SumUp, a British-German mobile point-of-sale startup, is today announcing its expansion to Scandinavia for the first time, launching in Sweden. That is notably where iZettle, arguably its main competitor in the space in Europe, was conceived.

Stockholm-based iZettle recently raised a sizeable €60 million round to pursue further growth, while SumUp brought its total capital raised to €50 million with a €10 million round from BBVA Ventures, Groupon, American Express and others.

With today’s launch in Sweden, SumUp is now active in a total of 14 countries, including Germany, the UK and Brazil.

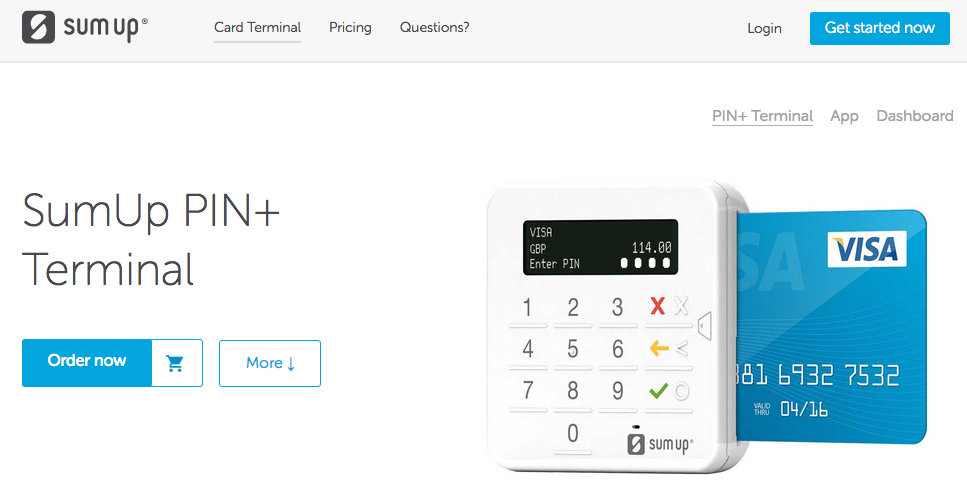

With its PIN+ Card Terminal, SumUp emphasises that it will be the first company to offer a proprietary card terminal to small businesses in Sweden - the company develops everything in-house, from the software and the payment services to the physical terminals.

That makes SumUp rather unique, as stressed by the company's CEO, Daniel Klein, when we caught up with him recently in Berlin for a video interview.

Using its card terminal with their smartphones or tablets, SumUp says Swedish merchants will be able to accept all major credit cards, including MasterCard, Visa and American Express, with the company netting a fixed 1.9% fee per transaction.

Says Klein in a press statement: “Swedes pay more frequently by card than any other European nation; this makes Sweden a very interesting market for us. We are excited to provide Swedish merchants with a simple and easy-to-use card acceptance experience that is so intuitive hat even those who have never accepted card payments before can start selling immediately without having to read a manual."

SumUp says it will announce 'strategic partnerships with big players in Sweden' soon.

Would you like to write the first comment?

Login to post comments