While 2022 saw a marked slowdown in funding almost across the board. However, according to a new report issued by Swiss VC firm Tenity, one outlier, in particular, was that of Climate Fintech. The firms' “Climate Fintech - beyond the Hype” analysed data from a total of 607 startups globally, and found that in 2022, all regions covered within the analysis showed increasing funding with Europe taking the lead when it comes to the total funding secured across the sector.

Just to compare and confirm this statement, Europe secured almost $1 billion in total funding in Climate Fintech, while our cousins across the Atlantic raised a mere $640 million.

The report also featured a cross-section of data from Climate Fintech startups working on decarbonisation using digital financial technology.

Focusing just on Europe, some of the interesting findings include:

- Switzerland possibly holds the highest per capita number in Climate Fintechs

- The UK is the leading Climate Fintech player in Europe both in terms of funding volume and the number of startups

- Estonia shows the highest number of Climate Fintechs with at least one female co-founder.

So what is behind Climate Fintech and why is it so important? Simply, because these solutions focus on the planet and the improvement of ESG performance while carrying out daily financial activities such as saving, spending, and investing.

The range of applications is wide, from carbon footprint tracking credit cards to climate risk data providers helping insurers better underwrite climate change risks.

The report also identified a top priority: market demand for ESG data and analytics solutions. The data showed that 230 startups are confirming and catering to this. However, this shouldn't come as a surprise as by now, we're all well versed in just how sticky the red tape around ESG regulations and guidelines can be. Access to quality, reliable data, can be tricky, and startups are stepping up to help companies make sense of it all. This is especially visible in Europe, as here almost 70% of startups in this category are located.

“There is increasing pressure on both companies and governments to bolster their sustainability commitments in response to growing demands for environmental action. The different use-cases and applications, on top of growing relevance in financial markets, means the role of Climate Fintech is more important than ever. Tenity is well positioned to support this growth.” Andreas Iten, Co-Founder and CEO of Tenity

Furthermore, the increase in the number of startups that are offering digital assets solutions (from 46 to 72) was evident and in line with the increasing demand for these types of investments.

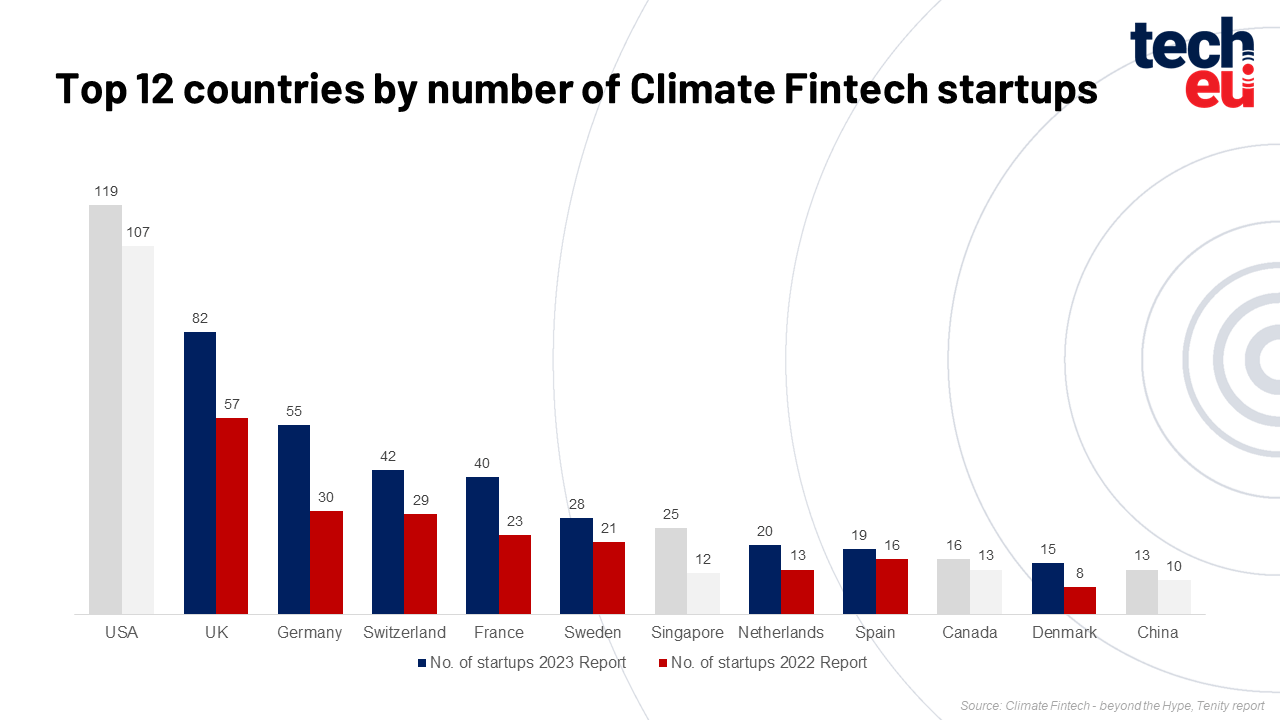

As noted above, Europe leads the list in the sector. On the top 12 list of countries with active Climate Fintech startups, 8 are from Europe, some of them taking the top 5 places. Thus, the UK takes second place (with 82 Climate Fintech startups in the 2023 report) followed by Germany (55 in the 2023 report), Switzerland (42 in the 2023 report), and France and Sweden (with respectively 40 and 28 in the 2023 report).

This year the report also conducted a more in-depth analysis of the demographic structure of the co-founders and CEOs of the companies and found that more than a third of all Climate Fintech startups have a female CEO or co-founder.

Out of 607 startups covered within the analysis, around 37% count at least one female co-founder or have a female CEO. And here, again, Europe stands out, specifically Estonia, which has the highest presence of female CEOs or co-founders (67%).

Would you like to write the first comment?

Login to post comments