Swedish integrated payment solution platform Juni has raised $206 million, $100 million in equity via a Mubadala Capital lead, and $106 million in debt funding via TriplePoint Capital.

The new capital will be used primarily to drive Juni’s credit card offering specifically tailored to enable e-commerce players to rapidly scale through media buying, as well as press forward with global expansion plans, all supported by a sustained recruitment drive.

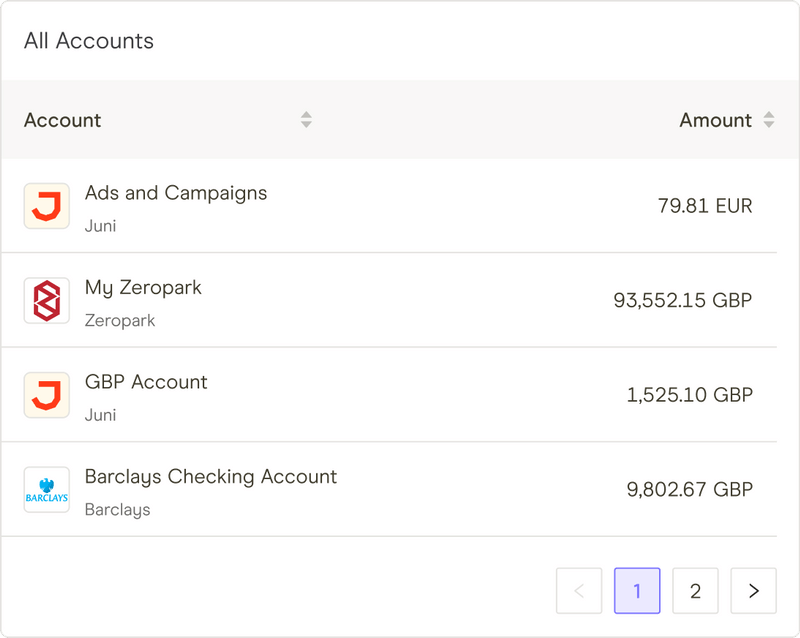

The fintech was founded in 2020, and officially launched in early 2021, and ties together physical and virtual cards, credit cards, accounting, analytics, and digital advertising platforms, giving growing businesses a complete overview of their finances.

The service integrates with thousands of banks and major payment providers and automates a number of routine functions, freeing up entrepreneurs’ time to focus on growing their business instead of managing ad spend and invoices.

“We’re very proud to have secured this funding in such a challenging environment,” commented Juni co-founder and CEO Samir El-Sabini. “I know first-hand the frustrations of running an e-commerce business and time wasted on spend management, the lack of visibility of cash flow, and scaling ad campaigns.”

In addition to Mubadala’s lead, the $100 million equity portion of Juni’s $206 million Series B round saw the participation of all existing investors including EQT Ventures, Felix Capital, Cherry Ventures, and Partners of DST Global.

“Despite unprecedented market conditions, we believe fundamental trends are here to stay. Traditional financial institutions continue to underserve the SMB e-commerce market – a customer segment that requires speed, simplicity, and real-time analytics to grow and scale. In Juni, we see a company with strong traction and a fantastic management team addressing this service gap through an inclusive financial product that is tailor-made for the e-commerce market,” concluded Mubadala’s Fatou Bintou Sagnang.

Would you like to write the first comment?

Login to post comments