As part of a move hinted at during the welcoming of former Blackstone executive John McCormick as an investor, Ark Kapital is gearing up for global expansion, and in so much, bringing the moniker home to port.

Christened today, the financing company formerly known as ArK Kapital sets forth flying the flag of Gilion.

Somewhat reminiscent of the days of Web 2.0, when startups began getting experimental with their titles, ahem, Google, the newly created word Gilion is derived from the metric system prefix giga and combined with the English suffix used to form names of powers of a million or millions (billion, trillion, etc.). Gilion.

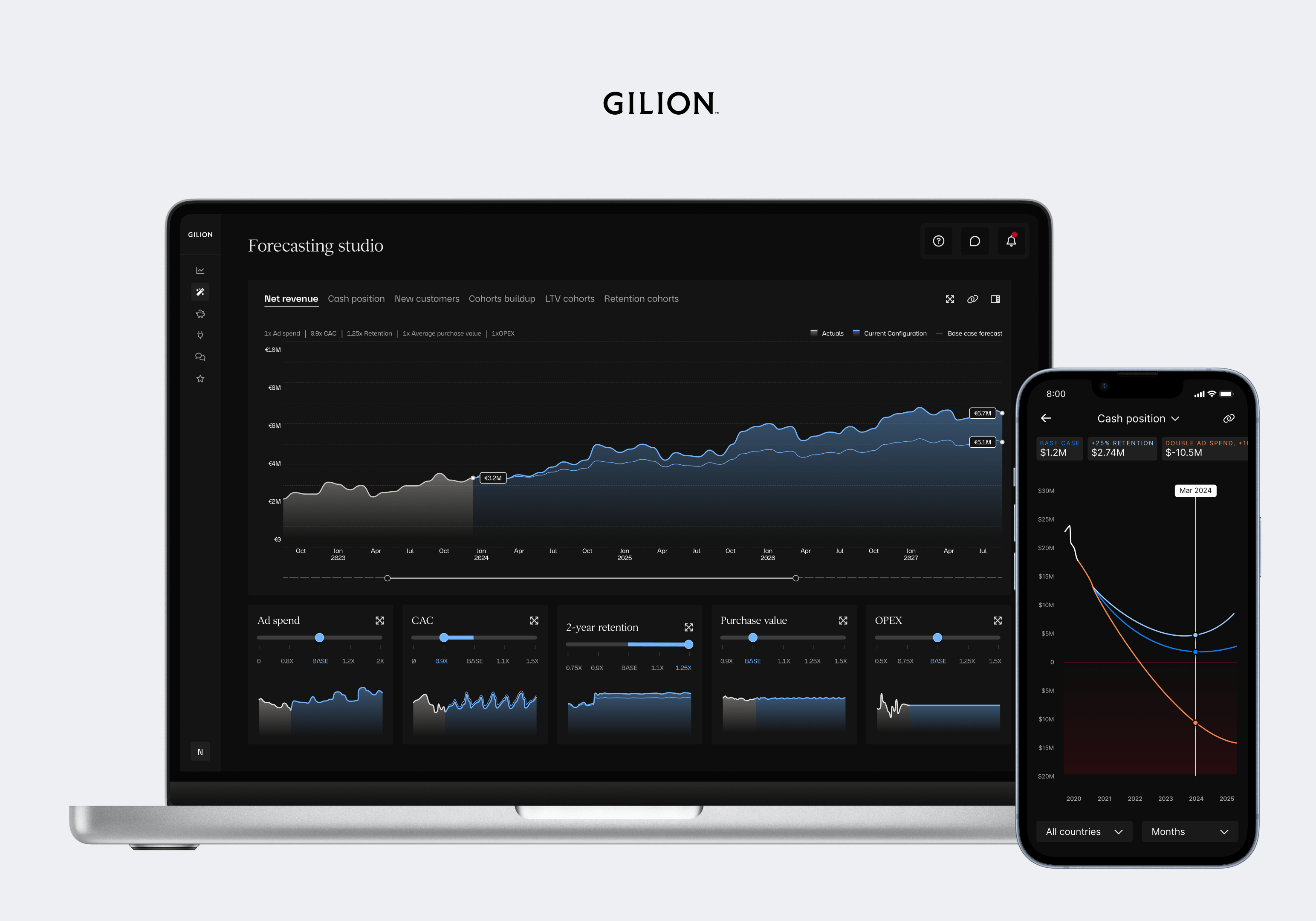

ArK, nay, Gilion says that the change in name is more than just an exercise in rebranding, but refers to the sheer amount of data generated daily by tech companies, data it says, thanks to AI, can be utilised to comprehend, optimise, and finance growth.

Gilion CPTO and co-founder Henrik Landgren explains:

"We are building Gilion to give founders across the globe access to everything they need to grow faster — from growth tools all the way to financing. Now, we're ready for the next phase and to start rolling it out globally.

“When a company connects to Gilion, they plug into the best AI models that growth analytics has to offer — a DNA test for your growth.”

Backed by the likes of Creandum and LocalGlobe, Gilion entered the somewhat crowded revenue-based financing market in late 2021 but immediately separated itself from the crowd with its case-by-case analysis risk assessment, one that looked well beyond ARR and/or MRR numbers.

Using what the company referred to at the time as its “precision financing” method to determine eligibility, Gilion offered non-dilutive loans ranging from €1 million to €10 million, drawing upon €150 million put up by private equity firm Pollen Street Capital.

From there on out, the company introduced a steady stream of founder-friendly services and tools, notably deciding to let the world at large have at it with a variant of its “precision financing” tool in an offer dubbed AIM (Ark Intelligence Machine), now a full fledge feature baked into Gilion.

Four months later, Gilion upped the ante expanding its capital available on tap to €400 million, and announced its entry to the German market.

At present Gilion says its platform hosts over 500 companies, over one trillion points of data, and tracks €1.5 billion in revenue.

According to Gilion co-founder and CEO Oliver Hildebrandt, the time is now for a US market entry:

“With one of the biggest non-dilutive capital pools, we are already well positioned to support European founders, but we intend to expand the pool to cover the US and the UK in the near future.”

And as for the ArK, Gilion assures me:

"No biblical figures or animals were harmed in this transition."

Lead image via Gilion

Would you like to write the first comment?

Login to post comments