Digital investment advisor Quin has raised €1 million in a seed round led by brokerage Sino AG with participation from Runa Capital and APX.

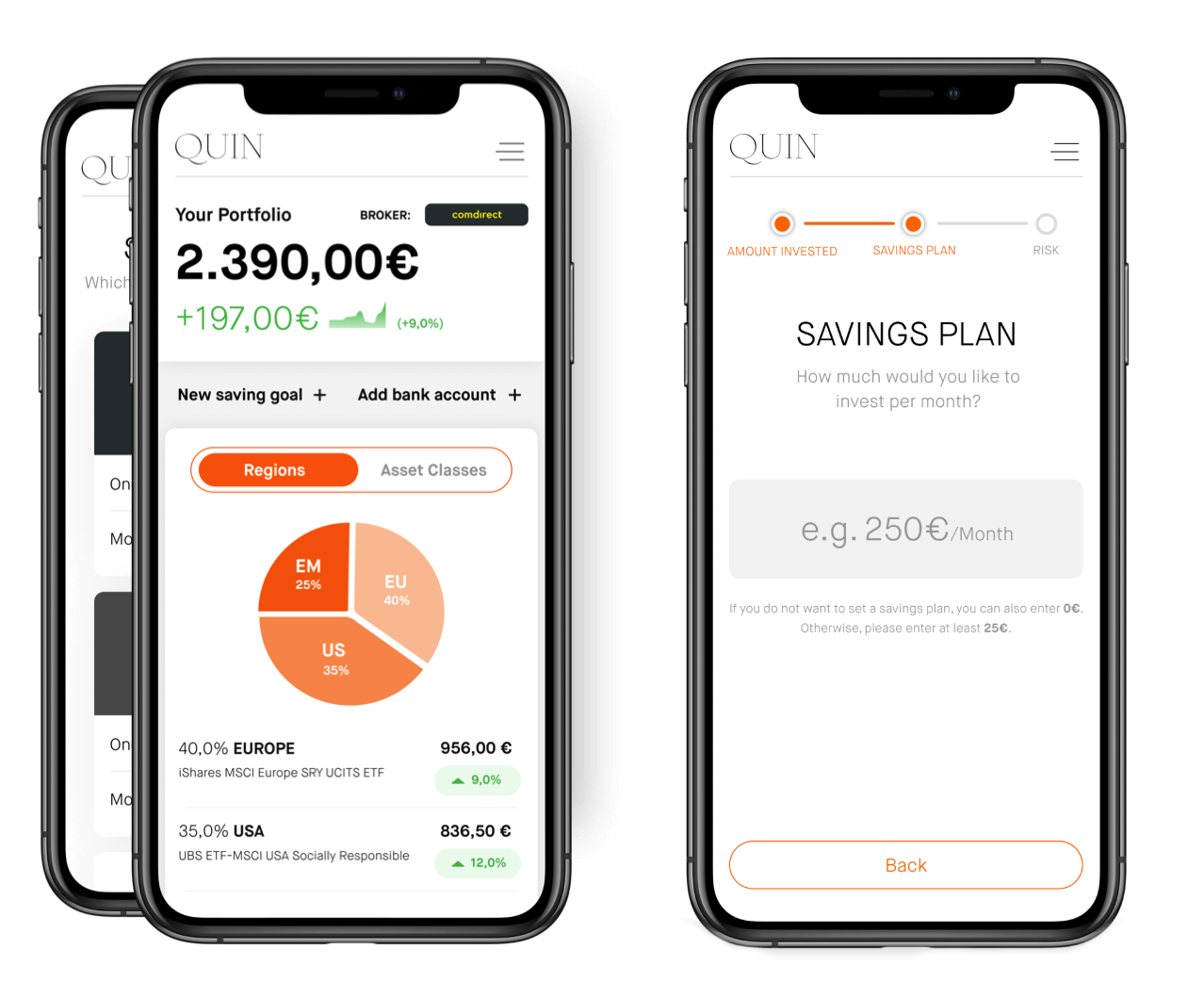

The Berlin-based fintech startup develops a non-custodian platform for investors that uses open banking to connect a user through their own bank to carry out investments in exchange-traded funds.

It allows investors to invest small amounts of funds, unlike some competitor services that can typically have minimums of $500.

Chief executive Christian Rokitta said the company was born out of his own challenges in finding help when he first started investing.

“Understanding how many people were facing the same problem, we’ve decided to simplify this process, launching the world's first multi-banking investment platform,” he said.

The startup is targeting the millennial market, citing figures that say around 43% of this market isn’t investing in some way. It has gathered 3,000 users in its native Germany so far with plans for expansion into other markets on the agenda.

Quin doesn’t charge any fees or commission on the capital invested but plans to introduce a paid version of the product that would add premium functions, other investment options and allow users to connect with multiple banks.

Investment apps have become popular in recent years with Robinhood in the US being the notable example.

Ingo Hillen, CEO and founder of brokerage Sino AG, the lead investor in Quin’s seed round, said creating “low barriers to entry” for investors made Quin an attractive investment.

“Young people in particular want to take their money in their own hands today - this has been demonstrated in recent years. Quin is a great tool for this.”

Would you like to write the first comment?

Login to post comments