It’s often said that Europe is the fashion centre of the world, and for good reason. The old continent’s long-standing tradition in design, and powerhouses like Inditex or H&M - two of the largest fashion brands and clothing retailers in the world - have contributed to an increase in popularity and relevance for multiple Europe-based, fashion-related and technology-enabled businesses.

Berlin-based Zalando (€796 million in sales in Q1), UK’s Asos (£1.1 billion in revenue in its last fiscal year) and the Yoox Net-a-Porter Group have become European powerhouses in fashion e-commerce, and their success has contributed to the launch of other clothing and retail businesses in the region.

**> Purchase our 'European Tech Funding Report for Q1 2016' for just £99**

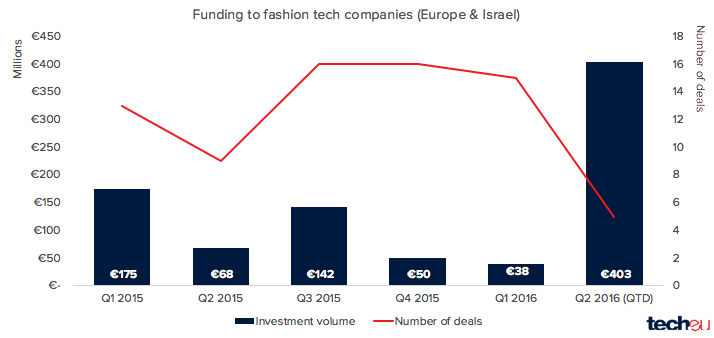

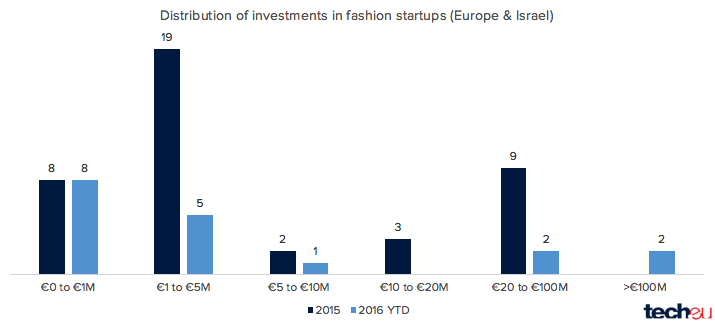

According to tech.eu’s data, in 2015, a total of 54 European and Israeli fashion technology companies raised capital, combining for €434 million. That’s an average of €8 million per investment, with a significant number of deals taking place in the €1 million to €5 million bracket and noteworthy activity in the late-stage markets (nine deals came in between €20 million to €100 million).

While impressive, even more notable is the fact that fashion tech businesses seem to be accelerating, at least in terms of fundraising.

In the first five months of 2016, European and Israeli fashion startups have raised more than €440 million in funding (more than in FY 2015), across _just_ 20 investments. This implies that there have been some _mega rounds_ in the region in the first two quarters of 2016. And that is indeed the case.

90% of the €440 million raised so far in 2016 belongs to two massive rounds from British/Portuguese startup Farfetch (which had already raised €78 million in February of last year) and Global Fashion Group (GFG), Rocket Internet’s fashion retailer that just raised €300 million from Rocket itself and Kinnevik.

While one could certainly argue that these two investments single-handedly skew the numbers and distort the analysis significantly, it should be noted that even excluding GFG and Farfetch’s 2016 deals, funding activity in the sector has increased year-on-year, at least in terms of number of deals.

The UK and Germany, and more specifically London and Berlin, have emerged as Europe’s leading fashion tech hubs, accounting for the vast majority of investments in 2015. While it’s too early to tell whether this geographic balance will remain true in 2016, it’s worth noting France’s increased relevance, with six fashion tech investments to date - the highest number for any European country this year.

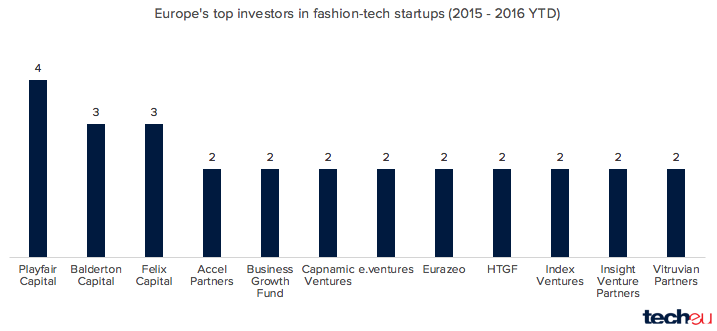

Behind many of these deals there’s a group of investors that have traditionally shown strong interest in the world of fashion and its intersection with e-commerce, such as Playfair Capital, Balderton Capital, Accel Partners and the young Felix Capital. As many as 12 different VC firms have completed at least two investments in fashion technology companies since 2015.

While all of the above speaks to the hypothetical bright future of Europe’s fashion tech industry, it’s always good to be reminded that things can go wrong even when it looks otherwise.

The examples of Fab.com, which in its heyday boasted more than 100 employees in Berlin, or the significant drop in valuation experienced by Rocket Internet’s Global Fashion Group in its latest round of funding (the company’s valuation decreased from €3.1 billion in July 2015 to €1 billion this year), show that the path from funding to exit is never easy. And that’s what matters the most.

**Also read:**

Fashion forward: Here’s 20 fashion e-commerce startups to watch in Europe

Fashion e-commerce juggernaut Farfetch scores $110 million at a reported $1.5 billion valuation

Accel raises $500 million fund to double down on Series A and B rounds in Europe and Israel

Would you like to write the first comment?

Login to post comments