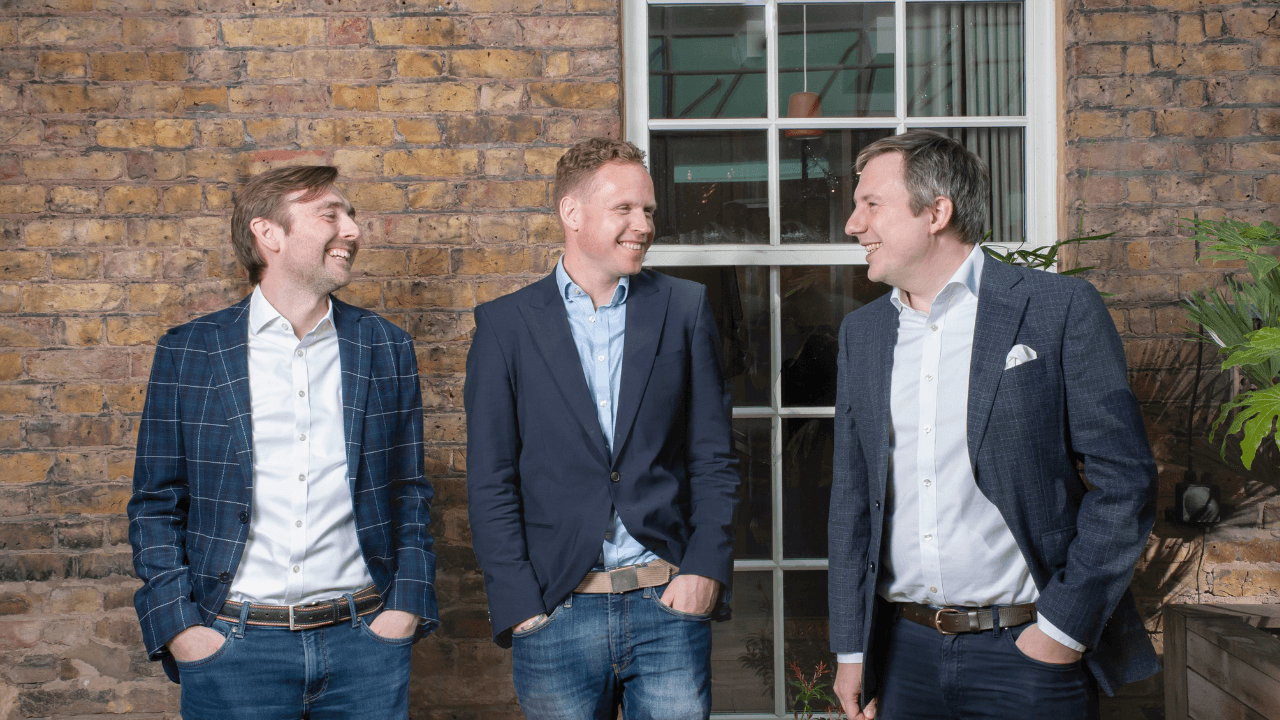

London-based fintech TreasurySpring is a cash investment platform founded by Kevin Cook (CEO), Matthew Longhurst (COO) and James Skillen (CTO), for companies to access cash investment opportunities which are usually only reserved for large financial institutions.

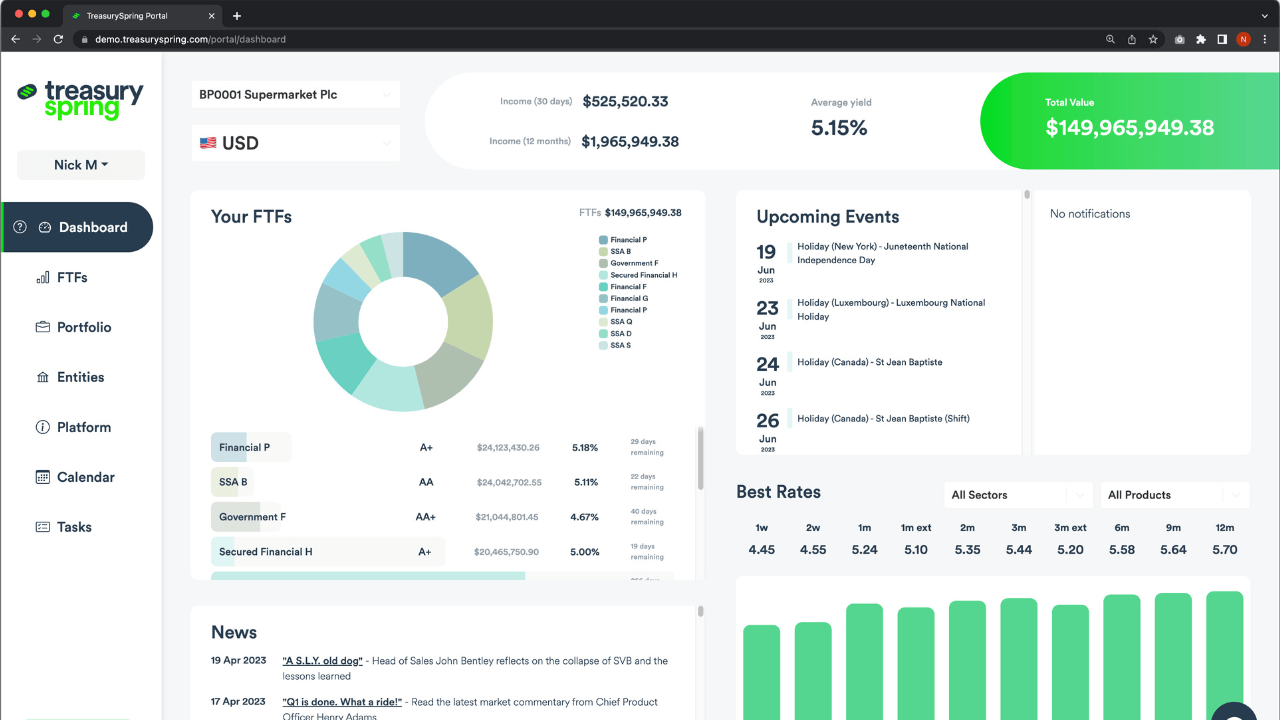

Via the platform companies can access over 600 standardised cash investment products, across seven different currencies and three categories: governments, corporates and banks. Companies can buy Fixed-Term-Funds (FTFs) that suit their preference, from one week up to thirteen months.

TreasurySpring has raised $29 million in a Series B funding round. The round was led by Balderton Capital and includes Mubadala Capital, and previous investors ETFS Capital, MMC Ventures and Anthemis Group. Fresh funding will allow the company to expand its product, sales, marketing and tech teams while expanding to new markets.

“There is a huge opportunity to radically transform cash investment for all businesses, but it remains entirely overlooked. The TreasurySpring team are true experts and have built an innovative, elegant solution to make cash investing work for all businesses, regardless of size and structure,” says Rana Yared, General Partner at Balderton Capital and TreasurySpring board member.

Schroders, Muller, Hg, Bunq, Lendable, Sainsbur’s Bank, Glovo, YuLife and Tide are names among TreasurySpring's client list. TreasurySpring claims grew more than 7x in the last year and total issuance through its platform now stands at more than $50 billion.

“For too long, the importance of cash has been overlooked by many operating businesses and investors alike. As rates have begun to rise across the globe and crises have once again started to permeate the banking sector, companies of all sizes have woken up to the benefits of diversification, security and attractive risk-adjusted returns," says Cook. "We have been growing the business rapidly for the last five years and are very well-placed to capitalise on current market dynamics. We’re delighted that Balderton is leading our Series B round – they understand our world deeply and have all of the experience necessary to support us on our journey to becoming a global leader in institutional cash investment."

Main image: TreasurySpring team

Would you like to write the first comment?

Login to post comments