London-based Choice Options (Update 8 September 2022: the company is now officially titled This One) has raised £1 million in a pre-seed round led by Harry Stebbings' 20VC. The fund also drew Cocoa VC and several notable angel investors to the table including former Google Ads and Commerce division SVP Sridhar Ramaswamy, Oculus VR’s former Head of Video Eugene Wei, Behance founder Scott Belsky, and Spotify’s Chief R&D Officer Gustav Söderström.

The business of putting the right product in front of the right customer at the right time is a big one. One that's undoubtedly been behind nothing but positive numbers for Amazon. In fact, reaching back to a McKinsey report from 2013, “35 percent of what consumers purchase on Amazon and 75 percent of what they watch on Netflix come from product recommendations based on such algorithms”.

These technologies have done such a good job at driving the bottom line for the tech behemoths that a cottage industry has sprung up around them offering smaller retailers similar "Amazon quality" services.

But just because these algorithms are providing consumers with fairly ok suggestions on what to buy next, let’s not overlook the elephant in the room: the end-goal of each and every one of these vendors, large and small, is to convert that potential customer into a paying customer.

In so much, yet-to-be-named startup (Choice Options for now, but let’s see if it sticks.) founder Martin Gould notes that these systems are, and have been specifically trained on, pursuing what he terms supply-side objectives; goals that include “maximise the probability that the customer makes a purchase” and “maximise the lifetime value of the customer”.

To be fair, Gould isn’t on a crusade to take down the man and do away with using technology to help us sift through the mountains of choice we're presented with on a daily basis. Rather, instead of pursuing a pure commercial play, he wants to steer the boat towards further distant shores. Shores that see machine learning driving the discovery of things we truly love.

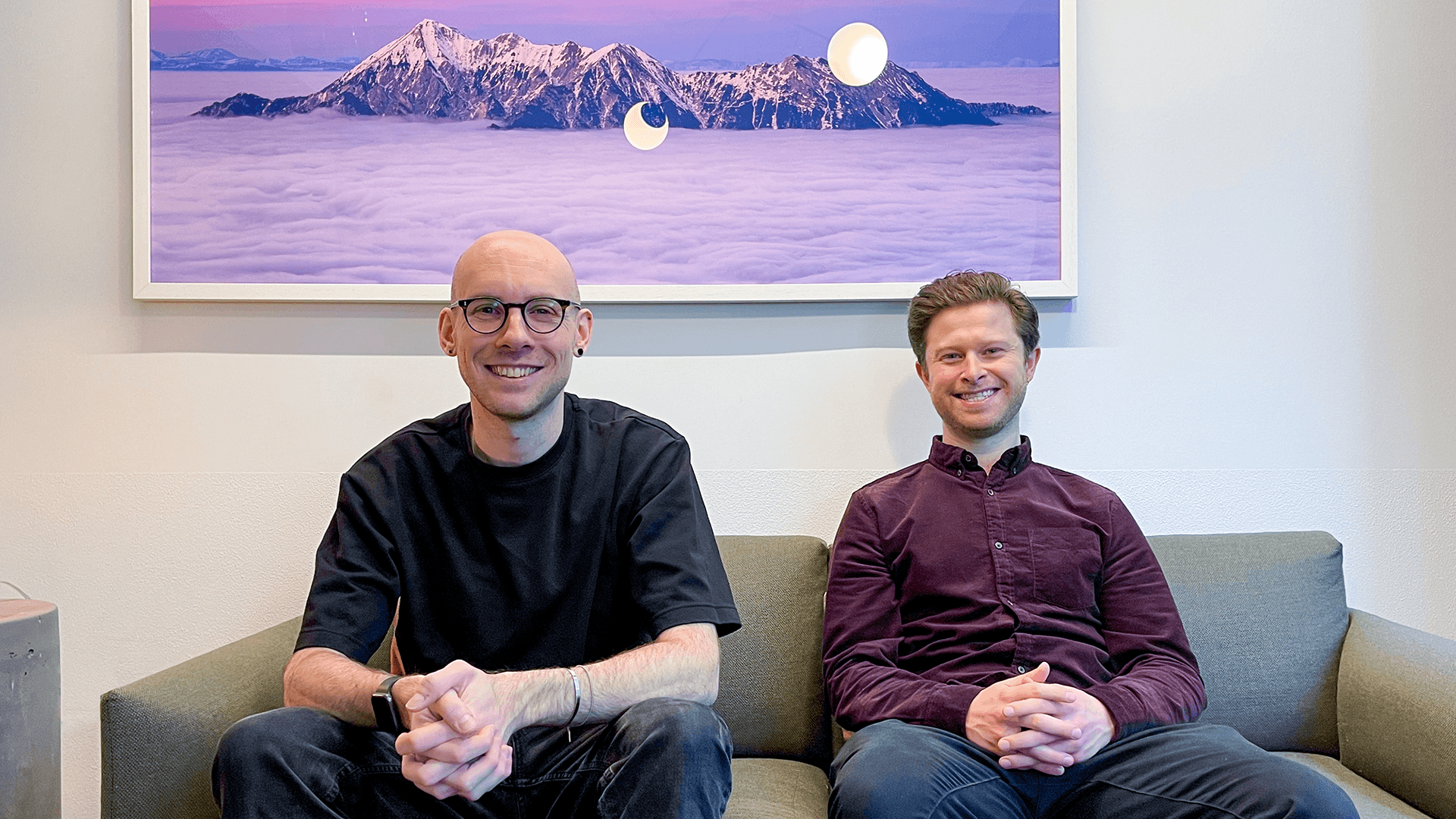

To understand where Gould and co-founder Johnny Hunter are going with this mission, we need to have a look at the founding principle of every successful business; what is the problem they’re aiming to solve?

“The ‘success’ of modernity turns out to be bittersweet, and everywhere we look it appears that a significant contributing factor is the overabundance of choice. Having too many choices produces psychological distress, especially when combined with regret, concern about status, adaptation, social comparison, and perhaps most important, the desire to have the best of everything — to maximize.” - Barry Schwartz, “The Paradox of Choice – Why More Is Less”

And there we have it. Awash in a seemingly unending array of choices, countless studies and papers have found that too much of a good thing is indeed, too much. What Choice Options is doing will help you and me find the personally meaningful needles in the haystack, the signals through the noise.

In an interview, Gould told me that while the company is starting out with a focus on "experience goods" verticals, i.e. films, books, restaurants, podcasts, etc., depending on what they learn along the way (lean methodology), coupled with user demand (product/market fit), he imagines Choice Options growing into, “a recommendation engine for life”.

If that be the case, as history, peppered with a healthy dose of fines and lawsuits, has taught us, with great power comes great responsibility; a factor Gould says is already being accounted for. He points to the 7 Privacy by Design principles as a strong foundation, also citing the company’s three core values: privacy, transparency, and algorithmic responsibility.

A true deep tech venture, when asked about what’s going to keep the lights on, Gould was a bit vague, answering only in model verbs: “It could be an affiliate fee, perhaps similar to what duckduckgo is doing with its anonymous affiliates, or it could be a white label solution. But this is a conversation for somewhere years and years in the future.”

If this all sounds a bit pie-in-the-sky, you’re right. It is. It’s a lofty ambition.

It’s the ambition of a continually curious Doctor of Mathematics. It’s the ambition of a founder who launched his own company in July of 2016, only to see it acquired by Spotify a mere 8 months later for an undisclosed figure. It’s the ambition of someone who, “learned so much from my time at Spotify. I’ve always had a deep passion for solving this problem. The time felt right for me to leave.”

And, it’s an ambition that convinced 20VC to lead, price, and bring Cocoa VC, Sridhar Ramaswamy, Eugene Wei, Scott Belsky, Packy McCormick, Gustav Söderström, and several other undisclosed angel investors to the table to commit £1 million in a pre-seed round.

“We’re on the third iteration of the algorithm right now, and over the next 3 to 4 months, we’ll do a number of rapid prototype iterations,” said Gould. “We’ve already begun hiring for our machine learning research team, and the funding will be used to source additional talent as well as drive continued R&D efforts.”

Would you like to write the first comment?

Login to post comments