PitchBook has released a new summary of Q1 2021 European VC numbers, and the results are eye-opening and jaw-dropping.

All That Glitters is Gold

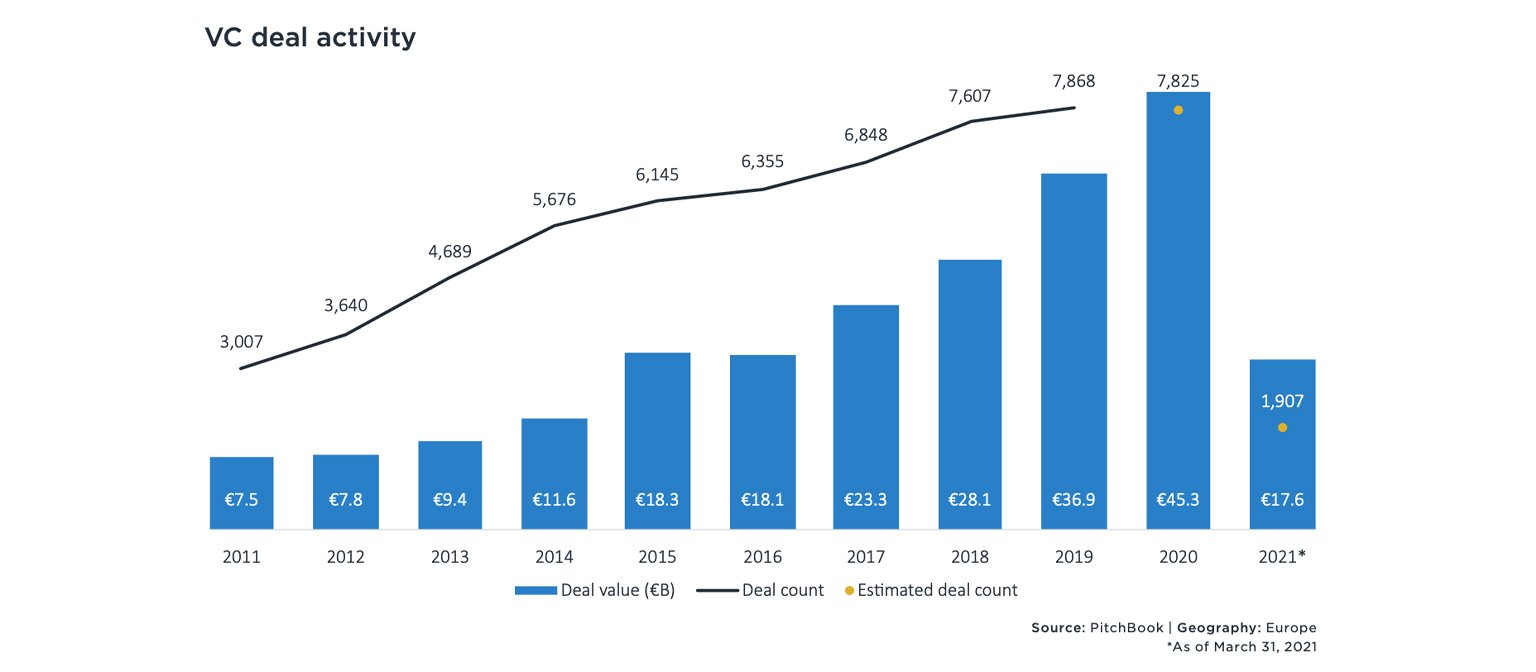

The 2020 numbers were already quite impressive, and it would appear that 2021 is already on target to surpass them. In the first quarter of 2021 alone, VC deal value is higher than years 2011, 2012, and 2013, respectively, clocking in at €17.6 billion.

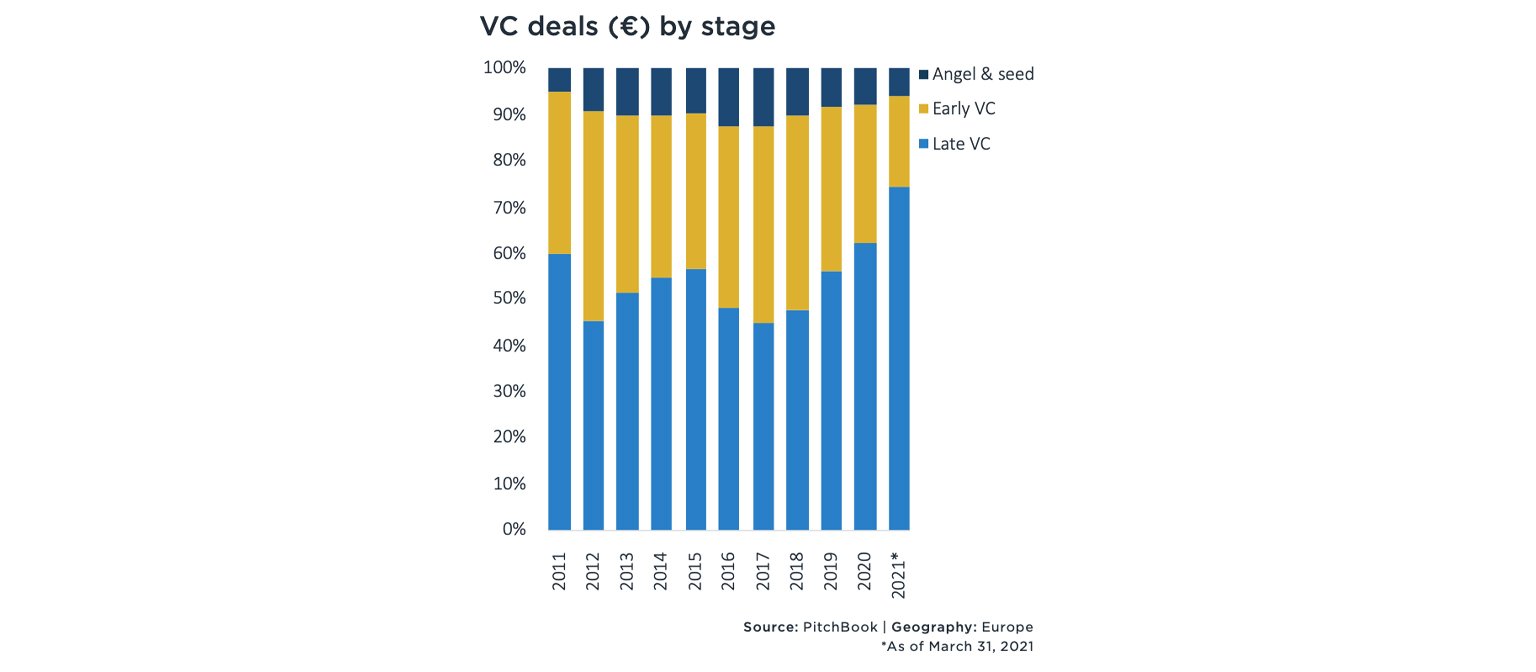

The majority of the deal values came in, at what should be no surprise, the late-stage, with €13 billion, or 74% of the total.

Part of the story behind these numbers is a surge in investors that are eager to bet on pandemic accelerated trends; those that could carry on well into the future. I.e. those that are able to read the winds of change aren’t waiting to get in on the ground floor.

Where in the World is Carmen Sandiego?

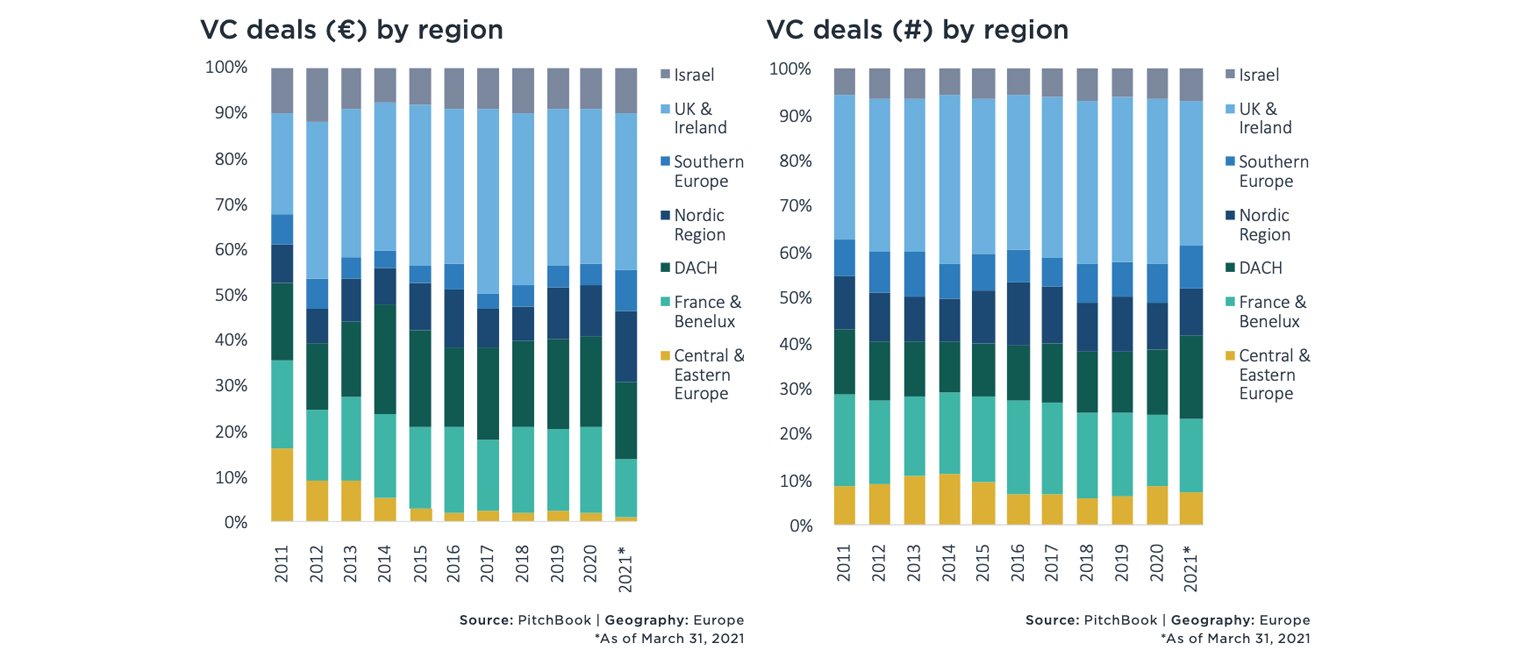

Let’s be honest, we all had some uncertainty about what Brexit would hold in store for the UK. Now drop a global pandemic on top of that, and knowing what the weather would be like next month seemed an easier calculation.

With that in mind, it would appear that the UK’s startup scene is weathering the storm quite well. €6.1 billion flowed into the UK and Ireland in Q1, which would put it well on course to surpass the €15.4 billion the arrived on island soil in 2020.

Likewise, despite the mass exodus of corporates, the UK is still home to some of the most valuable VC-backed companies on the planet. Leading this pack is the strong fintech sector, and of course the outlier Hopin with their approximate €4.6 billion valuation.

Tradition, Tradition!

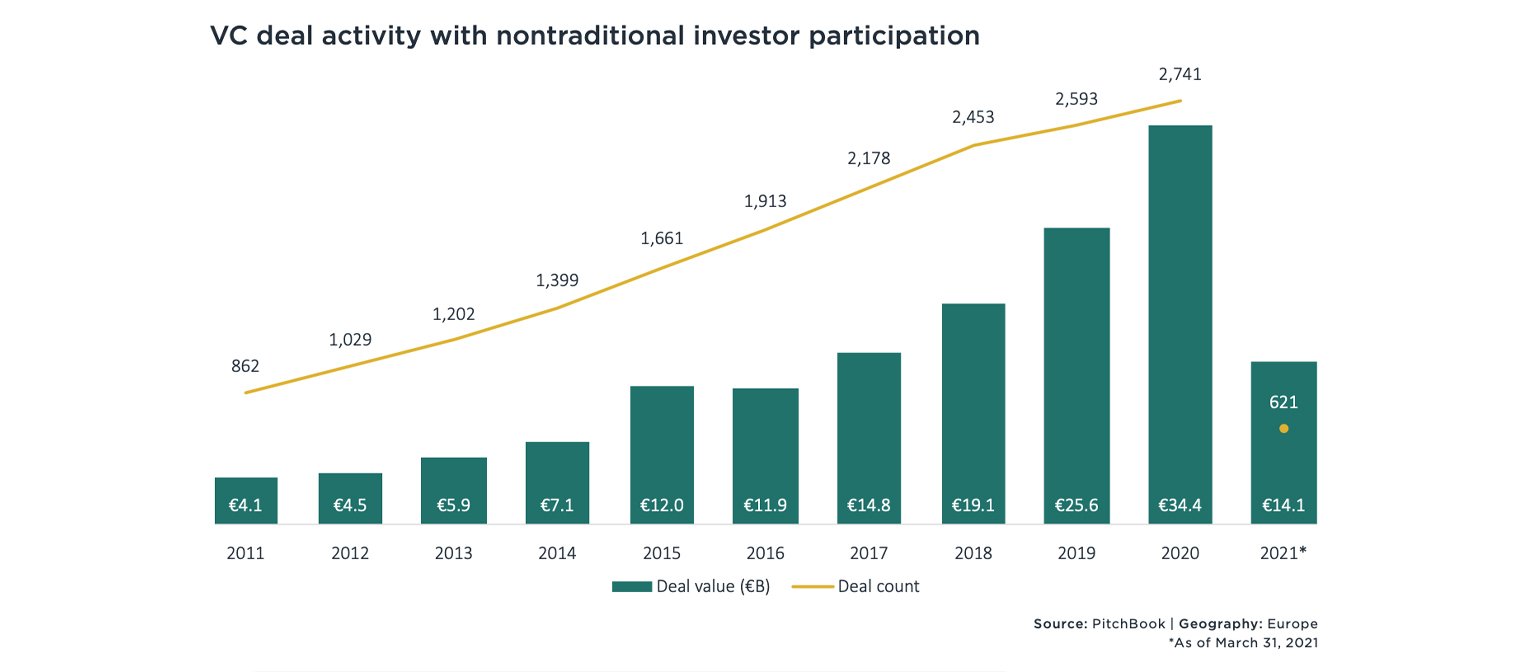

One particular sector of note is the non-traditional investor. Over the past five years, we’ve seen private equity firms, hedge funds, pension funds, sovereign wealth funds, and corporate VC operations, a.k.a., your nontraditional investor, all on the rise.

And as with just about everything under the tech-world sun, the pandemic has only accelerated this trend. On par with deal values, the nontraditional investor space has seen nothing but growth, with Q1 of 2021 garnering a number that shadows numbers from 2011-2016.

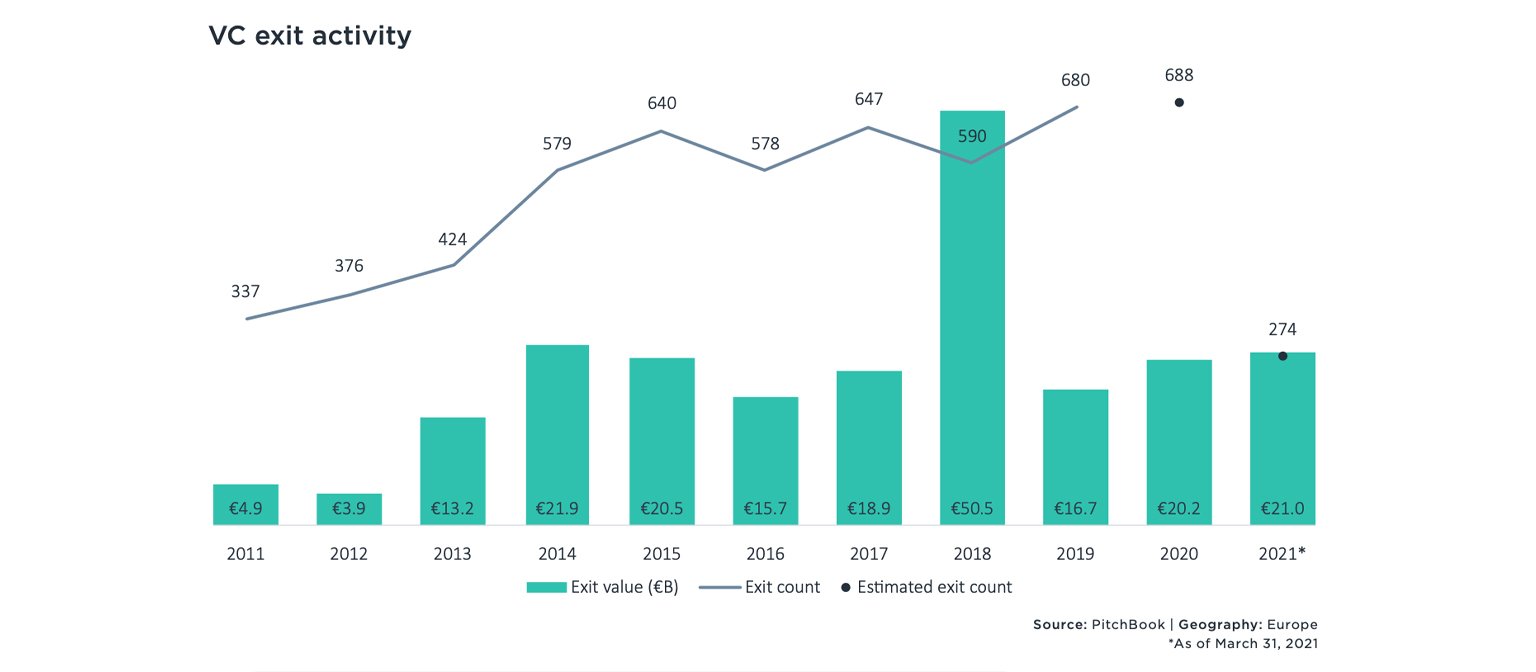

Exit Stage Left

Q1 2021’s VC exit value topped out at €21 billion, a number that surpasses the entire exit value of 2020. Now before we all get too excited here, there are three points we need to look at:

- The emergence of SPACs

- Deliveroo

- Auto1

The jury is still out on whether we really want to classify a SPAC as an exit, as it doesn’t really fit into a traditional model, but for the sake of the Pitchbook report, let’s run with it.

Deliveroo and Auto1 both have a pre-money (read: on paper) valuation of €6.6 billion, so combined they’re claiming €13.2 billion of this €21 billion on the table. And do we even want to go into the Deliveroo IPO? Right. Old news.

And They’re Off!

Across 23 funds, €3.4 billion was raised in Q1 2021. One of the biggest figures saw the Cathay Innovation fund close at €649.5 million (ignore the typo by Pitchbook), thereby putting the France and Benelux region out front with a healthy €1.9 billion raised.

Also of note, while the UK is seeing investment money flowing onto its shores, the funds had a slow news week. The Abingworth Bioventures VIII took to the top slot, but (only) brought home €382.6 million.

Extra, Extra, Read All About It!

Further, and a lot more, details are available in the Pitchbook Q1 2021 European Venture Report. Give ‘em your email, and you’re in for more graphs, figures, and numbers than you can shake a stick at.

Would you like to write the first comment?

Login to post comments