Climate tech funding in 2022 represented more than a quarter of every venture dollar invested in 2022 according to PwC’s State of Climate Tech 2022 report. This represents aggregate funds raised for climate tech since the start of 2018 of $260 billion, over which more than $52 billion has come in 2022. Climate fintech startups raised $3 billion in 2022, с. 3x vs 2021 according to data from CommerzVentures.

This is just the beginning of the surge. PitchBook estimates the climate tech market will be near $1.4 trillion in five years, representing a сompound annual growth rate of 8.8%. Carbon tech (incl. B2B climate-related software and fintech) will be the fastest subsegment. Pitchbook expects the market to double in 5 next years and reach $21 billion.

B2B software and fintech climate solutions will have a significant impact on sustainability. Companies need the tools and services to track their own carbon footprint and reward clients who reduce their CO2 emissions. Furthermore, B2B software and fintech climate solutions are indispensable for funding green energy projects.

There are several sectors of software and fintech that, we believe, will provide the most interesting climate-related products.

Payments

Carbon emissions have a direct correlation to spending habits. The more people and companies spend, the more carbon emissions they produce. Therefore consumers and companies need tools and infrastructure that enable them to make sustainable spending decisions. Сonsumer payment giants, such as Visa, are developing ways to encourage consumers to adopt green payment practices. But some companies move further and want to change the legacy payments’ status quo and build a new generation of payments linked to sustainability. Single.Earth is trying to create a payment ecosystem linked to CO2 associated with a specific forest or biodiverse area. Or corporate card company TreeCard donates 80% of the interchange fee to initiatives dedicated to sustainability.

Lending

Debt plays a major role in the green economy. The majority of heavy sustainability projects, such as solar panels or wind turbine installations are financed with debt. Sustainability-linked lending skyrocketed from $5 billion in 2017 to $120 billion in 2020. Those are mainly driven by growing interest in sustainability and government incentives and subsidies. But technology platforms also play a major role. These include new lending structures for green lending, new credit models based on ML and AI, and Blockchain-based platforms for transparency tracking. For example, Сlarity uses machine learning and big data to deliver environmental and social insights to investors and organizations.

Carbon Trading

Emissions and carbon trading have become established practices. It was a brilliant idea to put a price on carbon emissions and pollution and incentivize actors to offset such emissions. Voluntary carbon trading is a new but fast-growing market – more and more companies/citizens start to think about carbon footprint offsetting. But the market is still very fragmented, and practices are (not consolidated) widely different. There are different actors in this market: certification labels, NGOs, project developers, brokers, etc – thus the process is very complicated. There is a new generation of players who help facilitate transactions, e.g. ClimateTrade or Puro.earth. These companies simplified the process of carbon footprint offsetting, users/companies can buy carbon credits as easily as buying something on Amazon.

Energy Trading

There will be a huge boost in renewables energy penetration in the near future and a big part of electricity will be produced close to consumers. A new generation of companies is trying to provide infrastructure for decentralized energy systems incl. Fintech players (e.g. Tesseract or Anode Labs). There is also going to be a huge boost in energy trading due to the EV numbers on the road increase. So there is going to be a growing demand for new generations of tech players who facilitate energy distribution, e.g. ev.energy or Bonnet.

Web 3.0

Blockchain can solve different environmental issues and create new economies around sustainability. This can enable a range of climate-focused applications, such as a blockchain-based carbon offset marketplace, an energy management system, a renewable energy tokenization platform, and more. e.g. Nori focuses on carbon removal. Its marketplace provides financial rewards to farmers, who use regenerative farming practices that involve soil carbon sequestration. Web3 can also be used for supply chain visibility. Retraced’s platform focuses on tracing the supply chain in fashion to enhance transparency and accountability. UK startup Circulor uses blockchain technology to map the supply chain and track different ESG parameters. Cirplus is yet another startup that brings sustainability with blockchain. It is a global marketplace that develops a digital trading platform for recyclates and plastic waste feedstock.

Data analytics and rating

The global interest in sustainability drastically increased in recent times. So proper carbon data and reporting become critical for making sustainable decision making. Spending on ESG data analytics has surpassed $1bn plus in 2022 and projected that demand will only increase in the future. There is a new generation of companies that are trying to improve access to ESG data, with more accurate methodologies and deeper insights to check how sustainable companies are and deliver on their claims. A few of those include Impak Finance, YvesBlue, etc

Carbon management and offsetting

There is raising interest among consumers and corporations in carbon offsetting. Therefore we see a growing number of companies that facilitate this process. These platforms help to automate data collection and benchmark against peers. Those companies help clients to track their emissions and create reduction plans. Some platforms also give access to CO2-offsetting marketplaces. Major players focus on corporates at the moment, e.g. Sweep, Plan A. Other players focus on SMEs where regulation is less developed but data is easier to capture. Some interesting companies include Watershed, Emitwise, and Pledge.

Supply chain management

Carbon emissions are a major byproduct of supply chains: 8 highly polluting supply chains account for half of the total global emissions. Regulatory and consumer pressure lead to the rise of transparency: better visibility of supply chains could significantly reduce emissions and improve the environment. Companies start to use new technology to make their supply chains more environmentally friendly and visible. For example, AI-fueled carbon accounting Carbon Chain attempts to measure the carbon footprint across the supply chain and provide customers critical insights into risks and opportunities to improve the carbon footprint.

In conclusion, decarbonization is a key step towards reducing the impact of climate change and is essential for creating a sustainable future for generations to come. It is encouraging to see governments, citizens, and businesses taking action to reduce their carbon footprints. To further accelerate this process, countries, individuals and companies should consider investing in ClimateTech, Cleantech, or other emission-reducing tech startups. Fintech and B2B software is an important aspect of cleantech and provides solutions for carbon fighting without prior heavy investment in CAPEX.

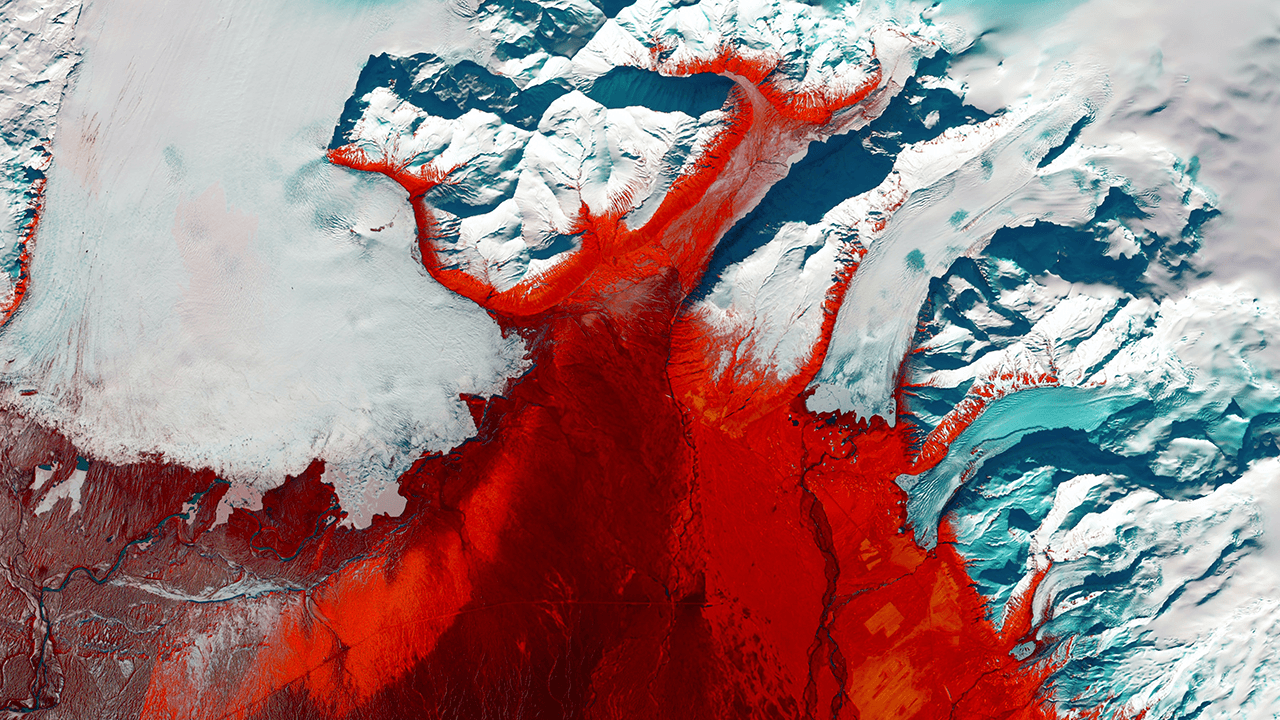

Lead image: USGS

Would you like to write the first comment?

Login to post comments