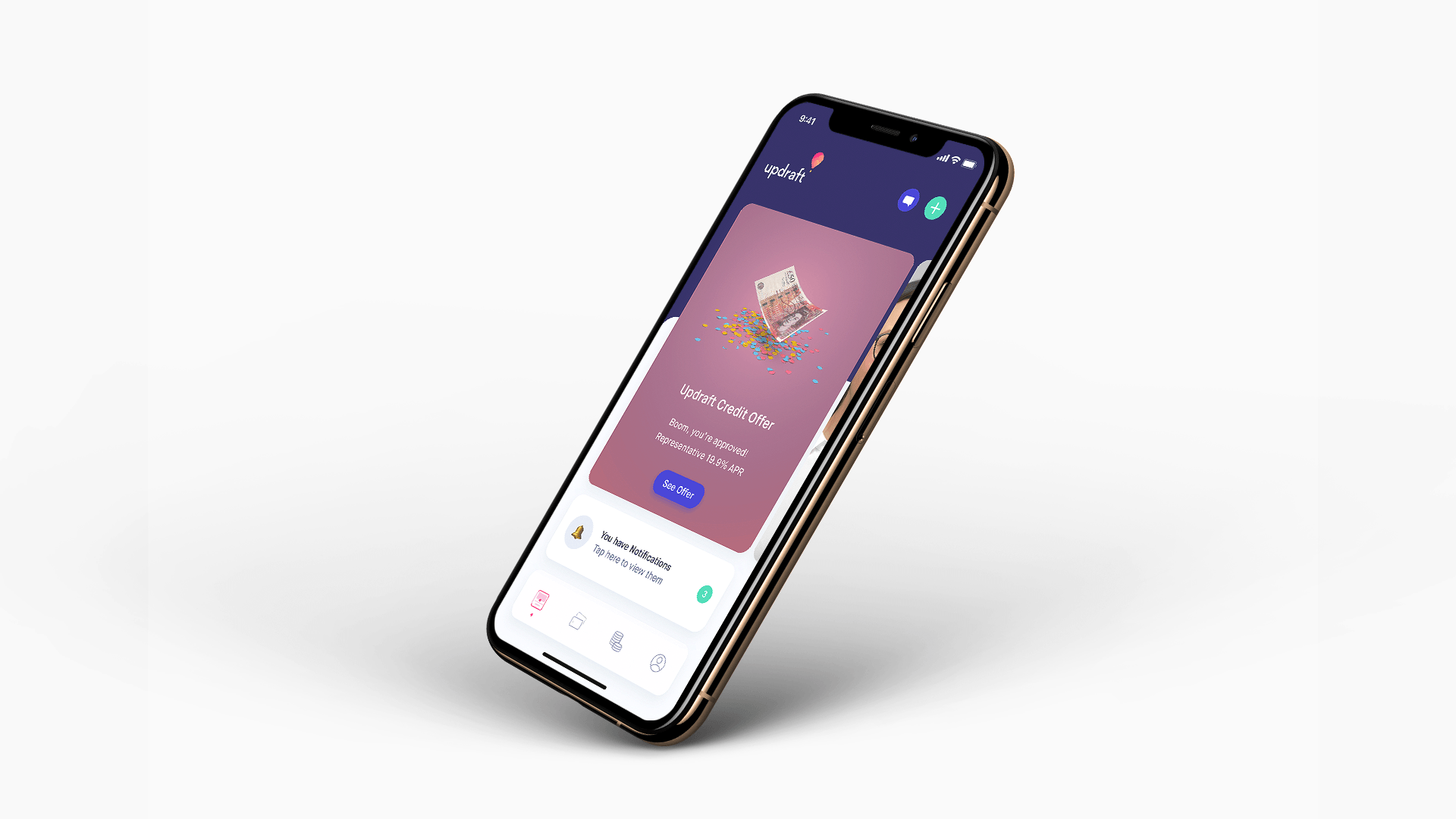

UK-based fintech upstart Updraft, which offers an app that it says is "part lending, part credit report, and part financial planning", has scored £16 million in funding to help people steer clear of avoidable credit card and overdraft charges.

The startup essentially wants to help customers get rid of spend-associated borrowings such as credit cards, overdrafts and increasingly, the 'buy now, pay later' schemes often found on e-commerce sites.

To accomplish that, it builds profiles of users' spending and borrowing habits, and offering to pay off high-interest-rate debts with a lower-cost loan when expensive borrowing is detected.

Updraft was started by financial services veteran Aseem Munshi, former Head of Cards and Unsecured Lending for HSBC, UK. The startup says more than 40,000 people joined the waiting list for the (FCA-approved) service, which is now live.

The funding round for Munshi's fledgling company is a mix of equity and debt, with investment firm Quilam Capital leading on the debt side, and the UK Government’s Future Fund participating via their convertible loan note alongside a group of unnamed 'high-net-worth investors'.

However, it's safe to assume these individuals are also on Updraft's advisory board, which includes people like Mat Braddy (Just Eat), Shawbrook Bank founder Philip George and Sanjiv Sud, the former Head of Retail Bank HSBC India, and global exec at HSBC.

Would you like to write the first comment?

Login to post comments