During an earnings call Barcelona-based publicly listed provider of residential and public electric vehicle charging and energy management solutions, Wallbox announced measures to reduce costs to “better align with its 2023 full-year guidance”.

As part of the projected savings of approximately €50 million, the company says that 15 percent, or roughly 210 jobs, will be impacted.

“We do not make these decisions lightly. We will work hard to minimise the impact to all those affected and we sincerely thank them for their contributions,” said Wallbox co-founder and CEO Enric Asunción. “We invested heavily in manufacturing capacity and product innovation in 2022, which improves our long-term competitive position, and sets us up well for continued growth. However, as previously discussed, near-term disruptions in global supply chains have impacted EV delivery rates, and as a result, require us to better align our cost structure with the current demand environment.”

We took a look at Wallbox in our Big Deal series in August of last year following the company’s acquisitions of Coil and ARES Electronics.

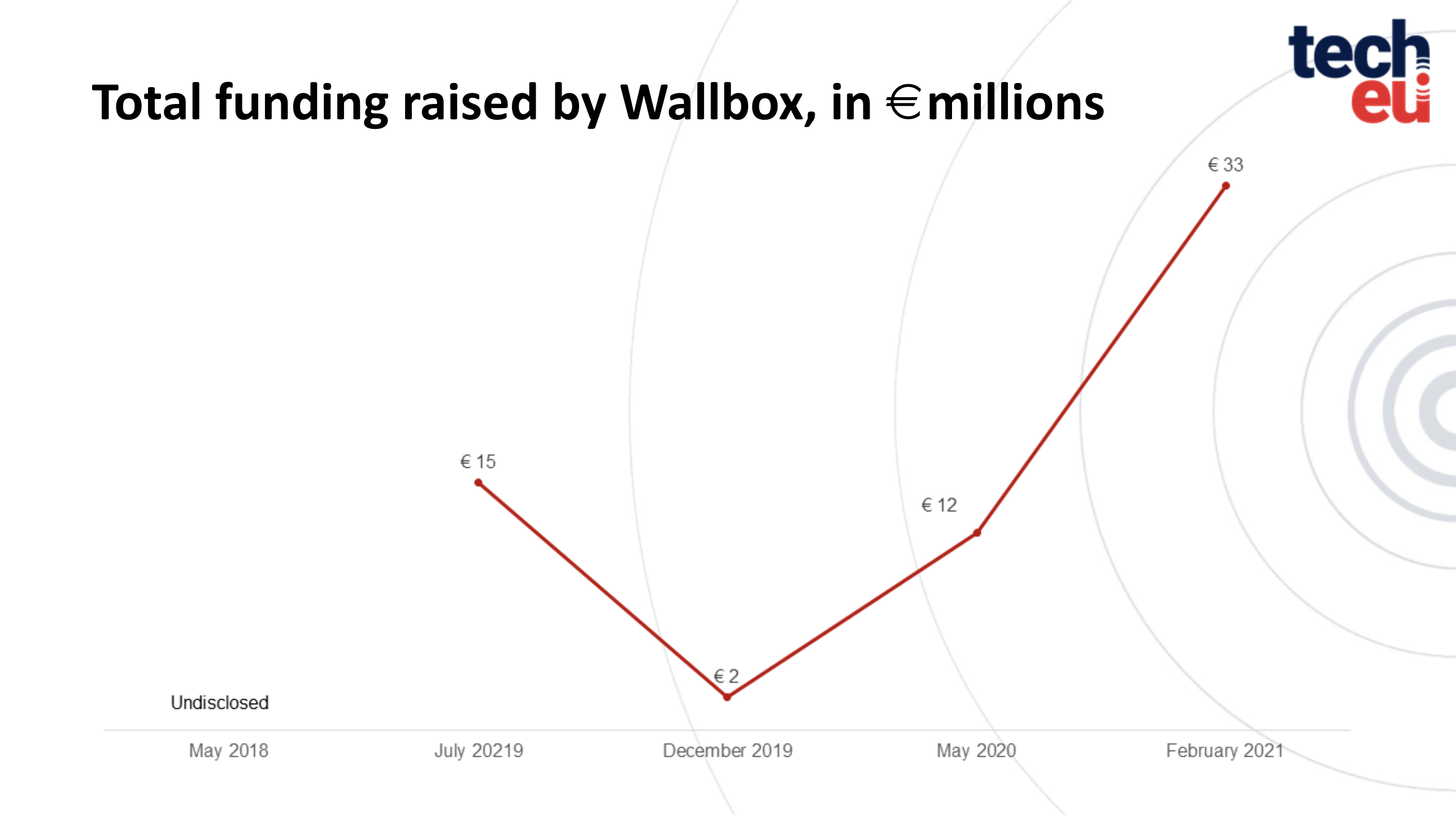

In addition to insights behind the impact of these acquisitions, we broke down Wallbox’s funding numbers and looked into how far the company has come on very little external funding.

In line with market conditions, It would appear that this sustained growth is now slowing and it should be interesting to watch how the company continues to navigate choppy waters.

Would you like to write the first comment?

Login to post comments