Investors in Danish spend management fintech Pleo snapped up secondary shares in the fintech unicorn earlier this year, as its valuation recovered “slightly" after billions were wiped off its value.

Pleo, founded in 2015, achieved star status in 2021 when it became the fastest Danish startup to reach unicorn status, in just six years.

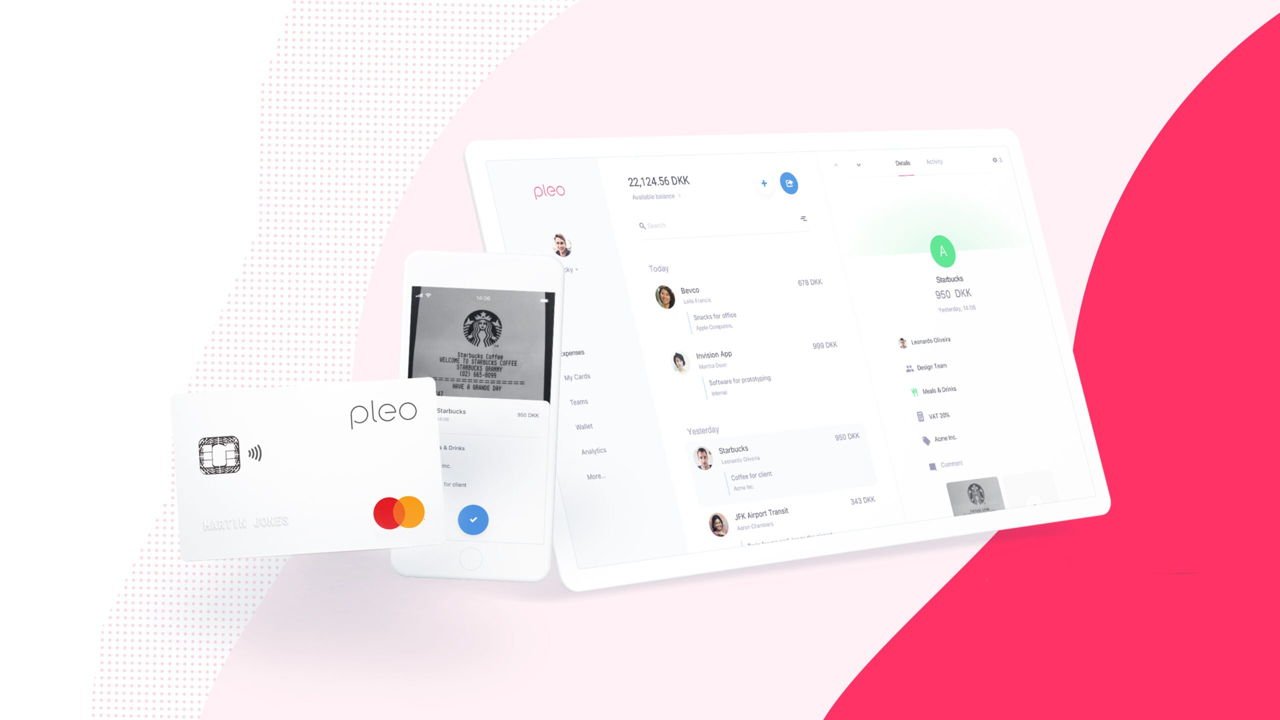

The Danish startup, which has raised more than $430 million in funding, provides European businesses with various spend management tools including company cards, employee expense reports, as well as credit products.

In 2021, it raised $150m at a $1.7bn valuation, and six months later raised another $200 million at a valuation of $4.7 billion, making it one of the more valuable fintech startups in Europe.

But its valuation has taken a significant nosedive since, with billions of dollars wiped off its valuation, according to a valuation by one of its leading investors.

In 2022 and 2023, several high-profile fintechs saw their valuations slashed amid a difficult economic environment.

In the first quarter of 2024, Pleo was valued by Kinnevik, which holds a 14 per cent stake in Pleo, at around $2.3bn.

Its $2.3bn valuation was three per cent higher than the previous quarter's valuation by Kinnevik.

Kinnevik said: “Our fair value increases slightly in the quarter due primarily to a strengthened Euro.”

Kinnevik and other investors acquired a “small number of secondary shares” in Pleo during the period, the Kinnevik report says.

Other investors in Pleo include Coatue Management, Alkeon Capital and Bain Capital Ventures.

A spokesperson for Kinnevik said: “Pleo is one of our core growth companies in which we have a strong conviction and therefore we bought some additional secondary shares."

One reason VCs typically buy secondary shares is they might not be happy with their original allocation, so picking up secondaries is a way of gaining more ownership and control of a business.

Next month, Soren West Lonning, a former executive with Chr Hansen, a Danish bioscience firm, is joining Pleo as CFO.

Pleo laid off around 150 staff in 2022 and is understood to have asked for voluntary redundancies last year in its UK office.

Pleo was unavailable for comment.

Would you like to write the first comment?

Login to post comments