With new government reforms introduced to the UK’s CSOP (Company Share Option Plan), the UK now finds itself in a highly competitive position when it comes to attracting the best talent in the world by offering employees a healthy financial stake in the companies they’re helping to build.

Since 2017, Index Ventures has led the charge when calling for reforms to the process of how and why, and in some cases why not, European tech industry workers have access to employee stock option plans, most notably enjoyed by their counterparts in other parts of the world.

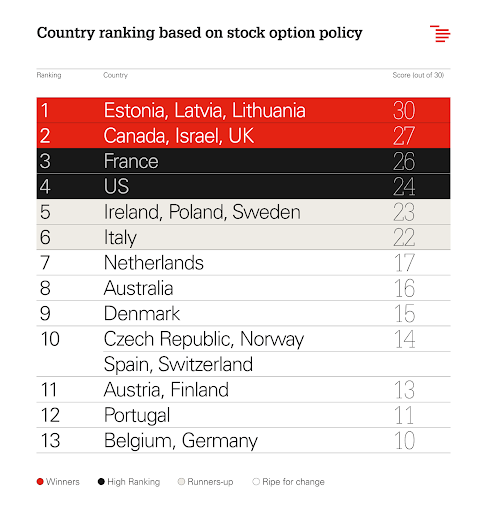

Today, Index Ventures has published its findings of a review of 24 national stock option plans and found that the newly reformed CSOP in combination with the Enterprise Management Incentive scheme places the United Kingdom at the top of the list in terms of G7 countries, shoulder to shoulder with Canada and Israel, and second only to Estonia, Latvia, and Lithuania.

The Enterprise Management Incentive (EMI) scheme has been used by startups across the UK, helping them in the early stages of their growth, however, the plans' cap of a maximum of 250 employees and less than £30 million in gross assets has been stifling growth. Once a British company surpassed these limits and was not yet close to an IPO, the attractiveness to top-level talent diminished rapidly. CSOP, introduced today, removes the 250-employee cap and sets no limits on gross assets. Additionally, the employee share options limit has been doubled from £30,000 to £60,000 per employee.

“We welcome the stock option reforms introduced by the UK government. They are critical in helping scale-ups attract and retain the talent they need,” commented Index Ventures partner Carlos Gonzalez-Cadenas. “This is especially important in the current economic climate that requires careful cash management. Introducing similar reforms in other European countries is of critical importance, as these uncertain times will give rise to many generational companies, and only countries that have favourable talent policies in place will benefit from the resulting innovation and value creation.”

Would you like to write the first comment?

Login to post comments