Hailing from Bucharest, fintech FLOWX has raised $8.5 million in a seed funding round. The enterprise-grade platform helps banks and financial institutions with complex IT infrastructures build digital experiences that neo-banks have been championing for years now, experiences that consumers have grown to expect. The seed funding will be used to expand operations across Europe and the US, namely via recruitment efforts.

Looking at FLOWX’s home market alone, according to a Microsoft survey, one-fifth of CEE financial institutions have not addressed the fact that traditional banks and financial institutions are struggling to keep up in today’s digital-first world, with only about one-third of them having dedicated teams working on it.

This legacy systems issue is only going to get worse, as each year the banking industry alone spends over $200 billion on technology, with 85% of this budget being allocated to “running the bank”, that is, infrastructure maintenance and regulatory updates. I guess this might explain those fees?

The startup provides the banking and financial services industry with a platform whereby they can launch complex solutions in as little as ten weeks, all without having to dismantle existing infrastructures. Once in place, the company offers a “core revival” modernisation procedure, i.e. incremental updates, as opposed to a slash-and-burn method.

In order to achieve this, perhaps the best way to think of FLOWX is if a legacy system is an espresso, FLOWX is the steamed milk, and together they form a delicious cappuccino. In other words, FLOWX forms a tech stack layer on top of existing systems and provides the tools to create user-friendly, scalable, applications for web and mobile.

Employing what they refer to as ZeroRedeploy technology, FLOWX claims that they can deliver anywhere between 10x to 100x efficiency when compared to a traditional development process or the current generation of low-code/no-code tools (such as crosstown rival Finshape).

FLOWX is looking further down the road as well, and already addressing the Power and Utility, Telco, and Consumer Packaged Goods industries, with clients including Banca Transilvania, Vienna Insurance Group, and OMV.

The company’s seed round was led by PortfoLion, and saw participation from Day One Capital and SeedBlink.

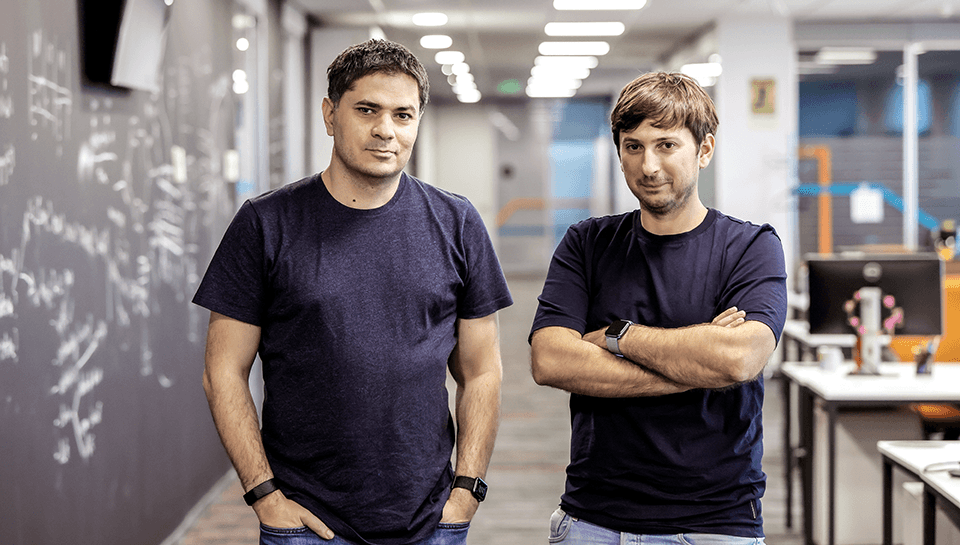

FLOWX CEO and co-founder Ioan Iacob concludes, “This seed funding, less than a year after starting FLOWX, proves that the problem we address is massively painful - legacy infrastructure is holding back enterprises from growing. This financing will support us in extending our offering globally, to giving companies back the freedom to build to more - together with our expanding network of global consulting and system integration partners.”

Would you like to write the first comment?

Login to post comments