Cologne-based trading platform for scrap and recycled metals Metycle has raised €1.5 million in an effort to homogenise and digitise the industry. The new ore will be used to further develop the platform and its operations, as well as instigate a recruitment drive that aims to assemble a team of approximately 20 industry specialists.

The €1.5 million pre-seed round was led by Market One Capital and DFF, and included participation from angel investors longtime recycling metals industry veteran Tom Bird and Caya co-founder Louis Pfitzner.

At just 9 months since founding, co-founders Sebastian Brenner and Rafael Suchan are taking their long experience working in Asia, China specifically, and addressing the $600+ billion global market that is scrap metals.

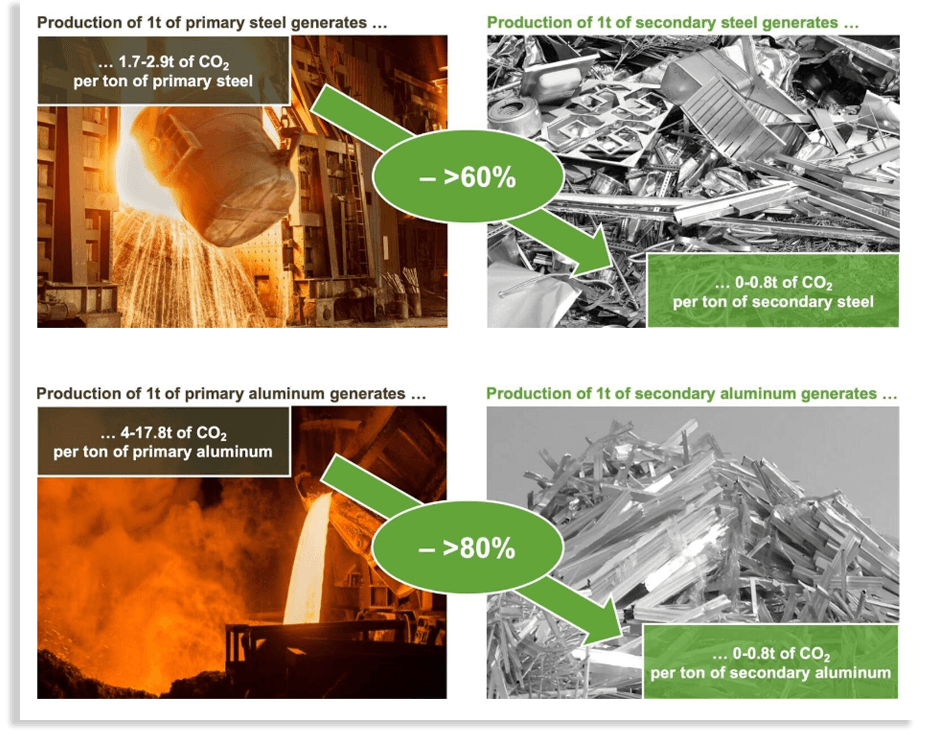

According to Metcycle, the production of primary metals results in 3.6 billion tonnes of CO2 emissions on an annual basis, recycled or scrap metals can serve the same job as their primary counterparts, without a decline in quality, with a CO2 footprint reduction of 60-95%.

Where Metcycle fits into the picture is by providing a digitised and efficient marketplace aimed at facilitating the trading of these materials. Specifically when the company notes that 70% of al global metal smelting capacities are located in Asia, the canvas starts to become clear when considering the founders combined 16 years of experience working in the area.

Brenner explains, “For suppliers, Metycle takes the pain of negotiating, monitoring payment and logistics flows. For buyers, we give access to prime quality material, payment options in local currency, and at payment terms.”

To be certain, Metycle is a brokerage platform and only facilitates trade between buyers and sellers. The startup is not involved in the trade between buyers and sellers. The company's financial service provider facilitates each payment and holds the funds secure in an individual escrow account until the goods have been delivered.

“Sebastian and Rafael know the market for secondary metals like no other. Powered by their deep domain expertise, they have built a marketplace that caters to the needs of buyers and sellers alike - creating transparency and efficiency across the entire value chain. Through its global marketplace and international matchmaking, the lifetime value of scrap metal is greatly extended - a fantastic win-win-win situation,” concluded DFF Partner Mart de Haar.

Would you like to write the first comment?

Login to post comments