Electronic Based Systems are a strength of the Austrian electronics industry. A central location in the heart of Europe, an outstanding research landscape, and a high quality of living make Austria a go-to place for tech startups and established players alike.

Linz is a hidden gem: The capital of picture postcard pretty Upper Austria is an important location for the global chip industry. In fact, the city has been home to a thriving semiconductor market for more than two decades.

“It started after two professors at Johannes Kepler University in Linz founded a semiconductor startup 25 years ago with an investment from Infineon Technologies,” says Thomas Lueftner, European managing director at chip design startup United Micro Technology. Since then, Linz has grown to a competence center for 3G/4G transceivers and radar chips. Nowadays, several of the world’s leading companies in the field are based across Austria, including AMS OSRAM, AT&S, NXP, IMS Nanofabrication, and EV Group.

“The history means there’s a very nice ecosystem for this market. Linz has become a little bit like Silicon Valley for RF circuit design. Globally it is a real hotspot, and therefore, we decided to establish United Micro’s RF IC design center here in Linz one year ago,” says Lueftner.

A world market leader

Michaela Laussegger, director at the Austrian Business Agency (ABA), says the semiconductor market is part of Austria’s ‘hidden champions’ economy:

"We have a lot of niche B2B companies that are either market leaders in Europe, or among the top three in the world.”

For example, Infineon Technologies and AMS OSRAM make chips themselves, but other companies in Austria are as important to the supply chain as they produce the equipment needed for the companies that build the chips.

The FEEI, an association representing the interests of the Austrian electrical and electronics industry, found Austria’s companies have a 90 percent world market share in security chips for passports, a 55 percent world market share in optical light sensors, and a 25 percent global market share in chips for energy efficiency.

World class research landscape

With the so-called Chips Act, a €43 billion incentive plan to boost semiconductor manufacturing in the member countries, the EU hopes to encourage more collaboration between European research hubs. “This will likely be good news for the Austrian chips market,” says Heimo Mueller, head of business development at Silicon Austria Labs. The centre was founded in 2018 to support tech-driven entrepreneurs in Austria and is owned by a consortium of the Austrian government, federal states and industry.

“We’re sure the act will make it easier for companies here to grow”, says Mueller, “and research centres like ours will really benefit because more money will be invested in research. We already work together with three big research centres in Europe and we’re going to improve this, and get stronger by working closer and in a more efficient way.”

The chip ecosystem benefits from a strong collaboration between research centres and companies like NXP Austria or Infineon. NXP Austria innovates hardware and software solutions as well as services for the Internet of Things, automotive, Industry 4.0, and mobile sectors. Infineon Austria employs nearly 2.400 researchers, a quarter of all R&D personnel. They focus on topics like energy efficiency, mobility and security.

Heimo Mueller agrees research plays a significant role in Austria’s attraction to EBS startups:

“The universities and the research centres we have here in Austria are well known and the government is supportive, concerning financial support.”

Startups and companies looking to set up shop or to expand in Austria can count on support from the state, for example by the ABA. This can include anything from financial support to help when looking for sites.

Relatively low cost of living

A soft factor that makes a huge difference in terms of attracting top talent is the high quality of living in Austria. Both Austria and the city of Vienna regularly score highly on quality-of-life rankings, Furthermore, in cities like Linz, pretty much everybody working in the industry knows each other, making networking and collaboration easy and effective.

This quality of living, and working, comes at a relatively low cost of living. The same salary, or even a lower one, can afford much more personal financial freedom than a higher one in places like San Francisco or, London. No wonder Austria can rival more prominent startup locations when it comes to attracting talent.

Learn more about Austria as a location for microelectronics companies

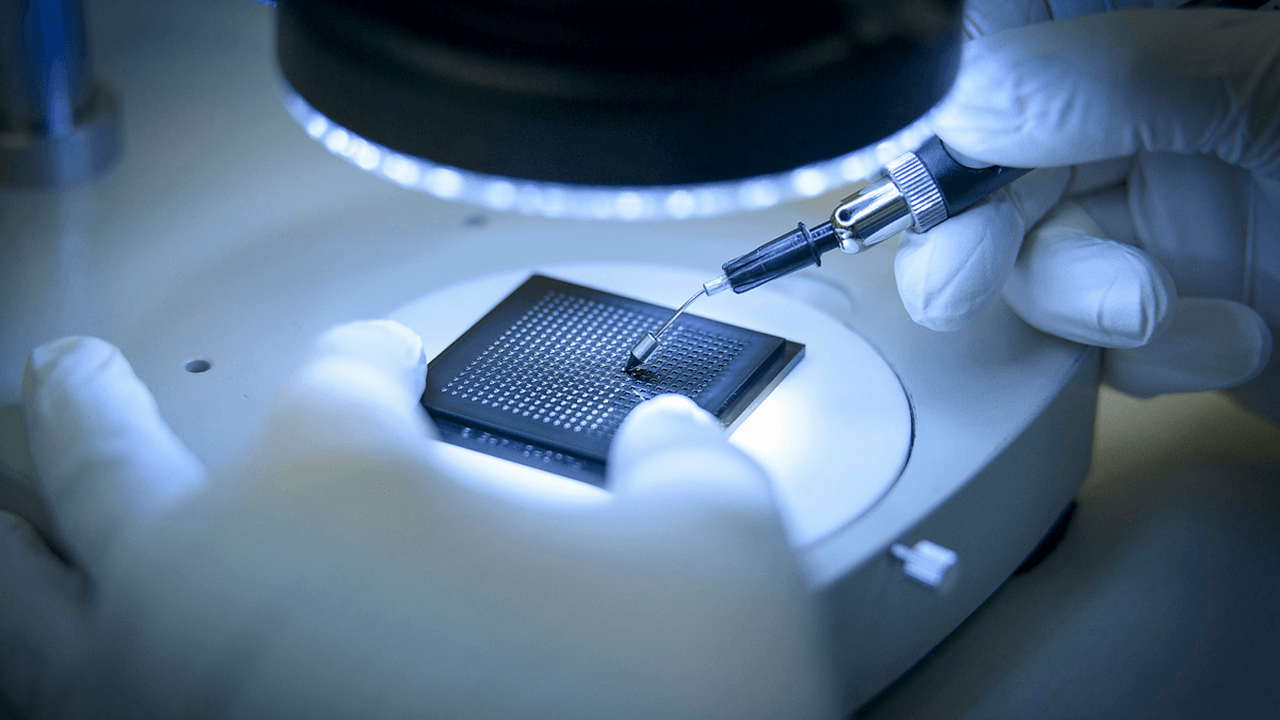

Lead image: Image Source RF / © Monty Rakusen / Westend61

Would you like to write the first comment?

Login to post comments