Following last month’s disclosure that the Amsterdam-based neobroker BUX had slashed 40 percent of its staff as part of cost-cutting measures and a retreat from the UK market, today ABN AMRO announced that it has agreed to acquire the company in full. Terms of the acquisition remain undisclosed.

The deal arrives at the end of a disappointing year for BUX, as rumours circulated widely in February that Germany’s N26 was to acquire the company in a deal reportedly valued in the neighbourhood of $100 million.

Over the past decade, BUX has grown to service approximately 500,000 clients, is operational in eight market markets, and raised just over $116 million from backers including Tencent, Prosus Ventures, HV Capital, and the aforementioned ABN AMRO who participated in BUX’s €67 million Series C round in 2021.

According to a statement released by ABN Amro Bank, the acquisition of BUX will serve to bolster its presence in the retail investor sector citing, “a combined number one position in the Netherlands”.

ABN AMRO’s Annerie Vreugdenhil explained:

“Welcoming BUX into the ABN AMRO family will create a unique combination of innovative user-friendliness and financial strength, stability, and expertise — a powerful foundation for future growth in the private investment domain, both for our clients and for the bank itself.”

While no figures were released, given recent developments at BUX in combination with fintech valuations have taken a severe hit, the chances of BUX’s acquisition by a previous investor equaling or surpassing that of the collapsed N26 deal are slim.

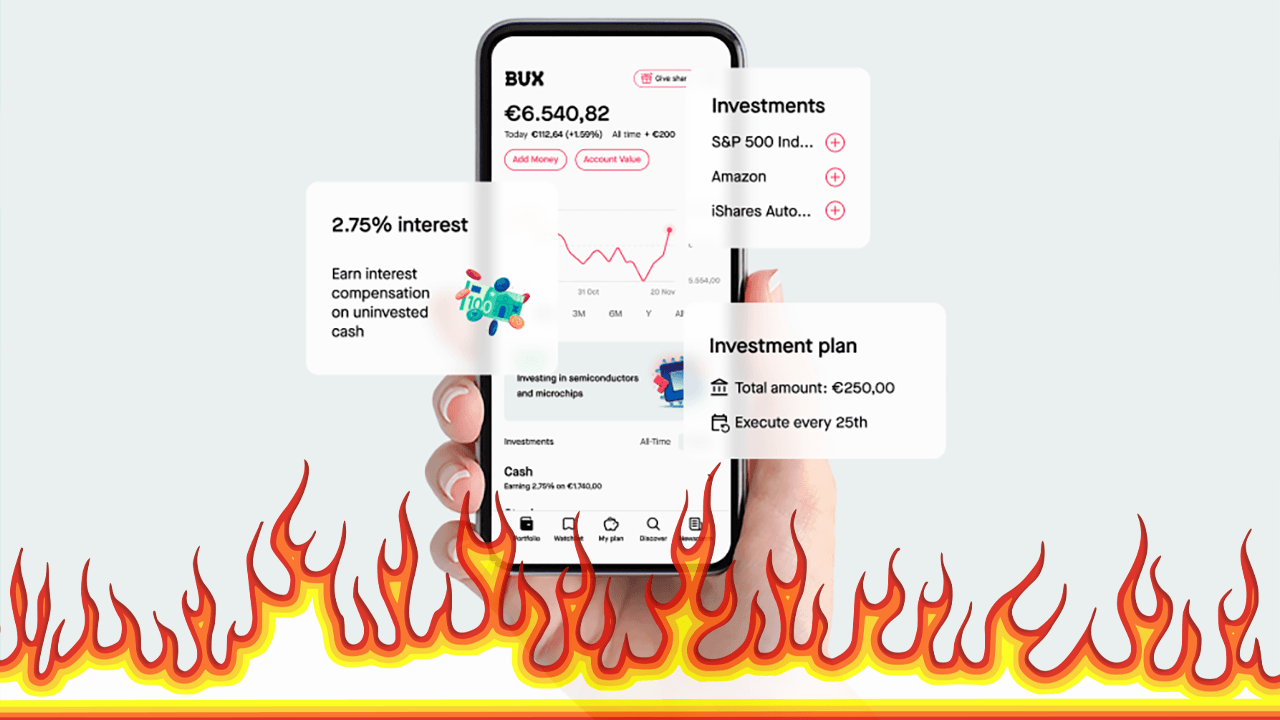

Lead image via BUX.

Would you like to write the first comment?

Login to post comments