Editor's note: this is a guest post by Tom Henriksson, a general partner at OpenOcean, a VC firm investing in European data-intensive software startups. He's previously written about 'The Rise of Intelligent Enterprise Automation'.

The process automation space (RPA, Robotic Process Automation) continued to grow strongly in 2020, despite -- or perhaps thanks to -- the global shift to working from home. Software companies automating business processes raised over $1.9 billion in 2020; the broader automation software space raised over $11 billion, according to PitchBook data.

Fittingly for 2020, the most funding for a single company went to Olive, an AI-driven workflow automation platform for hospitals and healthcare systems. They raised over $380 million last year across three separate rounds, with investors including General Catalyst, Tiger Global Management and Sequoia Capital.

But despite the chorus of exciting new entrants, mapping the automation software space requires a much more holistic approach than simply identifying the nascent players with next-generation solutions. The vast majority of large enterprises work with consultants that recommend “incumbent” behemoths such as UiPath or BluePrism, whom they are often partnered with. Indeed, some consultants like TCS even offer their own automation software alongside services, like TCS’ MFDM platform, while others, such as NTT-AT or TechMahindra are both consultants and platforms. These process automation services, which sprung out of the decades-old business process outsourcing and management space, must be mapped against the newer, product-first automation startups to give full context to the automation software landscape.

There are also older companies providing automation software platforms. Although on the surface they may not appear as technically-sophisticated as their recently-founded, artificial intelligence-based counterparts, they still drive revenue from tens of millions (such as Redwood, founded 1993) to billions (such as Newgen, founded 1992).

Having said that, truly intelligent automation solutions, leveraging machine learning such as natural language processing and computer vision, can be found all across our map. From UiPath’s extensive investments in AI to provide end-to-end automation for large corporates; to smaller startups such as Mimica Automation, whose algorithms clean, analyse and merge a user’s desktop actions into an accurate process map for businesses of any size; to KYP, whose platform can actually quantify the “automation potential” of any business process, the most modern automation platforms prioritise process intelligence, and this can be seen in several companies represented in each subsegment.

How to interpret our 360° view of the automation software landscape

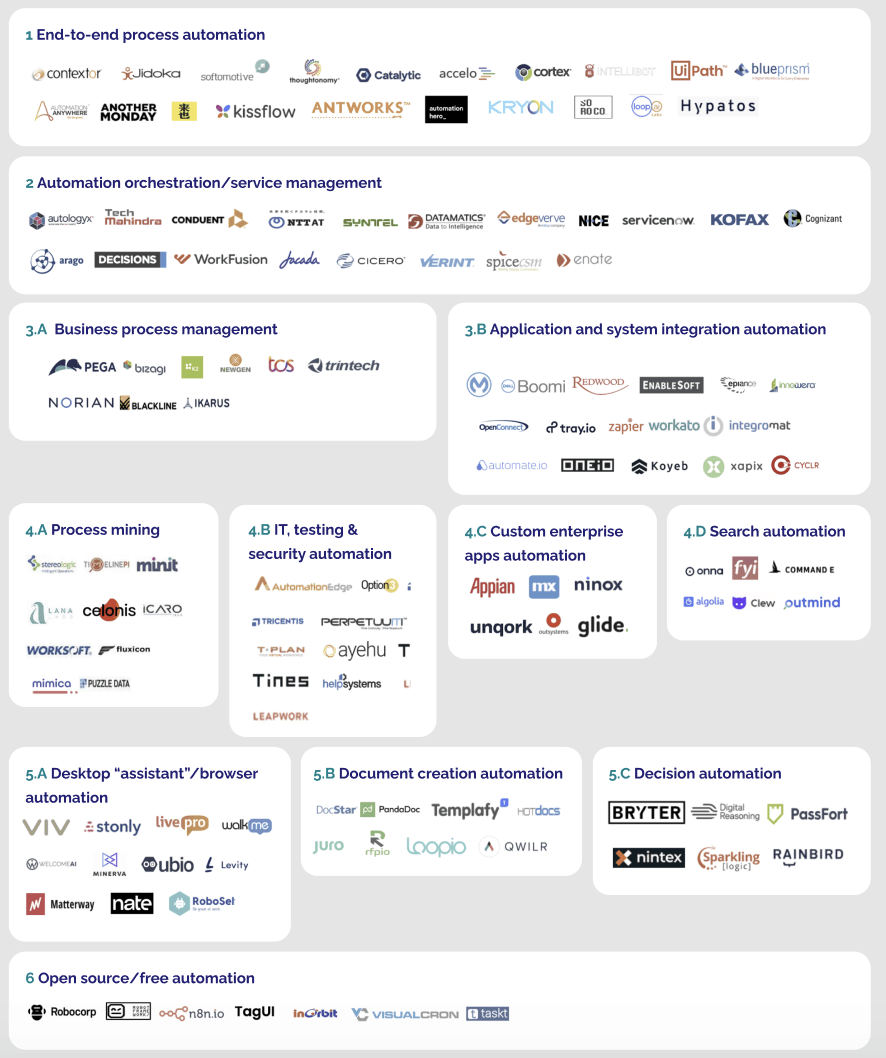

In order to provide that complete contextual understanding of the automation software landscape, we have mapped over 120 companies; new and old, large and small, according to their subsegment (the precise type of automation they provide). We’ve included companies from around the world, so you can also filter them by geography. You can click each company to see more information about it, find its website, and see who invested and how much. We also encourage you to submit suggested additions and edits to our map.

It should be noted that we intentionally excluded a number of subsegments: Marketing automation solutions really fall under MarTech rather than business process automation, although it is of course a core business function, one that has been on the forefront of handling huge volumes of customer data and automating marketing processes.

However, other vertical-focused automation software, like financial workflow automation or healthcare process automation, which could also be grouped into FinTech or HealthTech, do provide internal process automation more comparable to generic, horizontal process automation platforms. We’ve included some of those companies under the umbrella of the type of automation they address (business process management for finance and service management for healthcare, for instance).

We’ve structured the map so that the most established subsegment, end-to-end process automation with multi-billion dollar companies like UiPath and Automation Anywhere, scales downwards in nascency towards newly-emerging subsegments, such as open source automation tools like the Benchmark-backed RoboCorp and Sequoia-funded n8n.

Since we’ve worked hard to define a map with precise coordinates, you might disagree with a logo’s location, or you might think that an important subsegment is missing. That’s why we’ve made this map interactive: Submit your suggestions on OpenOcean’s website, and we’ll consider adding them to the map.

What the map says about the automation winners of 2020

The automation software landscape is constantly evolving as incumbents adapt to their clients’ changing needs, and new startups attempt to leverage AI or ML-first approaches to catch leaders asleep at the wheel.

Naturally, 2020 saw more automation products and features developed for remote workforces, but the pandemic’s dizzying impact on other industries, where legacy players were easily disrupted, has not taken place in the world of automation software: UiPath is slated to earn well over $400 million in revenue this year, nearly quadruple its revenue just two years ago; Automation Anywhere is said to have tripled last year’s revenue, making $312 million in 2020. These companies were previously struggling with low uptake from older, less digitally-savvy employees; the pandemic forced these users to figure out how to interface with those platforms. 2020 therefore might have been a watershed year for the automation leaders; perhaps not yet for the younger generation.

But startup competitors vying for a piece of the automation pie shouldn’t be disheartened: the market itself is ballooning, and truly differentiated propositions with automation platforms that employees actually enjoy using can win in the long-term. For all the gusto of 2020 being the “year of remote working,” remote-first automation platforms have not yet moved the needle at the enterprise level, and there are still many other angles to provide a better experience that can yet shake up the market.

Featured image credit: Gerd Altmann / Pixabay

Would you like to write the first comment?

Login to post comments