Editor's note: This is a guest post by Eden Shochat – a partner at Aleph, a venture capital fund focused on serving Israeli entrepreneurs. Here, he outlines how a simple spreadsheet started on a whim became a comprehensive mapping of the Israeli startup ecosystem through the powers of crowdsourcing. Also check out our earlier interview with Eden.

There's a list of seed investors I typically send to entrepreneurs when I think they're great, but are too early-stage for my fund, Aleph. One day, a couple of weeks ago, after sending the list out, I began wondering whether my list was up-to-date. On a lark, I decided to see how crowdsourcing might work.

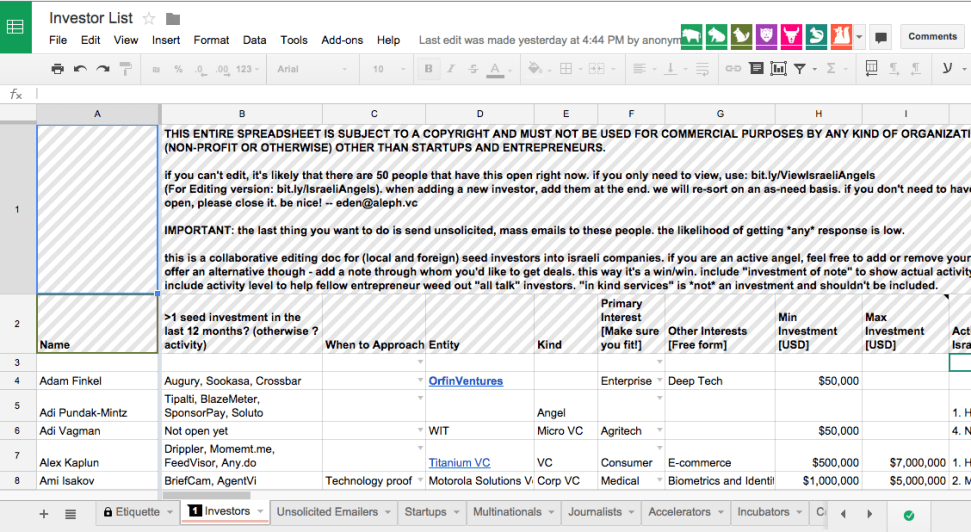

So this is what happened: I posted the list on a Google Spreadsheet and shared it on Facebook with my 28,000 followers. The first version I posted included the names, focus areas, minimum and maximum investment as well as contact details for 68 active Israeli seed investors.

There was no coding, app, nor website involved – simply a Google Spreadsheet with edit permissions for anyone with the link. Since I was crowdsourcing, I went “all in” and decided to make it community editable.

"The Spreadsheet": How it happened

To my utter astonishment, the community jumped in with gusto and – within minutes – I was tracking massive changes to the spreadsheet and comments on my Facebook post.

Fast forward a couple of weeks: It's now become “The Spreadsheet” and has brought unprecedented depth and transparency to a previously opaque Israeli angel scene. Initially, it was a kludgy, directory-like, alternative model to AngelList. However, the community transformed The Spreadsheet into a collaborative effort to comprehensively map the entire Israeli startup ecosystem.

At the moment, the spreadsheet includes over 180 investors, which is about more than twice the number I originally entered into the document. That's the breadth. As for depth, the spreadsheet also includes extensive details on each investor, including guidance on how to approach, minimum and maximum investments amounts, contact info and sample portfolio (in some cases complete).

The community then started adding other useful tabs into the spreadsheet, such as startups looking for capital, accelerator programs, international tech companies doing business in Israel, incubators, contact details for journalists and even a list of venture capital firms (which still requires validation).

Not only that, the spreadsheet was replicated in Sweden by someone who saw our Israeli version and I was also pinged by someone who just started one in Spain.

Since then, it's spread to several other places.

Want to start your own? Some food for thought

At a high level, there seems to be a big difference between an investor market where the sell-side has leverage and one where the buy-side has leverage.

Silicon Valley, for example, has become sell-side dominated. There are so many angel investors and so many good ideas that startups are choosing their investors. In fact, I’d argue that the current generation of entrepreneurs and investors in Silicon Valley don’t remember – and can’t even imagine – an environment before the abundance of capital sloshing around there.

However, most of the world does not work that way. In Israel, for instance, the buy-side dominates because there is more supply (startups wanting investments) than demand (investors). While there is more demand for investors in Israel today than any time before, it does not compare to the Valley, and the same seems to be true throughout most of Europe and Asia.

This difference governs whether angel funding is pull or push.

Therefore, AngelList – a push model – works wonderfully in Silicon Valley, where startups list themselves and investors use social proof to decide whether they want to invest. However, in Israel, where entrepreneurs need to pull and prod investors, getting a list of investors, their interest areas, and contact info seems to be the better modus operandi.

Additional challenges and take-aways from the experience

- Looking at the way the community drove the spreadsheet to comprehensiveness, it seems I accidentally addressed the need for a single destination that uncovers and aggregates “hidden” information, aka information that's not so easy to Google.

- My initial version could have easily killed the entire effort – why? Because I didn’t consider the level of spam that investors would get by simply listing them. Some entrepreneurs ended up emailing the whole list of investors, which was bad. Very bad. The first step to stop spam was surprisingly simple: Moving the contact column to the far right and adding a 'when to approach' column, which drove spam down significantly.

- When the spam backlash happened, a member of the community added an 'Etiquette sheet'. A couple of days later, one of the angel investors also created a column titled “Guidelines from the investor” with free-form text. People seemed to be reading it. When these people added their respective sections, it proved two things: 1) That investors saw value in this to both expand their funnel and filter it using an explicit statement of their interests 2) Self-policing works, and whoever added the etiquette sheet understood that if the resource was abused it would likely disappear.

- Using a Google Spreadsheet turned out to be a big challenge. The good news: It was very easy to edit and familiar to collaborators. The bad news: It turns out there can only be 50 editors of a Google Spreadsheet at any given time. Although 50 sounds like a big number, it's insufficient for community work because people who only want to view your spreadsheet are also counted towards the 50 count. The solution? Whenever publicly publishing a link, use the 'view link' and include the 'edit link' within the document heading.

- There will always be spammers, and it seems the community is willing to accept that to a certain extent. I wanted to mitigate this and recently changed two things: 1) I added a note that all content is subject to copyright and is not to be used for any commercial purposes or by anyone not actively seeking capital 2) I created a “honeypot”, an investor on the list whose email redirects to me. Though this “investor” may be approached by startups, any commercial spammer will be uncovered by me and included on another edit-protected sheet on The Spreadsheet called “Spammers”.

Within the span of one week, The Spreadsheet mapped most of the “dark matter” knowledge of the Israeli startup ecosystem, which I can only describe as barely a prototype of an MVP. I am intrigued to see how this spreadsheet will look in a month's time.

Featured image credit: Sergey Nivens / Shutterstock