Midas, Turkey's leading investment platform, has raised $80 million in Series B funding, the largest investment ever secured by a Turkish fintech company.

This brings Midas' total funding to date to more than $140 million.

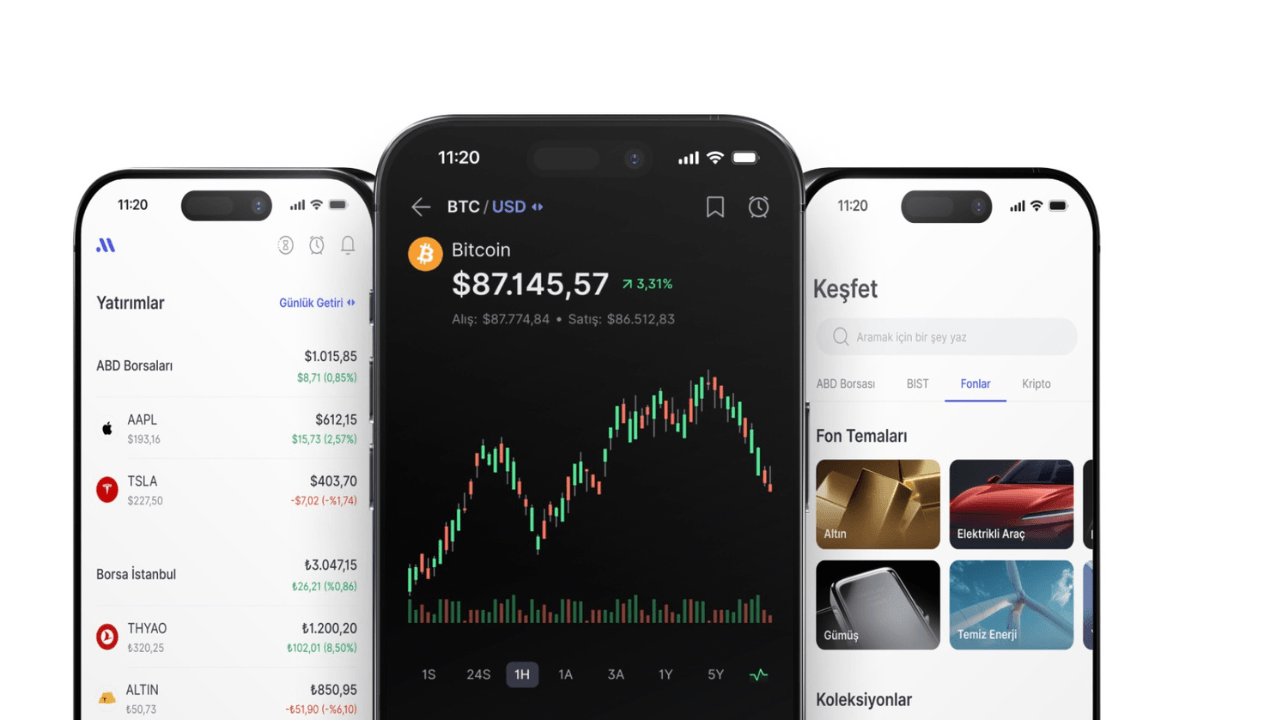

Founded in 2020, Midas offers access to Turkish and US equities, mutual funds, and cryptocurrencies through a single platform.

Since launch, Midas has grown rapidly and now serves more than 3.5 million investors. Midas enables trading on US exchanges at a competitive flat fee of $1.50 per transaction, while permanently eliminating all commissions and account-related charges, including clearing and custody fees, for Borsa Istanbul. In addition, the platform provides real-time market data at no cost to its users.

Since its founding in 2020, Midas has fundamentally changed how individuals in Turkey access financial markets. With a commission-free, seamless, and user-friendly experience, millions of people have made their first investments through Midas. Collectively, Midas users have saved nearly $50 million in transaction fees, and half of them began their investing journey on the platform. Midas has set new industry standards by dramatically lowering costs.

After cutting US trading fees by 90%, the company permanently removed all Borsa Istanbul commissions in 2025. Today, Midas offers free live market data, and instant, fee-free transfers—making it the go-to platform for Turkish retail investors.

Egem Eraslan, CEO of Midas, said:

"From day one, our mission has been to make investing accessible, affordable, and seamless for everyone. Today, millions of people manage their investments through Midas.

With this new funding, we are building a comprehensive ecosystem that unifies all investment needs on one platform, while further strengthening our security and technology infrastructure. This will enable us to keep growing as a fintech company that serves the needs of individual investors both in Turkey and globally."

The record-breaking raise highlights international investor confidence in Midas and its pioneering role in reshaping Turkey's fintech landscape.

The round was led by QED Investors. New investors include the International Finance Corporation (IFC), HSG (formerly Sequoia China), QuantumLight (founded by Revolut CEO Nik Storonsky), Spice Expeditions LP, and George Rzepecki. Existing backers Spark Capital, Portage Ventures, Bek Ventures, and Nigel Morris also joined the round, reaffirming their confidence in Midas.

Yusuf Özdalga, Partner at QED Investors, said:

"Midas has unlocked access to vast domestic and global investment opportunities for Turkish users, utilising cutting-edge fintech tools. As QED, we are proud to lead Midas' Series B round, and are incredibly excited to partner with Egem and his team, who have created an exceptionally strong product and performance culture.

We look forward to being part of this growth journey in Turkiye, the wider region, and beyond in the coming years."

Having democratised investing for the masses, Midas is now expanding into tools for more sophisticated investors. Following the launch of margin investing, advanced analytics, and Midas Pro, the company will use its Series B funding to introduce derivatives trading in both Turkish and US equities.

The rollout begins in September with US options trading, providing investors with free real-time data, competitive pricing, and intuitive interfaces—bringing the "Midas Standard" to derivatives markets.

In parallel, Midas is increasing its investments in security and operational resilience. With infrastructure built to meet global standards, the company remains committed to providing a safe, reliable, and uninterrupted investing experience.

The company will use the new capital to strengthen its security infrastructure to international standards further and to accelerate the launch of advanced products designed for active traders.

Would you like to write the first comment?

Login to post comments