Offering fleets a turnkey electrification programme, London-based Zenobē Energy has secured “up to” £241 million in a, “first of its kind” debt structure.

The firm is helping bus companies meet and adhere to legally binding climate change targets, and plans to use the new capital to finance up to 430 new e-buses in the UK and Ireland. Through the multi-source debt structure Zenobē will be able to raise senior debt financing against the service contracts bus operator customers.

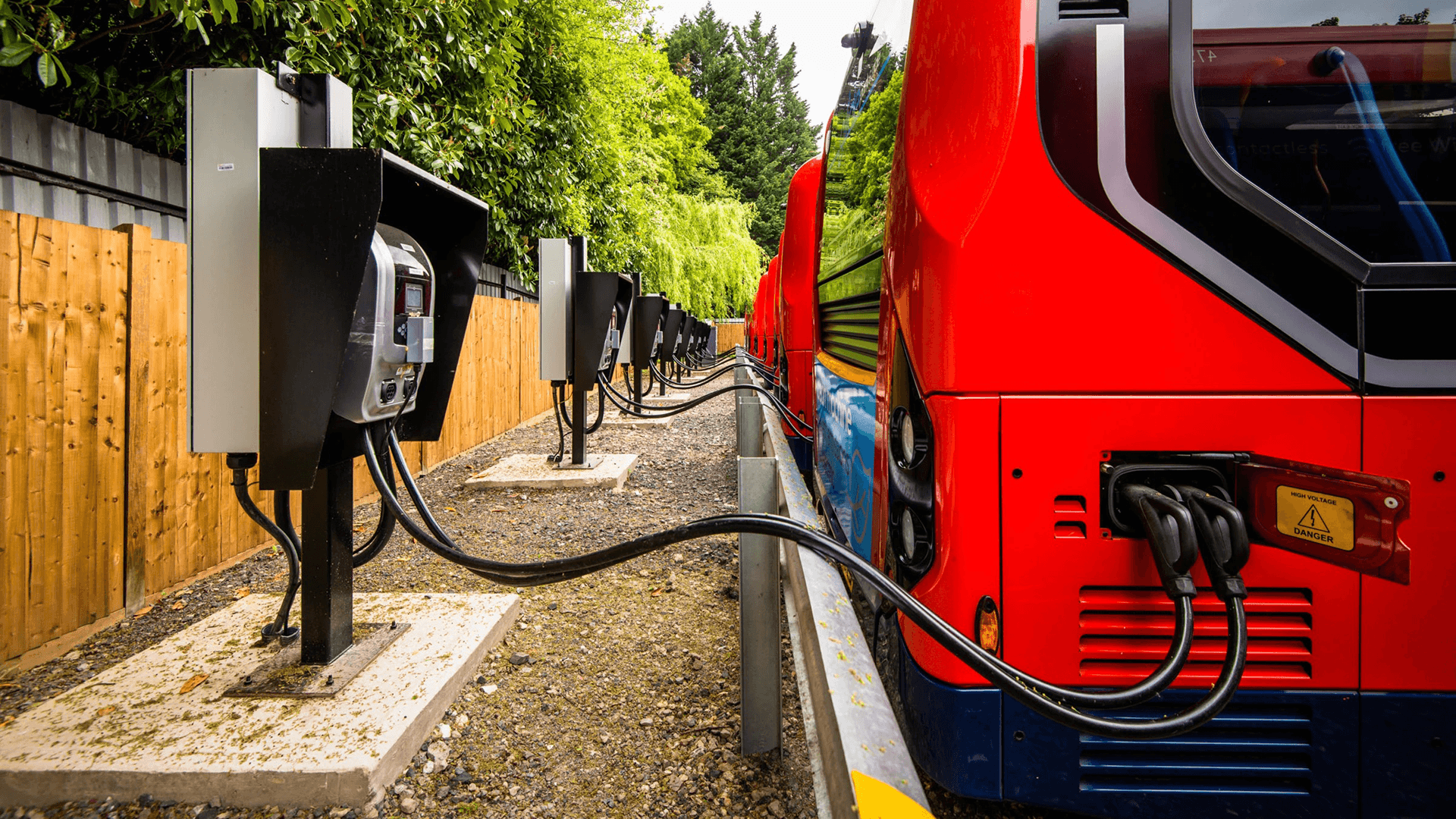

With 175MW of operational and contracted storage assets and 394 EV buses, or a quarter of operational EV busses in the UK, Zenobē makes a solid claim to being the UK’s market leader in the sector and operates with all major bus operators including Arriva, Abellio, McGills, National Express, and Stagecoach, as well as local authority-owned bus companies.

In total Zenobē has raised a total of approximately £507 million, £264.7 million in debt funding, £196.2 million in private equity, £24 million in venture funding, and £23 million in pre-see money.

The mutli-source providers of the debt funding include long-term players Aviva and Scottish Widows, and shorter-term players Lloyds, MUFG, NatWest, Santander, Siemens,and Sociētē Gēnērale.

“This is an incredibly exciting step for both Zenobē and the transport sector as a whole. This innovative funding structure marks the coming of age of structured finance solutions for fleet electrification, and signifies substantial growth for our business, allowing us to accelerate the rollout of electric buses across the UK,” commented Zenobē Energy founder director Nicholas Beatty.

Would you like to write the first comment?

Login to post comments