London-based VC Nauta Capital has announced its fifth fund with a first close at €120 million. Nauta Tech Invest V is expected to exceed the firm’s previous fund, which landed at €155 million in 2016, and which would bring assets under management over half a billion euros.

Operating from its three hubs in London, Barcelona and Munich, the firm plans to invest in companies mainly based in the UK, Spain and Germany, though is open to other continental European countries as well. The main rule is that the B2B software startup is capital-efficient.

“We have been very disciplined in backing companies that take a leaner approach; whether that is during fundraising or how they leverage cash efficiently to achieve growth,” says Carles Ferrer, the firm’s General Partner. “At a time when we are navigating a global pandemic – where the global economy has taken a severe hit – it’s more apparent than ever that our conviction in capital-efficiency maximises sustainability and leads to greater long-term outcomes for entrepreneurs, regardless of their stage.”

The fund has already invested in its first venture, leading a $2.3 million seed round for NumberEight, a UK-based ‘contextual intelligence’ software that helps mobile apps mine consumer data.

Other portfolio companies include: Brandwatch, a UK digital consumer intelligence company with $100 million ARR; Onna, a knowledge integration platform that just raised a $27 million Series B from Atomico; PromoteIQ which was acquired by Microsoft in 2019; and zenloop, a Berlin-based experience management platform.

Nauta Tech Invest V attracted investors from continental Europe, UK and the Americas including fund of funds, financial institutions, insurance companies, and large family offices, with 80 percent of the first close coming from existing LPs.

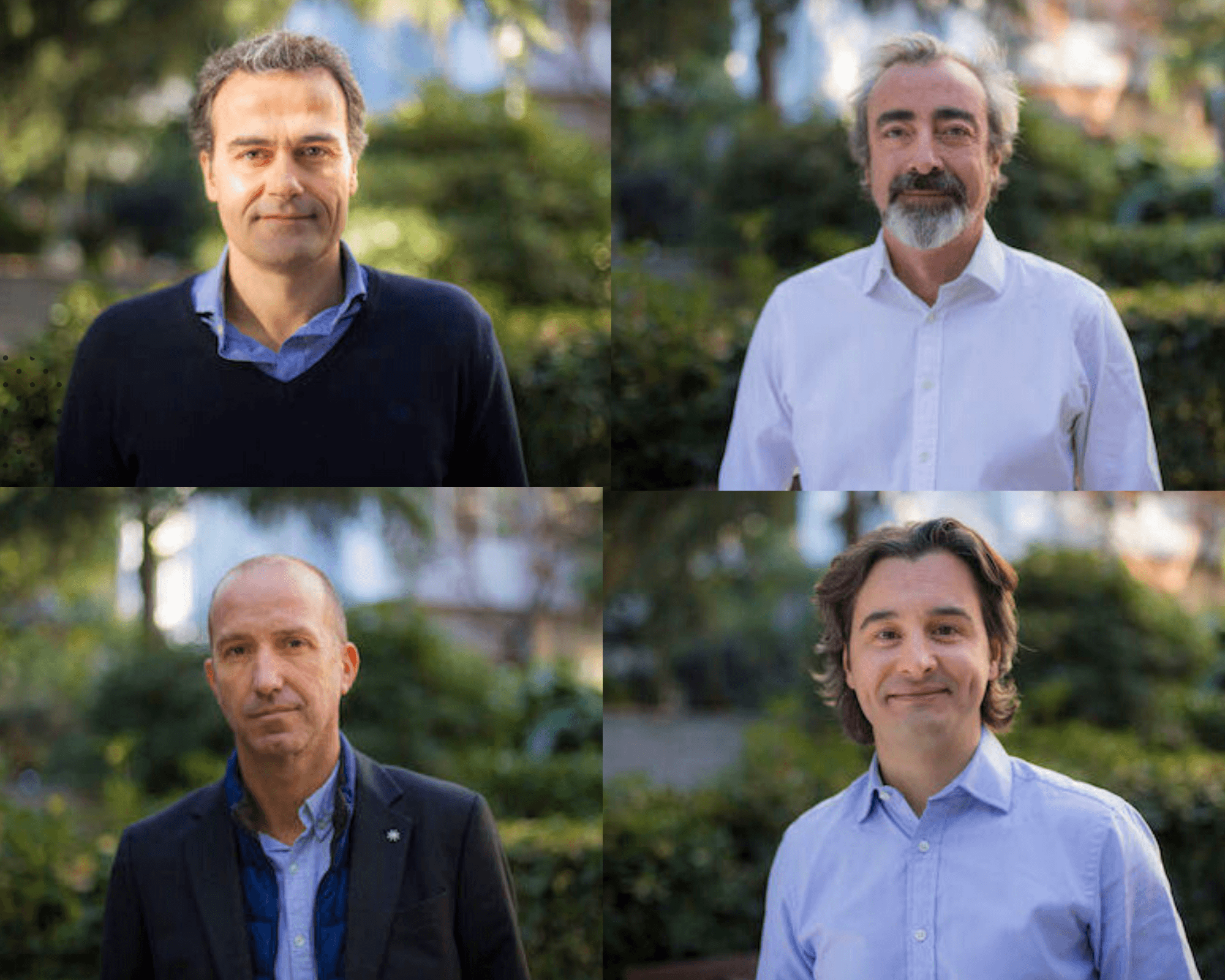

Photo: Nauta Capital partners

Would you like to write the first comment?

Login to post comments