Paris-based VC firm Elaia has announced the close of its Digital Ventures 4 fund at €200 million, a figure up €80 million from May 2021’s number of €120 million.

In it’s fourth outing with the Digital Venture team and seventh overall, Elaia’s newest fund aims to back 25 to 30 European companies (and now Israeli companies as well), working in the fields of cybersecurity, cloud Infrastructure, digital life sciences, fintech/insurtech, and/or digital transformation. Offering ticket sizes ranging between €1 million and €15 million, Elaia is looking to invest in companies that are anywhere between pre-seed and Series B funding rounds.

The fund has been backed by LPs including BNP Paribas, Bpifrance, BRED Banque Populaire, CNP Assurances, EIF, MGEN, SWEN Capital Partners, and a number of prominent family offices.

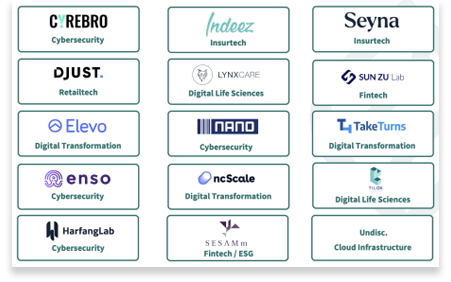

The DV4 team has already made 15 investments with this new capital into startups including HarfangLab, Seyna, Lynxcare, SESAMm, Djust or NANO Corp.

The DV4 team has already made 15 investments with this new capital into startups including HarfangLab, Seyna, Lynxcare, SESAMm, Djust or NANO Corp.

“We’re proud to have our investors’ renewed trust in this fourth-generation fund, testifying to our 20-year experience on the market,” commented Elaia managing partner Xavier Lazarus. “Our thesis of investing in B2B tech-intensive companies is a crisis-proof bet and therefore, reassuring in the current context. Brought together, this means we will continue to back future tech champions built from Europe.”

Would you like to write the first comment?

Login to post comments