European founders and startups need to incentivise more talent to join their companies by offering employee ownership benefits and a “greater stake in the game”, according to a new report from VC firm Index Ventures.

The report, Rewarding Talent, finds that stock options are much more common in the US than in Europe. It said that European tech startups need to offer better rewards to employees in order to attract and retain talent and to ultimately build a global tech company.

“Access to talent is the single most important ingredient for creating transformative tech companies, which is why we are calling on European governments to help level the playing field for our ambitious entrepreneurs by creating the right conditions to support and incentivise employee ownership,” said Martin Mignot, partner at Index Ventures.

“Attracting the best talent is the biggest focus for all entrepreneurs and should be the singular focus of all governments who seek to support innovation, entrepreneurialism and job growth,” he said.

In the US, employees own 20% of late-stage startups while it’s only 10% in Europe, where employee equity is not offered consistently. In Europe, it’s more likely that deeply technical businesses in fields like AI or enterprise software offer benefits, much more so than ecommerce companies. In cases where stock options are offered in Europe, they are mostly reserved for the most senior executives; whereas across the Atlantic, the opposite is true.

Denmark-founded JustEat, backed by Index Ventures, offers stock options to its employees. “We set aside £1,000 in legal costs per employee, in each country, to set up a scheme within this budget, we did our very best to create a programme which was tax-efficient overall for both staff and the company,” explained Mike Wroe, who was CFO of the company up until last year.

The UK, Ireland, Scandinavia, and the Netherlands were the markets friendliest to stock options, he said, with the most challenging being France (as it was required to establish a subsidiary there) and Belgium.

“The main benefit was motivational – we were able to talk to all our employees as shareholders, which was great for pulling the team together,” he said.

Peter Campbell is CEO of Mimecast, which is a NASDAQ-listed company that previously raised investment from Index. He explained that when a European company expands into the US, they need to be prepared to offer stock options as employees expect it: “Everyone takes it as a given, and believes they are entitled to them – particularly when your company is smaller.”

There are three chief factors that are holding back the widespread adoption of employee ownership benefits in Europe – government tax policy, lack of awareness among prospective employees, and lack of knowledge for founders and companies.

European employees should not be penalised for their stock or equity benefits, said Index Ventures. Such employees are often paying a higher strike price and higher taxes on exercise and sale, leaving the employee little to no reason to have such benefits if they receive nothing in the end.

“This is in stark contrast to the US where stock options are supported and encouraged by more favourable tax policies,” said the authors of the report, adding that to tackle this issue in Europe, there needs to be more harmony between national tax policies.

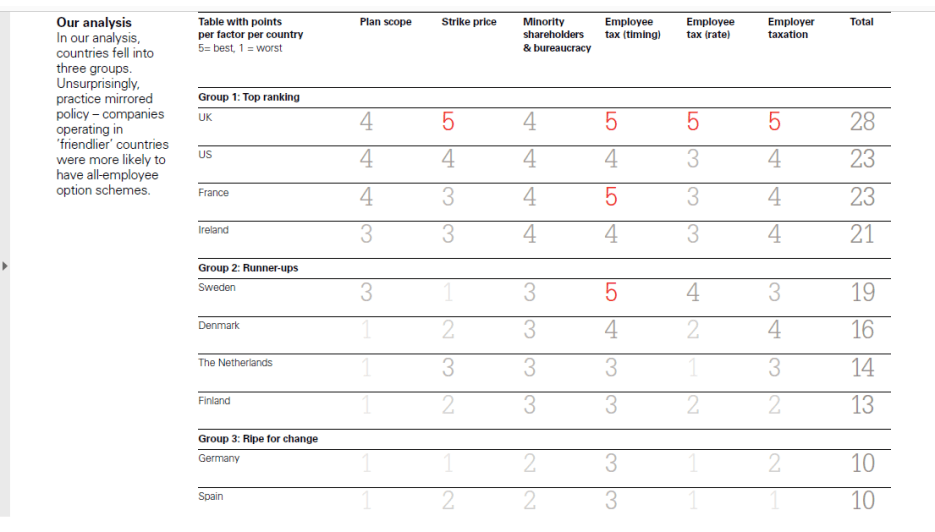

According to Index Ventures, the UK, Ireland, and France are the friendliest European countries when it comes to offering stock options. Germany and Spain are the most in need of change.

Just last week, Sweden relaxed some of its rules around stock options to make it easier to offer employee benefits to workers.

Following changes to policy, employees need to be made more aware of stock options and their potential value. According to the research, employees are largely unaware of these options mostly because they have not witnessed the benefits.

On the other side of the equation, European entrepreneurs lack information on how to offer these stock options. To that end, Index Ventures has also launched the OptionPlan app and handbook, which helps companies design stock option plans that they understand and are compliant.

The Index Ventures report follows a similar report from Balderton Capital, which last week published its guide to employee equity for founders and entrepreneurs.

The full Index Ventures publication Rewarding Talent report is being released this week at the Slush conference in Helsinki.

Would you like to write the first comment?

Login to post comments