Vienna, Austria-based Bitpanda, which provides a brokering/exchange platform for trading digital assets such as cryptocurrencies and precious metals, has raised a Series A round of $52 million.

The monster round, which is claimed to be the largest Series A this year so far, was led by Peter Thiel’s Valar Ventures and joined by Speedinvest and other investors. Andrew McCormack, a founding partner of Valar Ventures who has overseen investments in the likes of TransferWise and N26, will join the scale-up's board.

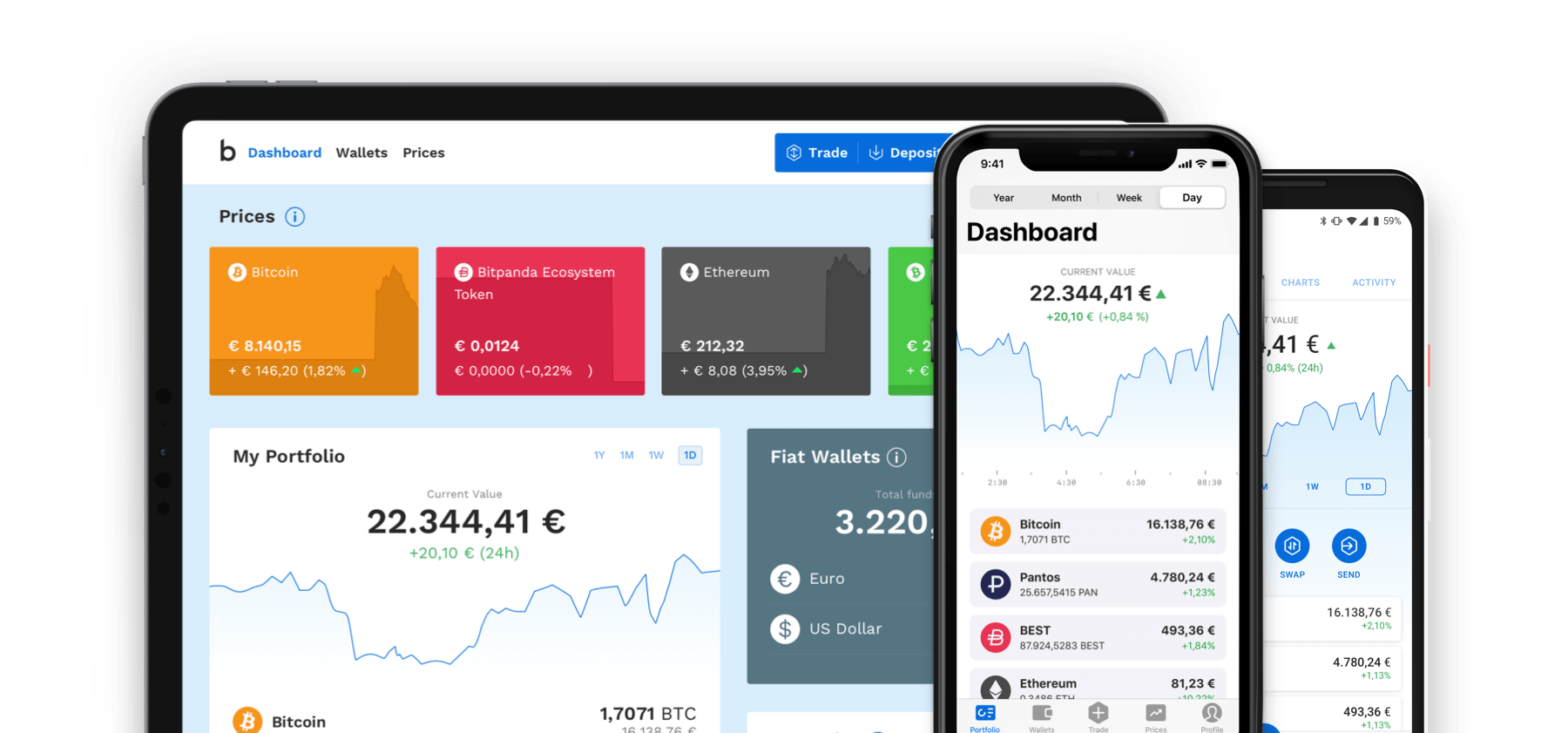

Bitpanda's goal is to to build Europe’s leading multi-asset investment platform, and the fresh cash will help it expand into new markets and grow its team faster.

The fintech company claims it has over 1.3 million users today, and is currently doubling revenue on an annual basis. This is helped by the recent launch of its payments and savings platform and launches in France, Spain and Turkey.

Bitpanda is looking to grow its team to 300 employees by the end of 2020 as it intends to debut a 'new and innovative way of stock trading' to boot.

Eric Demuth, co-founder and CEO of Bitpanda, said:

"This investment from Valar Ventures is a major vote of confidence in Bitpanda and our vision from one of the world’s pre-eminent investors in successful fintech companies. By using industry-leading technology and building innovative financial tools, we’re democratising investing and giving everyone access to the financial markets, no matter their financial means. We are making it possible for everyone to take ownership of their financial future and are providing our customers with financial knowledge and education in the process. Our goal is to become the leading investment and trading platform in Europe, not only for the people who are already familiar with trading but for everyone. This funding will help us do just that and, crucially, continue to recruit some of the world’s leading talent to our team."

Would you like to write the first comment?

Login to post comments