Angel investors in Britain are making more investments than ever before, according to comprehensive research findings presented today by the UK Business Angels Association (UKBAA) trade body and the Centre for Entrepreneurs (CFE) think tank.

The report (PDF) shows that the median number of investments made by business angels in the UK is now five - double that reported in 2009.

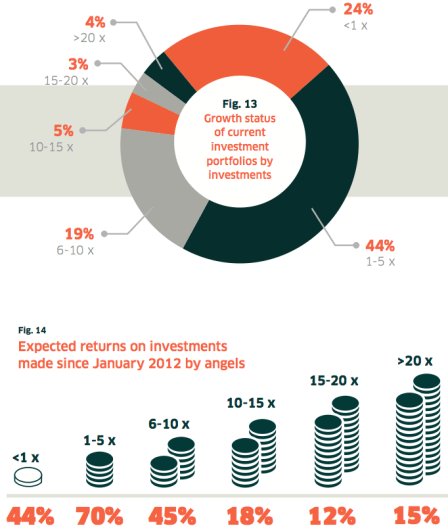

The research also found that angel investors are far more confident in the growth status of their portfolios, with some 45 percent reporting that their portfolio companies are showing high growth, and with higher expected rates of return than found in earlier studies.

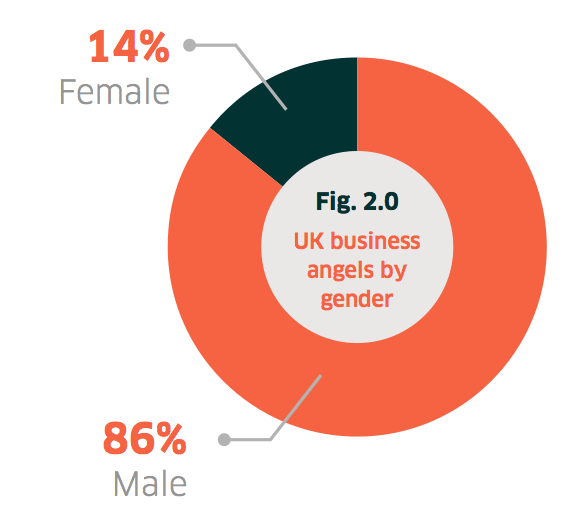

The sheer number of angel investors in Britain is also steadily growing, the research shows, with an increasing number of women and younger persons backing tomorrow's startups and entrepreneurs.

Women now represent one in seven angel investors, which is double the rate observed in 2008.

That's encouraging, but the UK still ranks far below the United States where, in 2013, 20 percent of angel investors were women. There is still a long way to go to achieve a significant gender balance of business angels in Britain, but at least it's a step in the right direction.

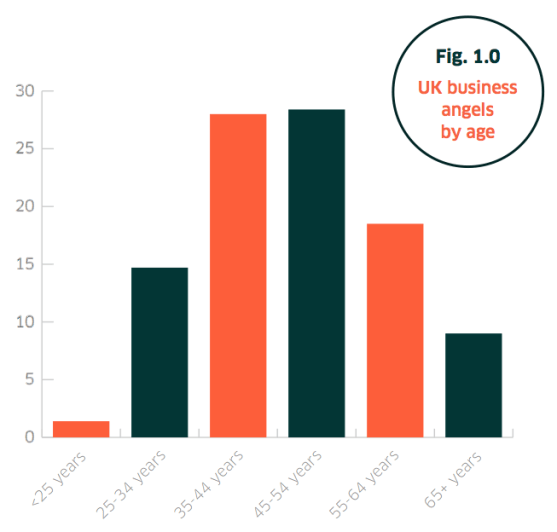

Meanwhile, the UK-based individuals banking on entrepreneurs in the early stages appear to be getting younger every year. The research suggests that three quarters of Britain's business angels are now aged under 55, with 44 percent under 45 and 16 percent under 35 years.

In London and the South East, the shift is more pronounced according to the study, with 46 percent of angels aged under 45 compared with 37 percent across the rest of the UK.

Also read: UK startups are hiring – and paying – more as tech scene continues to mature (study)

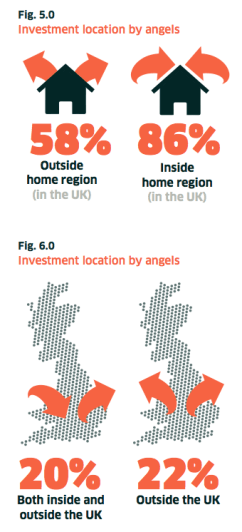

There are more interesting findings in the report, including that UK business angels are increasingly investing outside their home region (58.4 percent) and even outside the UK (22.3 percent), demonstrating that geographic distance is becoming less important in investment decisions.

This is of course a global phenomenon, but it's always good to have numbers to back up the trend.

Unsurprisingly, the UK's Seed Enterprise Investment Scheme (SEIS) and the Enterprise Investment Scheme (EIS) play a pretty big role in encouraging investment activity. Nine out of ten angels have used one of the schemes and close to 80 percent of investments in angels’ portfolios were made under EIS (55 percent) or SEIS (24 percent), according to the research.

The study was commissioned by UKBAA and CFE and carried out by the Enterprise Research Centre, and sponsored by Barclays, Deloitte and BVCA. To give you an idea of the size of the data set and methodology: 403 angel investors shared portfolio information through an online survey, 28 syndicate and network leads representing 8,000 angels completed an online survey, while 43 angel investors discussed their investment behaviour through phone interviews.

Featured image credit: Zepedrocoelho / Shutterstock