London-based debt prevention and management platform SuperFi has raised a $1 million Pre-seed funding round to help Londoners to manage their debt better. The round, which was facilitated on the fundraising platform Floww, was led by Ascension and also includes a grant from the Greater London Authority. The start-up has previously been backed by Antler.

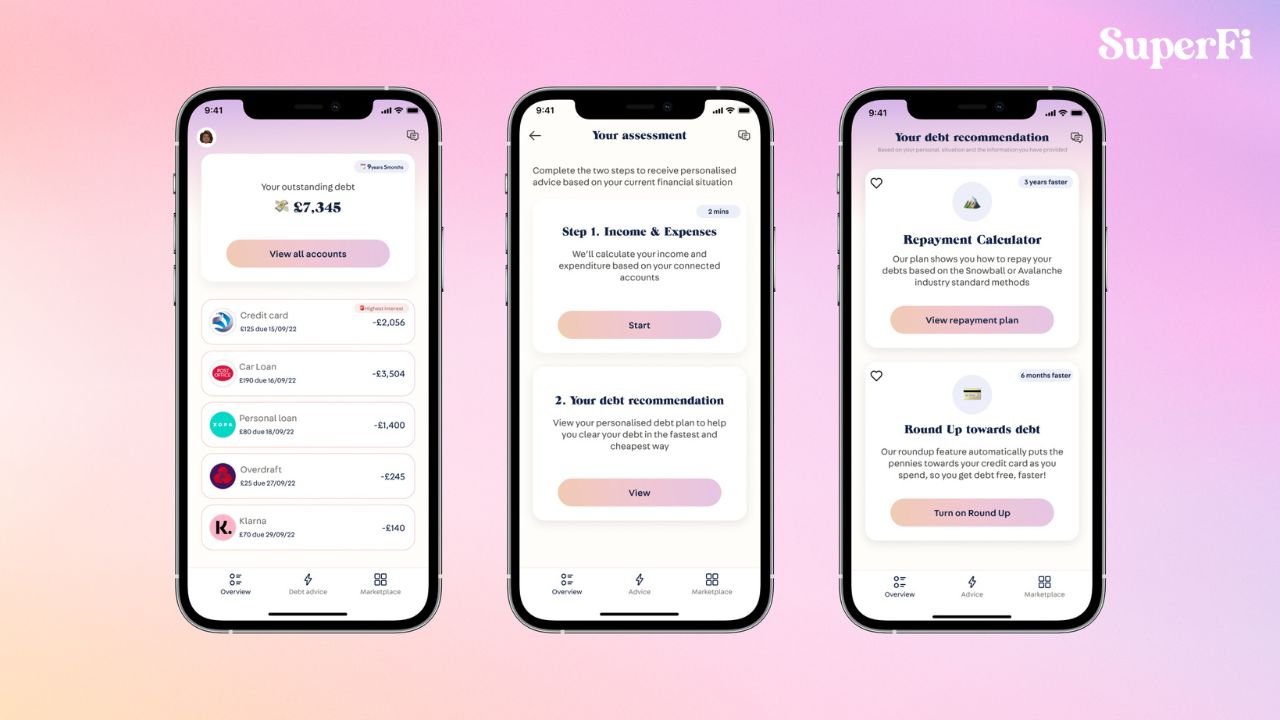

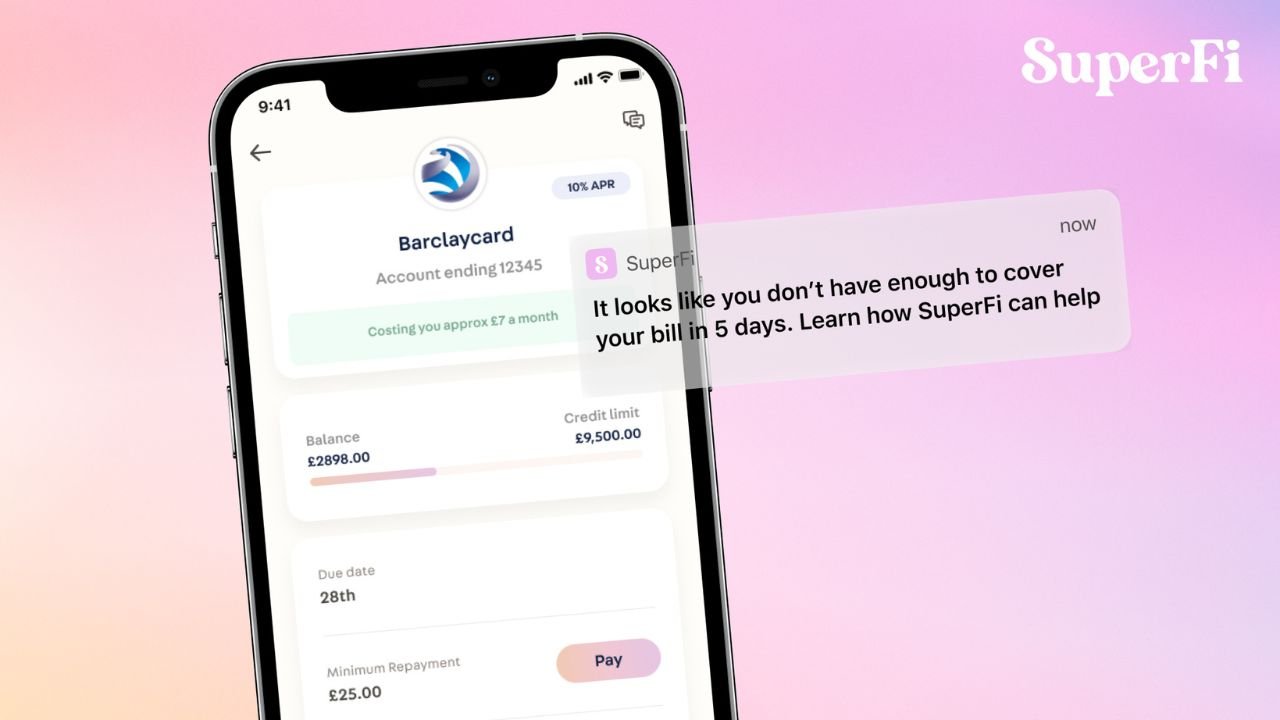

Initially launching a test in the London area SuperFi gives users an overview of their debts, analysing their financial and personal circumstances, while giving them the tools and services they require to better manage their debt. The platform was set up as a response to the cost of living crisis in the UK – plans are to serve the whole of the UK in future.

"We are thrilled to be supporting SuperFi in its mission to tackle the UK's growing debt crisis and improve financial well-being for individuals and communities. With over £1.6 trillion in personal debt in the UK alone, the scale of the problem is massive, and SuperFi's innovative platform is uniquely positioned to address it through a partner based business model that remains on the consumers’ side as the business scales. We look forward to helping the team achieve their vision,” says Emma Steele, Partner at Ascension.

SuperFi will test its platform with councils and housing associations across London.

"We believe that debt management should be proactive, not reactive. Our goal is to help millions of people struggling to pay their bills and credit commitments better manage their debt before it becomes a crisis. In doing so, we believe we can help British people during the cost of living crisis - saving businesses and society billions associated with problem debt,” says Tom Barltrop, co-founder of SuperFi.

Would you like to write the first comment?

Login to post comments