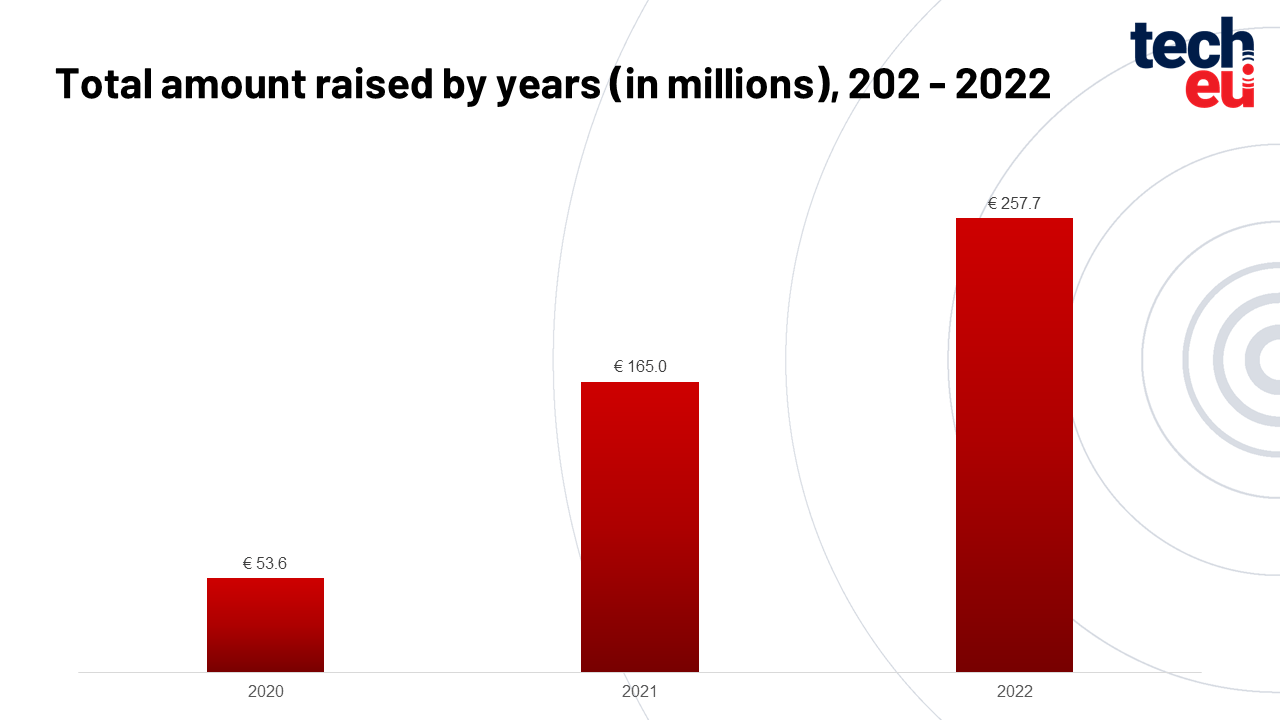

Over the last few years, one trend in tech investment shows no sign of abating – pet tech. Early-stage startups continually expand and raise funds, with many acquiring other companies as they grow, while newly founded startups successfully raise millions in their first couple of years.

Pet ownership boomed during the pandemic. Thus, it's a great time to develop tech for our pawsome Zoom meeting companions and walking buddies.

Let's take a look at the growth over the last few years and the companies going from strength the strength:

The pet tech companies clawing to dizzy heights with recent fundraising

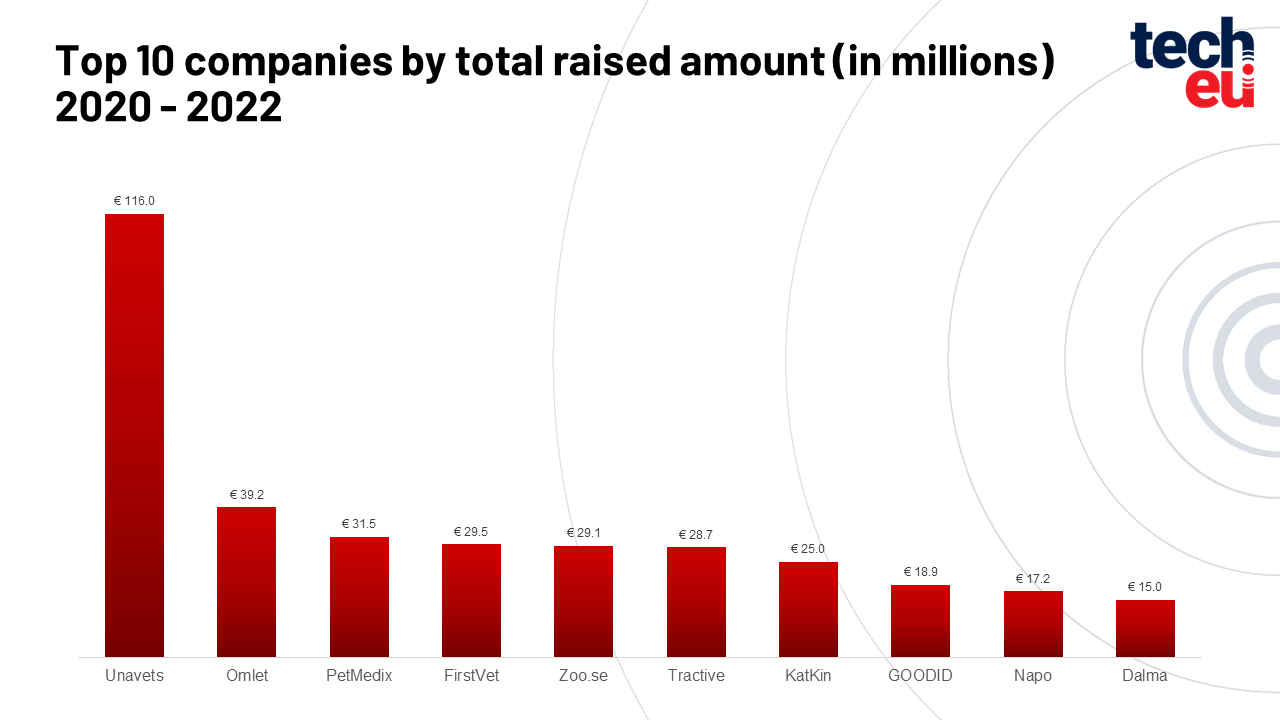

Unavets (Spain)

Why have one pet clinic when you can build an empire? Founded in 2019, UNAVETS, headquartered in Spain, has not only raised a mammoth € 116 million in Series A and B funding rounds but has also extended its vet services to 95 practices across Spain and Portugal, including specialised centres, 24-hour hospitals, primary opinion clinics and vet offices.

The company is focused on sniffing out new markets by acquiring and partnering with veterinary practices in different regions. It has since expanded to the US, investing in the Easy Vet Franchise. A company set for world domination?

Omlet (UK)

What happens when students studying art decide to design a chicken house? Something that looks like an Igloo and creates momentum for a mammoth business. Besides selling over 125,000 "Iglus", the company has carved a niche in functional designer goods for pets, including budgie cages, rabbit tunnels and dog beds that allow pets to "exhibit their natural behaviours."

PetMedix (UK)

PetMedix show what happens when you bring scientific breakthroughs in human therapeutic drug development to vet science. PetMedix is a veterinary bio-pharmaceutical company based in Cambridge, UK. It's focus is building platforms that generate fully species-specific, naturally-generated therapeutic antibodies. These platforms create a repertoire of antibodies as diverse as the companion animal immune systems they are based on and led to more precision treatment for medical conditions.

Besides raising £37 million across two funding rounds, the company has already successfully generated over 50,000 fully canine, antigen-specific antibodies.

FirstVet (Sweden)

COVID made many pet owners go digital-first to seek health care for their furry and feathered friends. Founded in 2016 in Sweden, FirstVet is a digital vet service offering a 24-hour service independent of other veterinary practices and companies.

An early disruptor long before COVID, the company has raised €96 million over five funding rounds, including a sizable €29.5 million within the last three years. It has a strong presence in Germany, the United Kingdom, and the Nordics and partners with over 40 European insurance companies.

Zoo.se (Sweden)

Most pet stores are staffed by surly teenagers making TikTok videos with the reptiles. But Zoo.se has taken pet retail to a higher level by hiring staff with different animal interests, ranging from dog breeders, dog handlers, feed specialists, animal caretakers, veterinarians, cat breeders, animal health workers, herpetologists, specialists in small animals and to aquarists. This creates services with a difference.

The company has raised €29 million in funding.

Tractive (Austria)

Losing a pet is an owner's worst nightmare. Tractive has built a pet tracker which uses GPS to track your furry family member's whereabouts at all times. Founded in 2012, the company outlasts numerous competitors in the pet wearables market, raising €32 million in series A funding in 2021.

The tracking service has expanded to virtual fencing to detect if your pet strays from the garden, and the ability to track your pet's activity levels and sleep.

Katkin (UK)

If I were to pick one sector that's bursting with startups, it would be pet food, with companies like Petgood, Butternut Box, and DogChef turning our pets into gourmands.

Still, while cat food is the fastest-growing sector in global pet food, expected to be worth around $50bn by 2030, companies prioritising fresh cat food are underrepresented.

Hailing from the UK, Katkin provides freshly cooked "human-grade" food formulated by a Board Certified Veterinary Nutritionist to keep the fussiest cats healthy, preventing problems like obesity and poor dental health. The company's blog even has a recipe for a birthday cake for your cat.

The company has raised $28 million to date, including $22 million in Series A at the end of 2022.

GOOD !D (Belgium)

Looking for nutritious products that your furry friend will actually eat instead of giving you a look of disdain is a never-ending challenge. Belgium company GOOD !D has the market licked with pet snacks and food for dogs and cats.

The company also owns Pharma.pet, delivering supplements and vitamins for doggos with ailments like a cold or arthritis. The company raised €18.9 million in 2021.

Napo (UK)

Insurtech is a fast-growing industry, and services for pets are no different. Napo has created a digital-first approach: no letters, no phone calls, and no back and forth via email.

It takes a holistic approach to health prevention, facilitating free 24/7 video calls with vets and behaviourists, and tools such as puppy training apps and funds to help find missing pets as part of the monthly insurance payment. Then, a £75 flat fee is payable when an animal requires treatment up to a £16,000 threshold.

The company raised £15 million in series A funding in 2022.

Dalma (France)

Dalma delivers health insurance to the dogs and cats of France, with 100% digital, transparent insurance with no excess, reimbursing veterinary costs within 48 hours and providing access to free and unlimited advice from veterinarians.

An App provides unlimited and instant access to veterinarians for any question related to the health, education or nutrition of your dogs and cats.

Since launching in 2021, the company has raised €15 million in series A funding—an essential piece of mind for our furry family members.

Where's all the money situated?

This is just the first in a series about the pet tech landscape here in Europe. Over the next few weeks, I'll be talking to investors, startups, industry insiders, and animal behaviourists to bring you a deep dive into the state of play and why this is just the beginning of a massive industry transformation.

Would you like to write the first comment?

Login to post comments