 (Germany) valued at $1 billion

Global ranking: 83rd

Total funding: $1 billion (valuation is x 1 total funding)

The third and final Rocket-backed company on this list, Home24 passed the billion dollar valuation mark when they raised €120 million in June, including €20 million from existing shareholders, such as Rocket. This latest round saw UK-based investment firm Ballie Gifford enter the cap table.

Investors: Investment AB Kinnevik, JPMorgan Chase, REWE, Rocket Internet, Zimmermann Investment.

9. Shazam (United Kingdom) valued at $1 billion

Global ranking: 83rd

Total funding: $170 million (valuation is x 5.88 total funding)

Shazam's $30 million round at the beginning of this year, managed to tip its value over the billion dollar mark, with the new (and undisclosed) investors buying around 3% of the company. Their valuation effectively doubled since a $20 million round in March 2013 valued them at $500 million.

Investors: Access Industries, America Movil, DN Capital Limited, Institutional Venture Partners, Kleiner Perkins Caufield & Byers, Lynx New Media Ventures, Soft Park IDG Ventures China, Sony Music Communication, Universal Music Group.

10. Farfetch (United Kingdom) valued at $1 billion

Global ranking: 83rd

Total funding: $195 million (valuation is x 5.13 total funding)

Led by DST Global, Farfetch's $86 million Series E meant that they too joined the 'unicorn' club. Other than Shazam, they've raised the least total funding of companies on this list.

Investors: Conde Nast International, Virtruvian Partners, DST Global, Advent Venture Partners, Index Ventures, Novel TMT and e.ventures.

11. Funding Circle (United Kingdom) valued at $1 billion

Global ranking: 83rd

Total funding: $273 million (valuation is x 3.66 total funding)

Another London-based venture, and another round led by DST Global. Funding Circle's latest round of $150 million led to them being valued at $1 billion, and therefore becoming the third European fintech company on this list.

Investors: Accel Partners, Baillie Gifford & Co., Blackrock, DST Global, Index Ventures, Ribbit Capital, Sands Capital Management, Temasek Holdings, Union Square Ventures

The most striking datapoint, is that Europe is home to only 11 of the world's 100 most valuable VC-backed privately-held companies, a paltry 11%, with just four European companies present in the world's 50 most valuable. As it stands, Spotify is the only European company who is truly competing on a global scale at building a highly-valued, VC-backed, privately-held business.

Interestingly, UK companies don't pop up until 6th place in our list, and even then it's a Scotland-based company - FanDuel. However, London does eventually see some representation with Shazam, Farfetch and Funding Circle all in equal 8th position with their $1 billion valuations.

This subsequently gives the UK four spots, compared to Germany's three, Sweden's two and Israel and The Netherlands one.

Sweden's presence is testament to their continued development as both a mature startup ecosystem, and a place that attracts serious venture capital, and comes on the back of them raising the second most money in Europe in Q2 (and yes, of course Spotify had a big hand in this).

Verticals that pop up more than once are 'fintech' with three (Klarna, Adyen, Funding Circle), an area that Europe is known to excel in, 'fashion' (Global Fashion Group, Farfetch) and 'music' with two apiece (Spotify, Shazam).

And investors that look to have more than one hit on their hands include Rocket Internet (3), Index (3), DST Global (3), Kinnevik (2), Kleiner Perkins Caulfield and Byers (2), Accel (2), Ballie Gifford (2), Temasek (2), Institutional Venture Partners (2), Tengelmann Ventures (2), Northzone (2) and General Atlantic (2). From these investors, 58.3% of them are based in Europe, with 41.7% from outside the bloc.

Close, but no cigar

It's also worth pointing out, that if reports are to be believed, Stockholm is about to become home to a third 'unicorn' in Truecaller, which is supposedly raising $100 million at a $1 billion valuation.

Other companies that have unconfirmed valuations up and around the billion dollar mark include France's BlaBlaCar who are reportedly currently seeking private funds at a valuation just north of $1 billion, and the UK-based Transferwise, who despite headlines to the contrary, remained just short of a billion dollar valuation during their latest round of funding in January of this year.

Others that are up for inclusion in the list above is Scottish tech star Skyscanner (which raised funding at a $800 million valuation in October 2013 but has since grown a lot) and potentially also SoundCloud, Scytl and Takeaway.com. And despite having a $2.7 billion valuation, UK-based Powa Technologies were not included, as although they are privately-held, all of their external funding has come from Wellington Management, who are not strictly a VC firm.

Obviously, there are likely even more, as funding rounds nor valuations of private companies are always disclosed.

Further reading:

13 European tech companies became ‘unicorns’ in the last year

Tech Tour lines up 50 European high-growth tech companies

These were the 20 biggest funding rounds in European tech in the first half of 2015

Analysis: European tech companies raised €3.47 billion in venture capital in Q2 2015

A visit to Klarna, the Swedish company poised to disrupt the online payment industry (video)

The unicorn of Amsterdam: Catching up with Adyen co-founder and CEO Pieter van der Does (video)

An IPO isn’t the only possible exit for Spotify. Don’t believe me? Google it…

Featured image credit: tech.eu

Would you like to write the first comment?

Login to post comments