Editor’s note: This is a sponsored article, which means it is independently written by our editorial team but financially supported by another organisation, in this case, Euronext. If you would like to learn more about sponsored posts on tech.eu, read this and contact us if you are interested in partnering with us.

In collaboration with Euronext's TechShare, a unique pan-European programme that helps founders better understand the role of capital markets to finance the growth of their tech startups, we've come up with a list of myths about initial public offerings (IPOs) that really need to go the way of the dodo.

Whatever you (think you) know about taking startups public, it's important to distinguish fact from fiction before making a decision on how to finance your company's growth. So, without further ado, here are a few myths about going public.

1) You have to be a behemoth to qualify for entering a stock exchange

Size doesn't matter as much as preparedness: to undertake a successful IPO, you will need to properly assess your readiness of tapping the public markets for growth funding. While the decision to take your company public is a big one, you don't necessarily have to be a big company.

To illustrate: Euronext is currently the trusted home for more than 1,120 SMEs from across Europe, and many of them can grow and evolve during the stock exchange journey.

An outstanding example of this is Solutions30, which completed its transfer to the Euronext regulated market in Paris in July 2020. This came after the company initially started its stock market adventure back in 2005 by listing on Euronext Access, a market dedicated to companies with a smaller market capitalisation.

Ten years after that, the company operated its first transfer to Euronext Growth, and a mere five years later, Solutions30 entered the regulated market on Euronext Paris.

Within those 15 years, Solutions30 went from a €4.5 million market cap to an impressive €1.5 billion.

"They have multiplied their market capitalisation by 270 times with no capital increase in the meantime," points out Camille Leca, Chief Operating Officer Listing at Euronext.

In short, what that means is that there is no 'one stock exchange' reserved for listings of major multinationals, but alternatives that can cater to a company of almost any size. In fact, Euronext boasts dedicated markets to allow founders to experience the stock exchange in accordance with their companies' particular development patterns and needs.

2) An IPO is an administrative burden

The IPO process can be a lot lighter and easier than you might think, depending on what stage you are in, and rarely is it as big an administrative burden as feared beforehand. There's of course a specific timeline to keep in mind, and you need to take into account that you'll need to prepare the proper documentation for the operation to be legally valid.

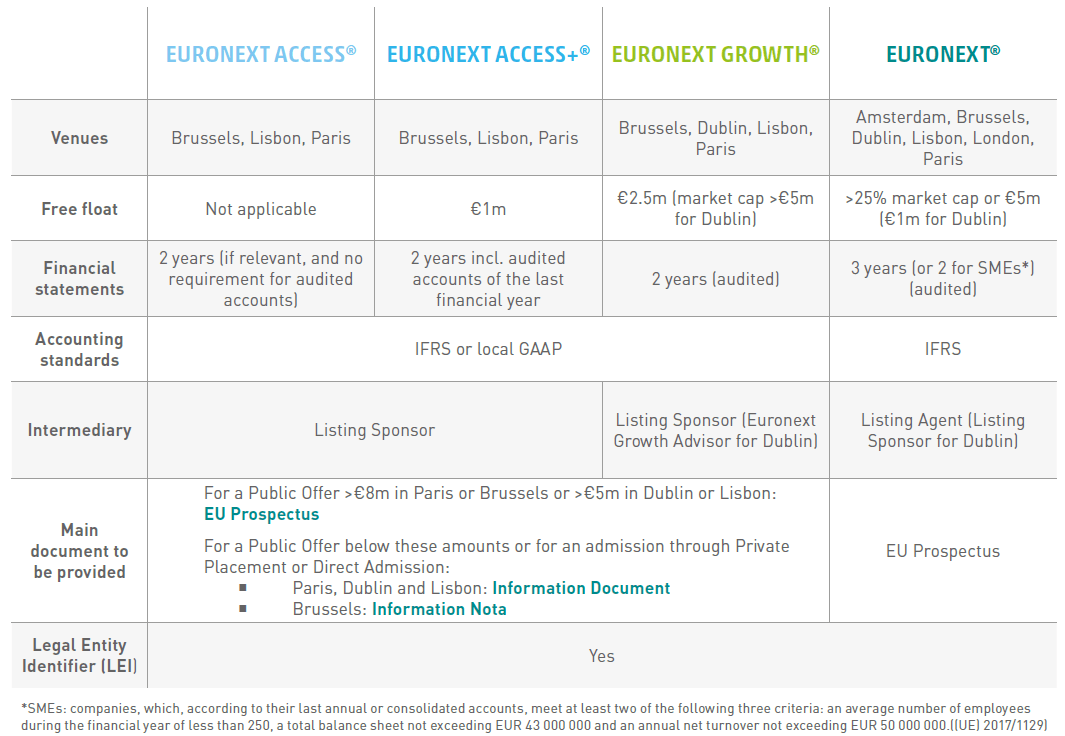

Euronext proposes different market segments, each with different requirements. Depending on the market you choose for your listing, the reporting requirements both before and after the IPO, as well as the eligibility criteria required to list in the first place, are not one and the same.

The requirements linked to listing are also a great opportunity to professionalise and structure the management of the company, its strategic plan, reporting, and governance.

Another essential aspect of an IPO to consider is the importance of being well surrounded. You must establish a working group that will follow you all throughout the listing adventure but also, importantly, keep placing the company's needs first.

Your team should be carefully selected, and you should take your time in your research process.

In Euronext's case, the IPO advisors are usually investment banks, legal advisors, auditors, listing sponsors and a designated Euronext Account manager. They commit to guiding you throughout the whole process, and help you gain the knowledge you need to complete your IPO while you can keep running and growing your company.

3) You need to be a connoisseur of all things finance

Whatever your level of financial literacy is, if it appears to be an obstacle to entering the stock exchange, you can rest assured. While it does help to know how it works, you certainly don’t have to be a finance guru to float your company successfully.

As a stock exchange, Euronext understands that the financial sector can seem very complex from the outside, and that you would need advanced knowledge of it to be able to use it effectively. That is precisely why Euronext designed TechShare, a pre-IPO programme designed to help companies familiarise themselves with the capital markets.

Based upon three educational modules — academic campuses, workshop sessions, and individual coaching, — TechShare exists to provide you with an in-depth understanding of the capital markets through tailored content provided by committed partners from the financial industry.

4) The IPO comes with a golden cage

With the entry of a consequent number of new shareholders in the participation of your capital, you might be frightened of losing control of your business. That is just another myth that prevents growing businesses from achieving an IPO.

And yet, listing your company is a big opportunity to consolidate the governance of your enterprise. For instance, many companies assert their independence through the stock exchange by choosing their free float and diversifying their investors base.

5) An IPO is just a financial operation

Going public is not just about money, even though it’s the valuation that usually gets featured in flashy media headlines surrounding IPOs. The possible reasons for completing an IPO include leading the strategic development of your business or creating a liquid market for your shareholders, as well as many others.

On the investors’ side, non-financial criteria now play a significant role in their decision-making process. A company needs to make its values, vision and above all, its mission, known in order to be and remain successful.

This is an opportunity to gain local and international visibility. The visibility — and credibility — achieved through an IPO will enable a company to carry out new strategic projects such as:

- Talent acquisition

- Promoting employee engagement through social plans

- Raising your profile and status

- Empowering management

Whatever the initial aim, an IPO is a significant operation for your company that changes the dimension and scope of your business, and boosts your credibility towards all your stakeholders. It is also a unique opportunity to mobilise your team around a long-term project.

Would you like to write the first comment?

Login to post comments