Beglian fintech Cashforce has raised a €5 million Series A, led by INKEF Capital and Citi Ventures. The round was filled out with support from existing investors Pamica NV and Volta Ventures.

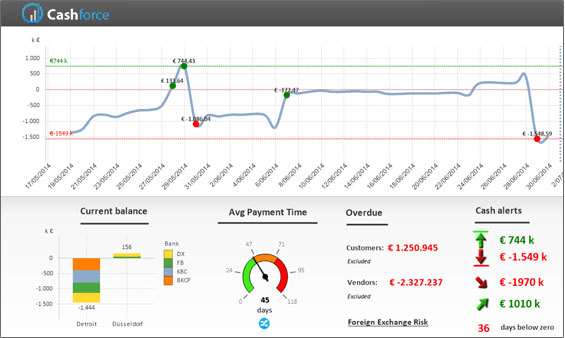

The startup offers cash forecasting and working capital management through its treasury platform, aimed to help global enterprise customers make better financial decisions by moving them beyond mere analysis to advanced automation.

More specifically, the Cashforce technology improves “clients’ ability to aggregate disparate data sets across their enterprise to help better manage their working capital and more accurately predict through algorithmic techniques their potential liquidity exposure,” says Ron Chakravarti, managing director at Citi Ventures.

Corné Jansen, managing director of INKEF Capital, explained further: “With the help of Cashforce’s technology, the way cash flow forecasts are generated and working capital is managed can be radically transformed. By addressing these deep-seated challenges for many corporates using automation and AI, Cashforce is well-positioned and has tremendous potential to significantly help enterprises.”

Cashforce has grown rapidly since its launch last year, expanding beyond its Antwerp origins to new offices in London, Ghent, and Copenhagen in 2019. Offices in Zurich and Singapore are already in the pipeline.

Executive Chairman Michel Akkermans and CEO Nicolas Christiaen commented on the success so far and the opportunity ahead: “Cash forecasting still remains one of the most important challenges for treasurers worldwide. The last three years have been very fruitful for us, developing our solution and broadening our eco-system through partnerships with global banks, treasury consultants, and bank connectivity partners. Our mission remains unchanged: delivering reliable technology that enables financial leaders to make high-caliber decisions. We are therefore very enthusiastic about our new global strategic banking partnership with Citi, jointly offering their corporate clients a crystal-clear future.”

Would you like to write the first comment?

Login to post comments