Editor’s note: This is a sponsored article, which means it’s independently written by our editorial team but financially supported by another organisation, in this case, The FinLab. If you would like to learn more about sponsored posts on tech.eu, read this and contact us if you’re interested in partnering with us.

Singapore, ranked as Asia’s top financial center by the Global Financial Centers Index 2016, has been maturing as a FinTech hub for not just Southeast Asia but globally. The city provides a unique opportunity for FinTech businesses, with its thriving startup ecosystem that helps entrepreneurs develop innovative ideas, serving as a launchpad into the Southeast Asian market, an increasingly lucrative market for startups.

The country stands out as an excellent slingshot for FinTech startups because of its position as a financial hub and its integration into the ASEAN region. Furthermore, Singapore’s stable government is gearing the country towards being a “Smart Nation” and this is reflected in its numerous grants and support from statutory boards, like the Monetary Authority of Singapore (MAS).

The strong support for FinTech development in Singapore is evident in the inaugural Singapore Fintech Festival last November, which saw MAS sharing its vision and the event, with more than 12,000 participants from over 50 countries cities, inviting FinTechs globally to apply to solve 100 problem statements in their Global Hackcelerator.

For FinTech startups in this part of the world interested in entering the Southeast Asia market, Singapore is a natural entry point. And the best method to do so is through joining an accelerator programme that can link startups to the desired network of partners, VCs and potential customers. One of these accelerators is The FinLab.

The FinLab is a FinTech startup accelerator backed by United Overseas Bank Ltd (UOB), a AA-rated bank headquartered in Singapore, and SGInnovate, a VC fund backed by the government that seeks to build up the tech ecosystem in Singapore.

The FinLab runs a three-month program to help early stage FinTech startups accelerate their business and go-to-market, with support from expert mentors from UOB and the industry. The programme also provides valuable connections to a network of investors, government agencies, and business partners from the region.

The accelerator received numerous applications from Europe last year and one startup, Turnkey Lender, was offered one of eight prestigious spots to participate in the programme. This year, The FinLab is inviting more startups from Europe to apply. Location and nationality do not matter as long as you have an innovative solution backed by a strong team, and a desire to propel it into the Asian market.

An initial 30 startups will be selected for the program’s shortlist and from that, up to 12 startups will be chosen to participate in The FinLab’s second round of acceleration, kicking off in April and running through to July.

The FinLab will also be attending the OurCrowd Global Investor Summit on February 16 in Jerusalem where interested parties will have the opportunity to speak with the team in person. Alternatively, they can be contacted via email.

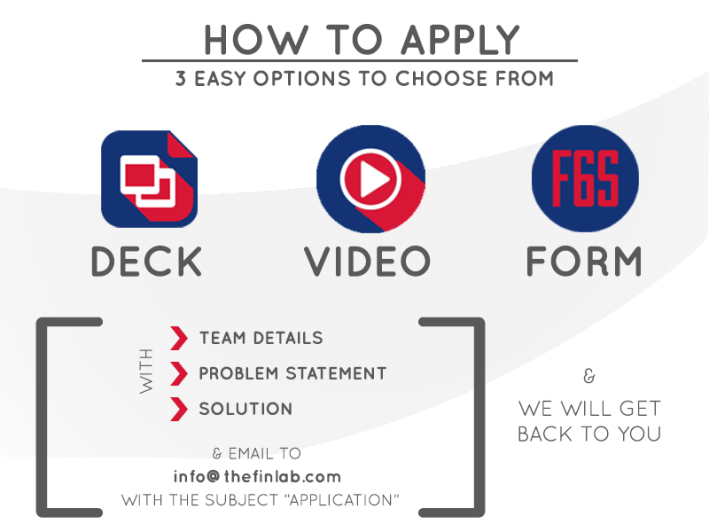

The FinLab programme is open for signing up now, simply drop them an email at [email protected] with your slide deck or introductory video and include your team details, problem statement and solution.

Applications close on March 17 and more information about the accelerator is available here.

Featured image credit: Leonid Iaitskyi / Wikimedia Commons

Would you like to write the first comment?

Login to post comments