After a very specific year last year, a lot has been said about the state of VC investments and the startup industry. We, at astoryaVC, took a specific look at the European insurtech scene to highlight major trends at work in that space and anticipate what might come next regarding insurance innovation and technology.

Insurtech followed other startup verticals and faced an investment drop

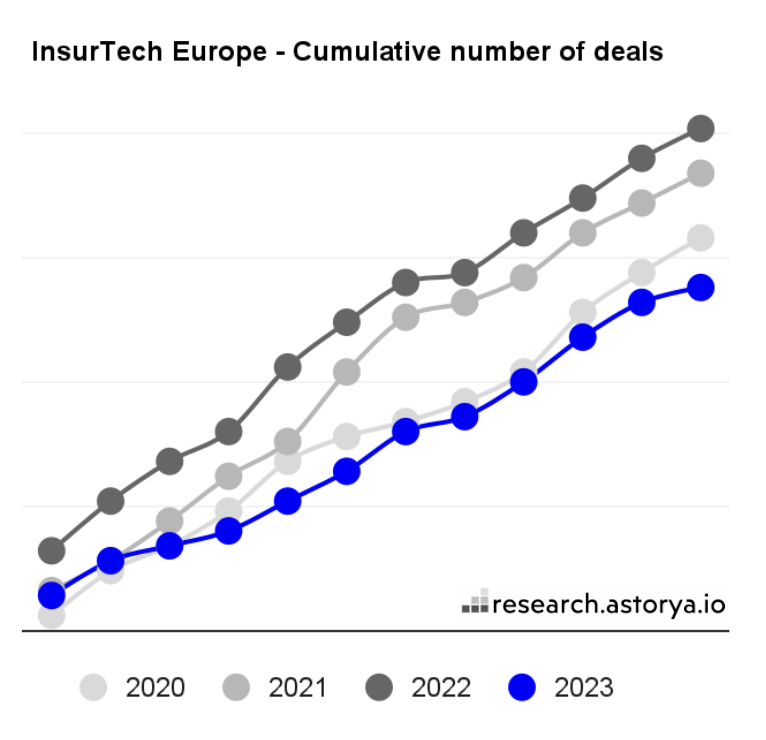

Let's address the elephant in the room: investments are down, both in the number of deals inked (-32 per cent) and euros invested (-54 per cent). This is slightly different from a year before when these dynamics were mixed: euros invested were also down in 2022, but there were more deals announced that year compared to a year before.

In 2023, it was simpler to analyse: both figures are down.

This is not specific to the insurtech industry, though, as this trend aligns with the startup industry as a whole. In most verticals, startups faced the same tough environment. To give you a glimpse of the level of activity in insurtech in Europe during 2023, it was close to that in... 2020! Long story short, we are back to the historical trend.

Though the dynamic across geographies remained very specific to the insurtech industry

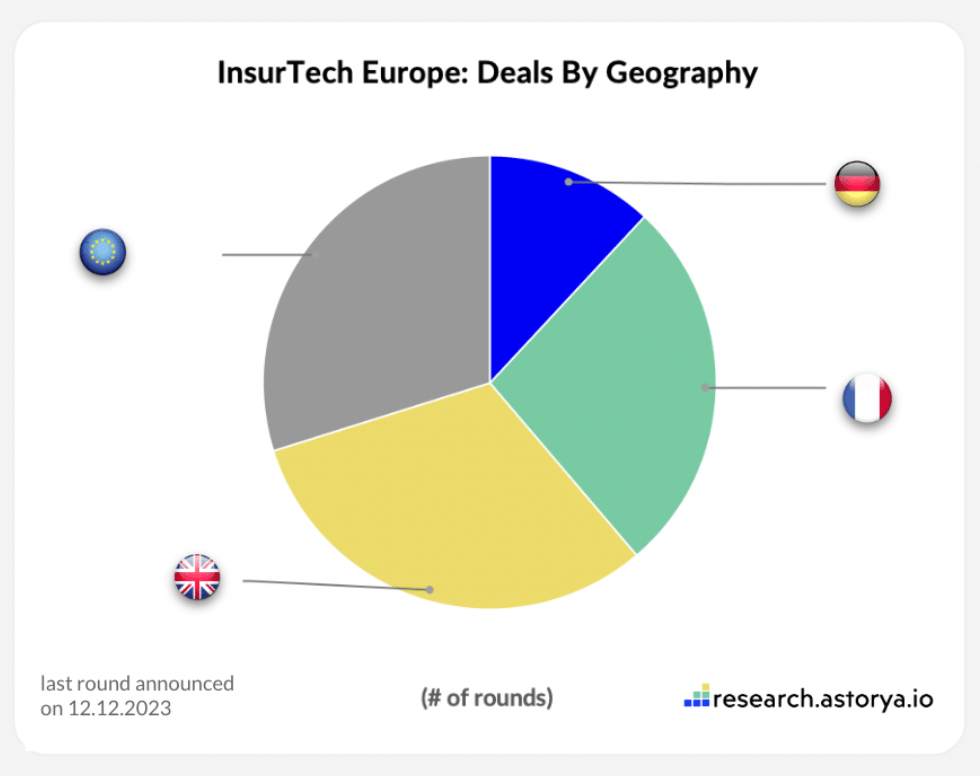

And the biggest startup ecosystems led the wave as usual: the UK is once again the largest insurtech scene. France was the second one, while Spain overtook Germany to become the 3rd most active ecosystem.

More broadly, the 'rest of Europe' (i.e., beyond the UK, France, and Germany) remained active, aligned with its level a year before.

But the dynamic is a bit different when it comes to money invested. A single company in Germany — Wefox — raised more money in 2023 than the three biggest rounds announced in the UK altogether.

More impressively, it raised more money than all the insurtech startups together in France! This enabled the German insurtech scene to be ranked second, behind the UK, in terms of money invested.

Technology is still revamping the value chain

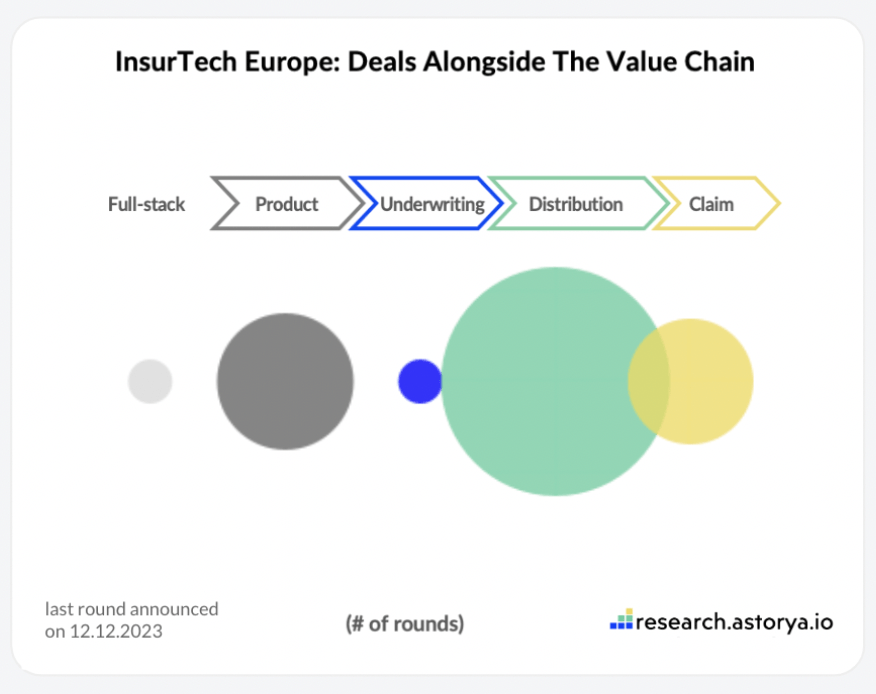

You might be familiar with the investment dynamic across the insurance value chain. In that case, you won’t be surprised to learn that 'distribution' accounted for over half of every deal announced. Once again.

What might sound more interesting, though, is the level of investment in the 'product' section (17 per cent). Several startups addressing 'new risks' raised money last year. Cyber insurtech or weather-related startups led the wave in that section, though there is still a lot to explore in that space (see the last paragraph of that essay). The 'claim' part was slightly more dynamic than its long-term average (14 per cent).

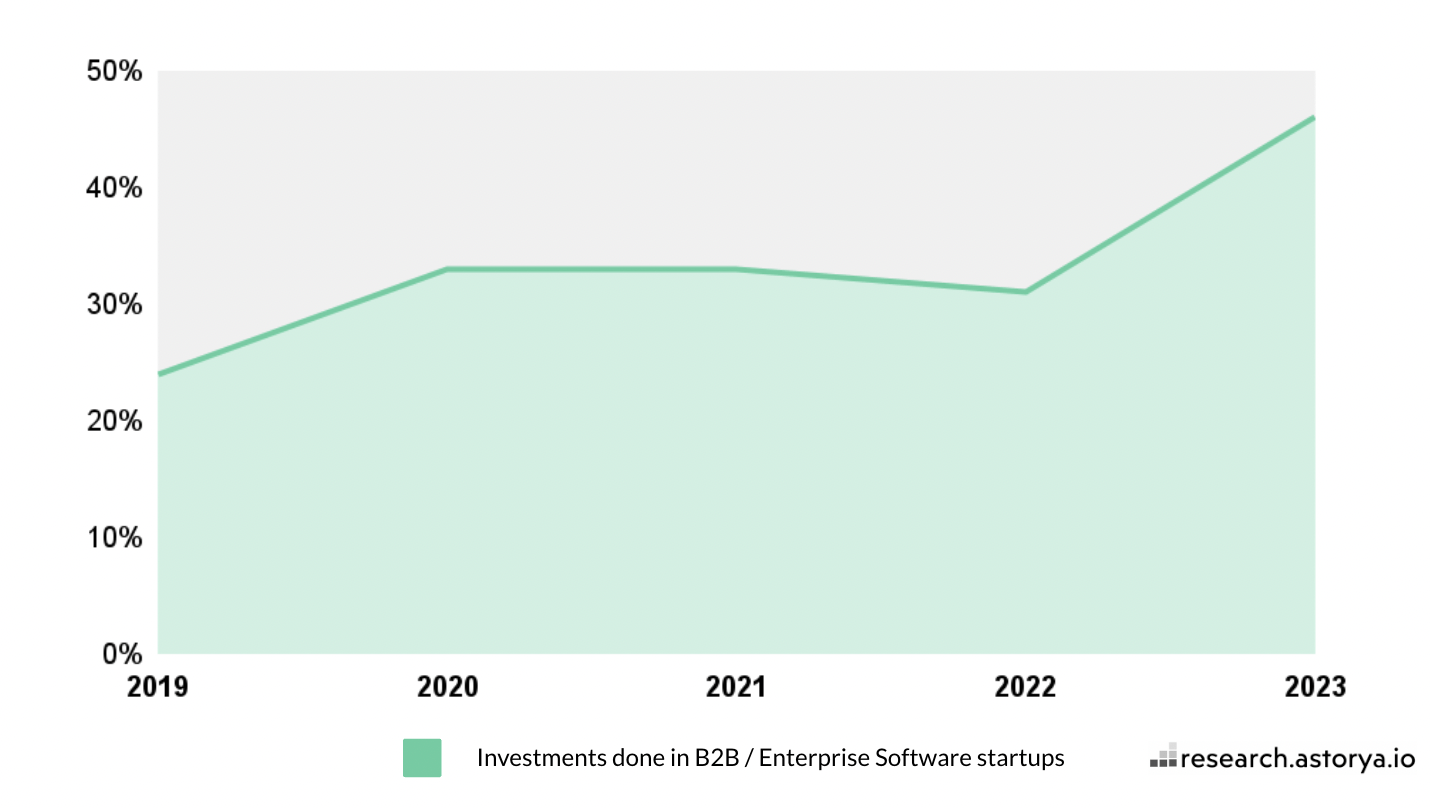

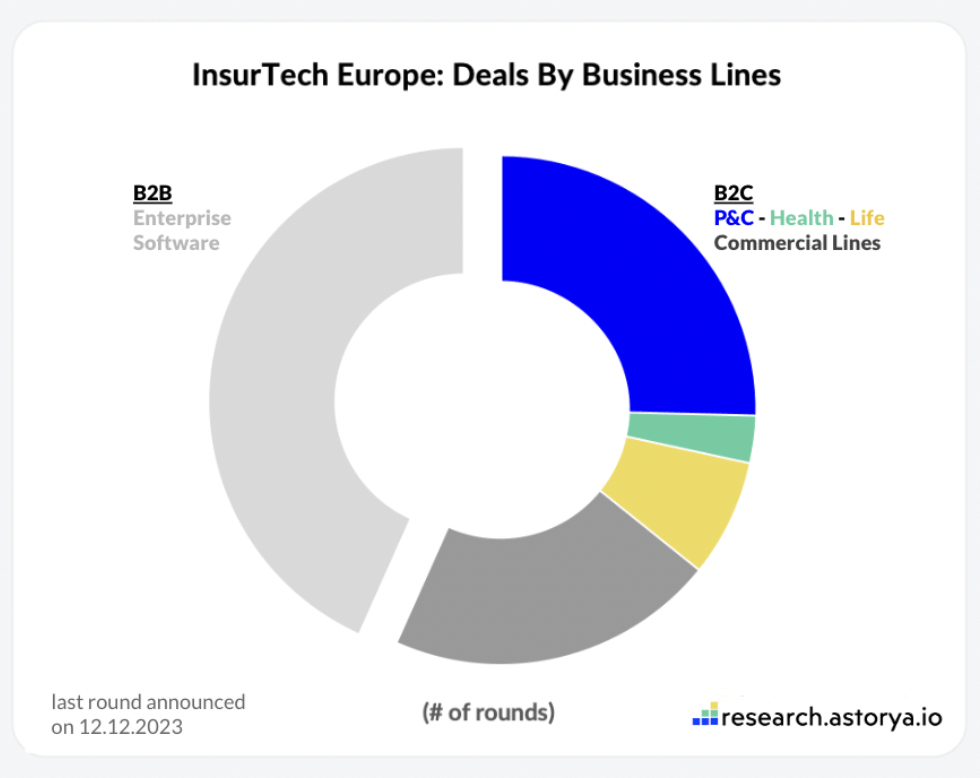

And B2B startups were hot

This resonates with another trend in terms of investments: the surge in B2B deals. These kinds of startups indeed accounted for almost half of all deals this year. This is a surge from both the year before and the long-term average. And it makes sense as there are still many opportunities to tackle in the insurance industry, especially in the current market where most corporates are now publicly announcing they are looking for 'operational effectiveness.' That’s where technology could help, including technology supercharging employees alongside the value chain.

This B2B trend is also an opportunity to say a few words about the most discussed tech trend of last year: artificial intelligence.

If insurance is usually listed among the top industries that could benefit from these technologies, there are already several startups delivering value to their insurance customers thanks to their AI-first solutions. And more is expected to come as incumbents are exploring how to embrace these technologies at scale.

Most of all, the future of insurance innovation is under construction

Speaking of the future of technology in insurance, it’s time to explore the Seed stage of the market (rounds up to €3 million). It accounted for almost half of every deal announced in 2023, which is aligned with the long-term trend and means future success stories are under construction.

Nevertheless, there is a gap in that part of the market when it comes to the geographical dynamic: the UK is leading the wave, and France is very dynamic in terms of Seed deals (accounting for one-third of all Seed deals done in insurtech Europe) while Germany was more discreet (with only 7 per cent of Seed deals announced in that ecosystem).

The 'rest of Europe' was dynamic too. This is a reminder that anyone interested in insurance technology should keep exploring opportunities beyond its domestic markets.

The same applies to the business lines: none is immune to insurance innovation. If P&C players — startups offering insurance solutions for home, car, pet, etc — led the wave once again, commercial lines will have a successful year. They are almost aligned with P&C players which usually are well ahead of the market. And beyond, several rounds were also announced on life and health lines.

What could we expect next?

The current VC environment is indeed tough and many investors are disappointed with the performance of the first wave of insurtech startups (note that most of it focused on direct online distribution).

Yet, there are still reasons to consider innovation will keep moving forward in the insurance industry:

-

Recent news from the insurance industry shows that attracting and retaining tech talents is still a challenge in the industry

-

Non-insurance challengers, who built strong relations with customers and users, own more data on the customers that are increasingly entering (or at least exploring) the market

-

Customers’ behaviours are changing, especially following the pandemic rise in remote work, e-commerce, which caused a more general expansion of online platforms, requires insurers to invest in tech solutions alongside the value chain to follow their customers online

-

New risks are surging (cyber, climate, AI, digital assets, EVs, etc)

In that background we expect a growing dynamic in the Embedded Insurance space (technology enabling third parties to become insurance distributors), more players offering operational effectiveness to corporates (alongside all the value chains, powered by AI or not) and startups addressing new risks.

Would you like to write the first comment?

Login to post comments