On the penultimate day of 2021, Valencia-based ClimateTrade closed a €7 million Pre-Series A convertible note financing round. The Valencia-based firm is now seeking to add another €13 million to this figure in order to fuel, or de-fuel, as the case may be, growth in the European, Asian, and American markets, as well as drive further technological advancements to the company’s offer.

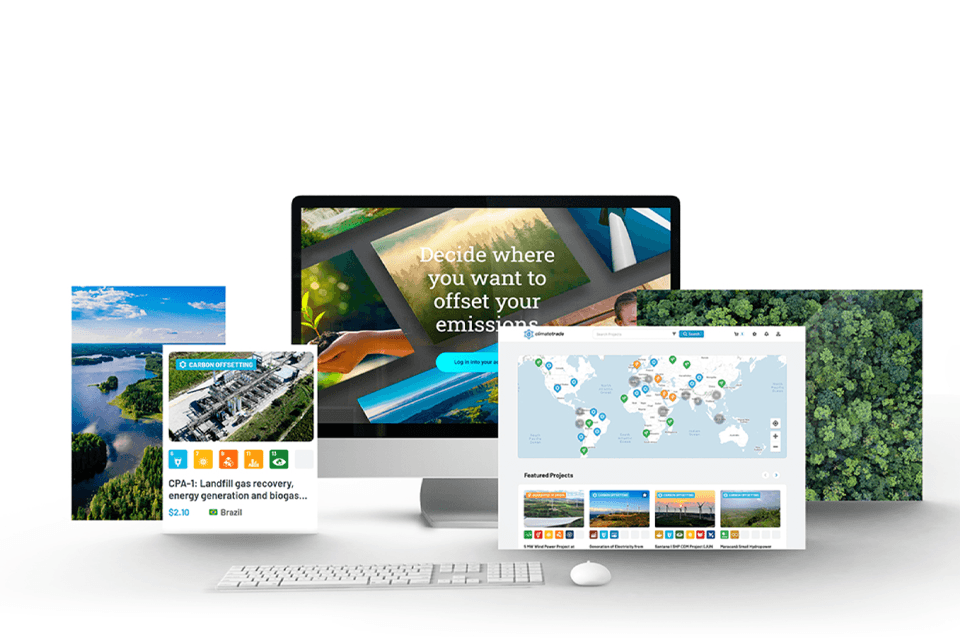

ClimateTrade is a blockchain-enabled platform that provides companies with a method of achieving their decarbonisation goals through carbon offsetting, and reports that the first tranche was oversubscribed, drawing interest from over 90 investment funds.

The second tranche of the Series A round is targeted at €13 million and holds the caveat of a U.S. reincorporation scheduled for later this year. Given the blockchain/decentralised nature of ClimateTrade’s positioning, there could really be only one choice to set up shop: Miami.

According to the company’s website, “All our projects are verified so you can achieve certified emissions reduction,” with names such as Cabify, Banco Santander, Telefónica, Correos, and Telégrafos, and Prosegur taking them up on this offer.

“For four years, ClimateTrade’s vision has been to enable climate action through technological innovation. Our blockchain-backed marketplace allowed companies to offset almost 2 million tons of CO2 in 2021 alone. This oversubscribed funding round is a testament to the impact ClimateTrade has already generated, and we are excited to further our action against climate change with this new infusion of capital,” commented CEO Francisco Benedito.

ClimateTrade's €7 million was provided Conexo Ventures, ClearSky, Borderless Capital and Algorand, SIX FinTech Ventures, Wayra, the investment arm of Japanese corporation Omron Ventures, Amasia, and Zubi Capital.

Now, this all sounds good until you look at the longevity of such carbon offsetting programmes, coupled with the fact that this mechanism can be seen as passing the buck of environmental responsibility on from corporate to consumer.

While it might have not made the evening news in Europe, last summer wildfires scorched massive sections of North America. In the Pacific-Northwest, Oregon specifically, the Bootleg fire destroyed over 147,000 hectares of forest.

Ironically, of the 80 major fires that raged across 13 U.S. states, a number of them contained trees that had been planted or supported by firms such as BP and Microsoft.

So while carbon offsetting programmes do have their benefits, it would appear as though the very effects that they’ve been designed to help combat might be burning them to the ground.

Would you like to write the first comment?

Login to post comments