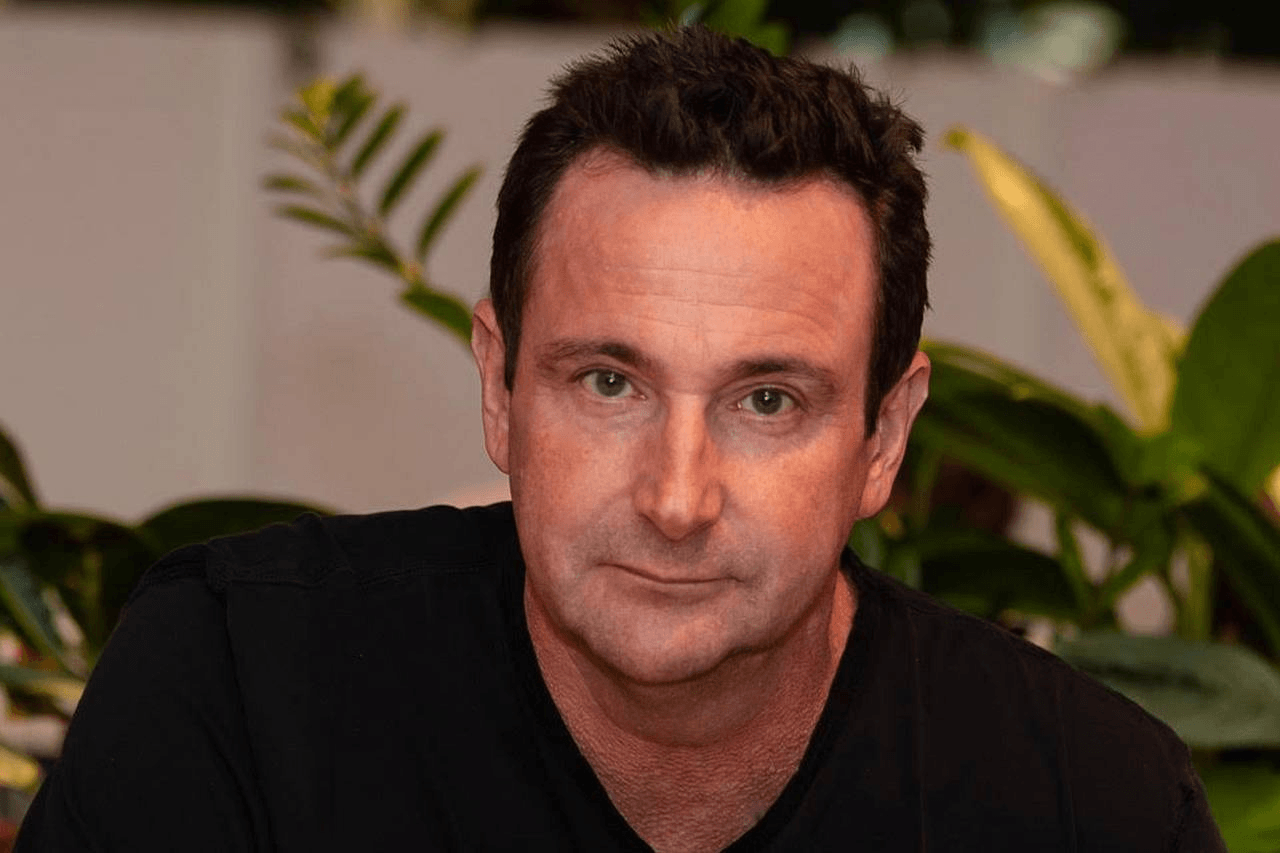

Mark Hipperson had a very busy Monday morning after his fintech startup Ziglu just launched its equity crowdfunding campaign on Seedrs.

It set a £1 million target but the campaign surpassed that goal within three hours. As of now it’s at £1.8 million.

“What we're trying to do is add customers and profile and crowdfunding does a really good job of doing that,” he told tech.eu. “It brings people to Ziglu who might not heard about it, from the investor community.”

London-based Ziglu is another fintech challenger throwing its hat into a crowded ring but in this case, Ziglu is focused on cryptocurrency with exchange and peer-to-peer and card payments.

Co-founder and chief executive Hipperson is no stranger to fintech circles, having co-founded Starling Bank where he was also CTO.

Earlier this year, Ziglu raised £5.25 million in a seed round from investors, whose names have not been disclosed. The additional funds from the Seedrs campaign is to add extra fuel to its product features and to launch in new markets.

“We're launching cards. There's a whole raft of new features that we're looking to launch. Some of that is around foreign exchange. Some of that surrounds some more advanced, challenging features,” Hipperson said.

“We're also pushing out into Europe as well, so we're pushing into Europe from Q4, and then we'll be pushing into the States from Q2 next year.”

Challengers

Hipperson started Ziglu in 2018, following his role at Starling Bank and serving as CTO at Centtrip, another UK fintech outfit. He had amassed a strong understanding of the pain points that challenger banks felt their early days.

He recalls the tricky conversations he had with regulators and investors when first getting Starling Bank off the ground.

“So you're launching a new bank that’s going to be an app only bank. Your website is not going to do any servicing, which was pretty unique at the time, it’s through this app only. You're not going to deal with cash, you’ve got no branches, you're not going to deal with cheques and you've not got billions of pounds in reserves like all the other big banks. And you think you've got a chance to compete in the marketplace?”

It was scepticism overcome as the app-only bank model has been normalised, he added, and people now expect that ease and usability in all their dealings with financial services.

“What I'm doing here in Ziglu is bringing all of the lessons learned from founding a leading challenger bank, but bringing into 2020,” he said. “You can't really start a challenger now without addressing today's problem. If I was starting Starling Bank in 2020, it would look like Ziglu.”

Ziglu’s card, delivered through Mastercard, is one example of applying the tried and tested method of fintech challengers to the crypto space.

“I think that sets us apart from the others. We’re a mainstream challenger that happens to offer crypto and that sets us apart,” he said. “What we try to do is it just bring the simplicity and ease of a challenger to the problems of crypto and into what is a modern financial services product that allows you to get the best of both worlds in one place.”

The expansion beyond the UK and into Europe presents its own set of challenges though. Ziglu is regulated in the UK as an e-money institution and adheres to the EU’s fifth anti-money laundering directive, a stringent of rules to weed out bad actors.

Hipperson said Ziglu has commenced a licence application in an EU member state to shore up its expansion regardless of how the UK-EU negotiations shake out but it will be early 2021 by the time it has that licence in tow.

Fintech trials

Fintech mainstays like Revolut, Monzo, Starling and N26 have dominated the conversation around fintech in Europe in recent years, launching products to challenge incumbent banks, raising hefty VC rounds and growing rapidly.

However challenger banks have also discovered that growth isn’t everything and the conversation is shifting more toward profits after years of losses.

Revolut, while tripling its revenue in 2019, suffered a loss of £106.5 million. Monzo’s latest accounts reported an annual loss of £113.8 million, up from £47.1 million the previous year, with the coronavirus pandemic throwing a spanner in the works for its US launch. Starling Bank meanwhile recorded a pre-tax loss of £53.6 million in its last financial year but said it will break even this year.

“Fundamentally the business model hasn't worked as well as we thought it might, to be entirely fair. It's not worked because of the fact that people aren't switching across in the numbers that they expected,” Hipperson said.

“Our business model isn’t about current account switching and coming across to us. Our business model is predicated on people wanting to buy and sell crypto at the best price,” he said.

“We do have some income from interchange rebate, we do have some income from foreign exchange, we will have some income from premium card products.”

Hipperson said that he expects Ziglu to break even by Q3 2022 based on its current trajectory but that can change depending on the next funding round.

Ziglu will be tapping investors and VCs in mid-2021 for a series A around £20 million, he added.

“Between now and Q2 next year is about establishing our market and making sure that we understand which customers like us and what value they bring to us and what we can provide to those customers,” he said.

“We're learning at the moment what customers we’re going target and what the price of acquiring those is. It's very little at the moment because people like the product and would be happy to download it. But if you want growth in the millions as we do, that's going to require a degree of investment in bringing those customers on board.”

Would you like to write the first comment?

Login to post comments