London’s SteadyPay has raised $5 million in a Series A funding round. The subscription-based service offers gig economy workers peace of mind when it comes to income, automatically topping up bank accounts when their earnings fall below average. The funding is slated to help the company further develop its products and services lineup, including a B2B specific embedded finance tool. Since late 2019, SteadyPay has raised $8.8 million.

Doing a brief stint as a gig economy worker myself during the pandemic (yes, it involved a bicycle and an overly sized backpack), I can testify to the rollercoaster of a ride that earnings can be. Some weeks are good weeks, some weeks are bad weeks, and this paradox doesn’t exactly add up to sound financial planning.

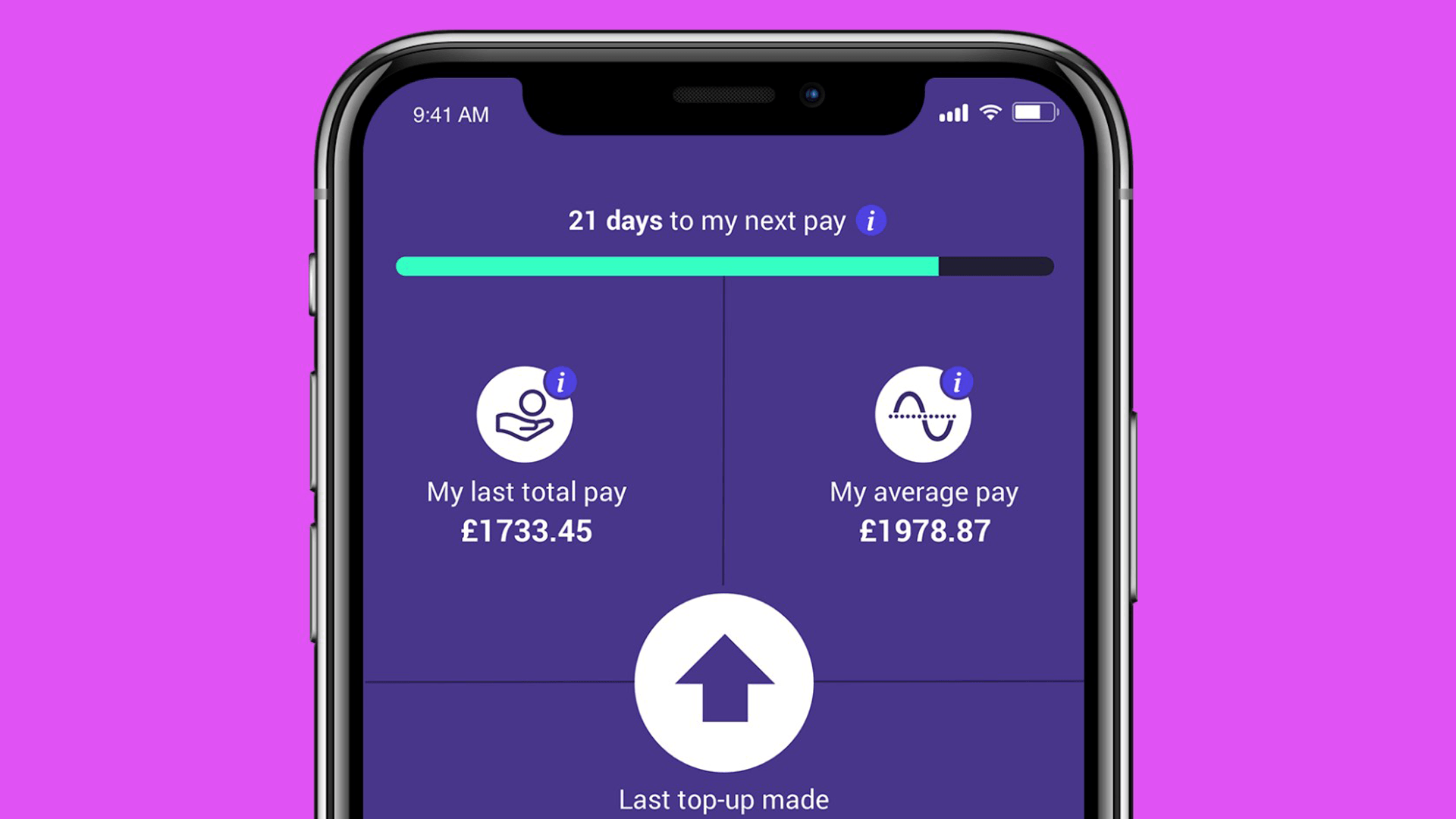

Taking direct aim at this pain point, for £4 a week SteadyPay provides these workers with a short-term loan that will level out their earnings should they fall £25 or less below the average.

Taking direct aim at this pain point, for £4 a week SteadyPay provides these workers with a short-term loan that will level out their earnings should they fall £25 or less below the average.

While this might sound vaguely akin to a traditional overdraft policy, FCA authorised and regulated SteadyPay is quick to point out that their terms and conditions do away with complicated interest and fee structures, providing workers with a high degree of transparency.

Employing open banking technologies and its own credit insights and decision-making AI, SteadyPay is able to evaluate an applicant's risk score and provide a thumbs up or thumbs down in a matter of minutes.

Based on workers’ pay cycles, the startup offers interest-free repayment options: 3 installments for monthly paid workers, 4 installments for bi-weekly paid workers, and 6 installments for weekly paid workers. And as an added bonus, these repayments are reported to credit agencies, aiding gig economy workers in establishing positive ratings, a factor that plays into their financial wellbeing years in the future.

SteadyPay’s Series A round was led by Digital Horizon with existing and new investors including Ascension Ventures (via the Fair By Design fund) and the UK government’s Future Fund, alongside a number of undisclosed angel investors.

“Fuelled by the pandemic and a new work paradigm, the gig-economy continues to create new forms of employment very quickly,” comments Digital Horizon’s Alan Vaksman. “However, the financial services industry has not evolved to meet their needs at the same speed. This means millions of people with a high, but not fixed income, have limited access to financial services. This is a social inequality and a missed business opportunity at the same time. SteadyPay has taken on the challenge and shown that things can be done differently. The company’s talented team has improved scoring models and created an inclusive product for a huge, underserved segment of customers. It is a bold and thoughtful platform, which has great promise.”

Would you like to write the first comment?

Login to post comments