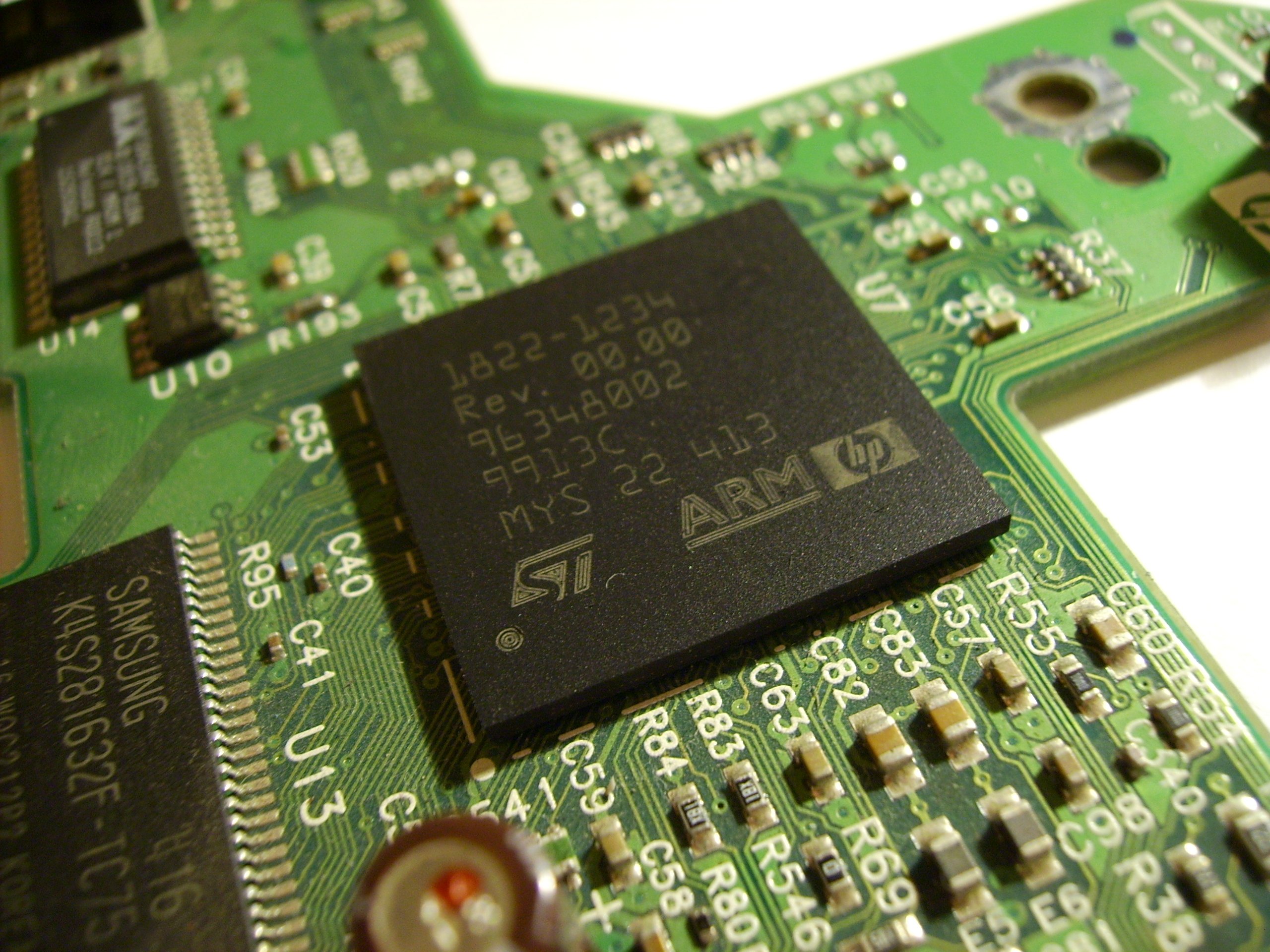

The third quarter of 2016 was far from an average one. SoftBank’s takeover of UK-based ARM marked the largest ever acquisition of a European technology business.

The UK’s largest listed tech company, which employs 4,000 people, was purchased for a total of £24.3 billion (approximately €29 billion) at £17 per share by the Japanese telecom company.

Would you like to write the first comment?

Login to post comments