Fintech seeks to make financial services easier for customers worldwide to manage their money and related items. Yet, achieving that ease for customers isn’t without hurdles for the fintechs themselves. Presently, fintech companies are struggling with streamlining infrastructure workflows during initial product development and also during product expansion phases. This results in complicated service provider integrations leading to lengthy times-to-market and a ripple effect of other issues.

Enter Swedish company Bits Technology, which has closed a €1 million pre-seed funding round to rethink and, ultimately, reshape how global fintechs build financial services. The round was led by European early-stage venture capital firm Cherry Ventures and backed by Alliance Ventures, Forward VC, and Greens Ventures. The team also gained additional backing from a supergroup of angel investors from fintechs and SaaS companies in the Nordics and beyond, such as Klarna, iZettle, Pleo, and Moss. The funding will fuel business development and accelerate recruitment across engineering teams as it gears up its launch.

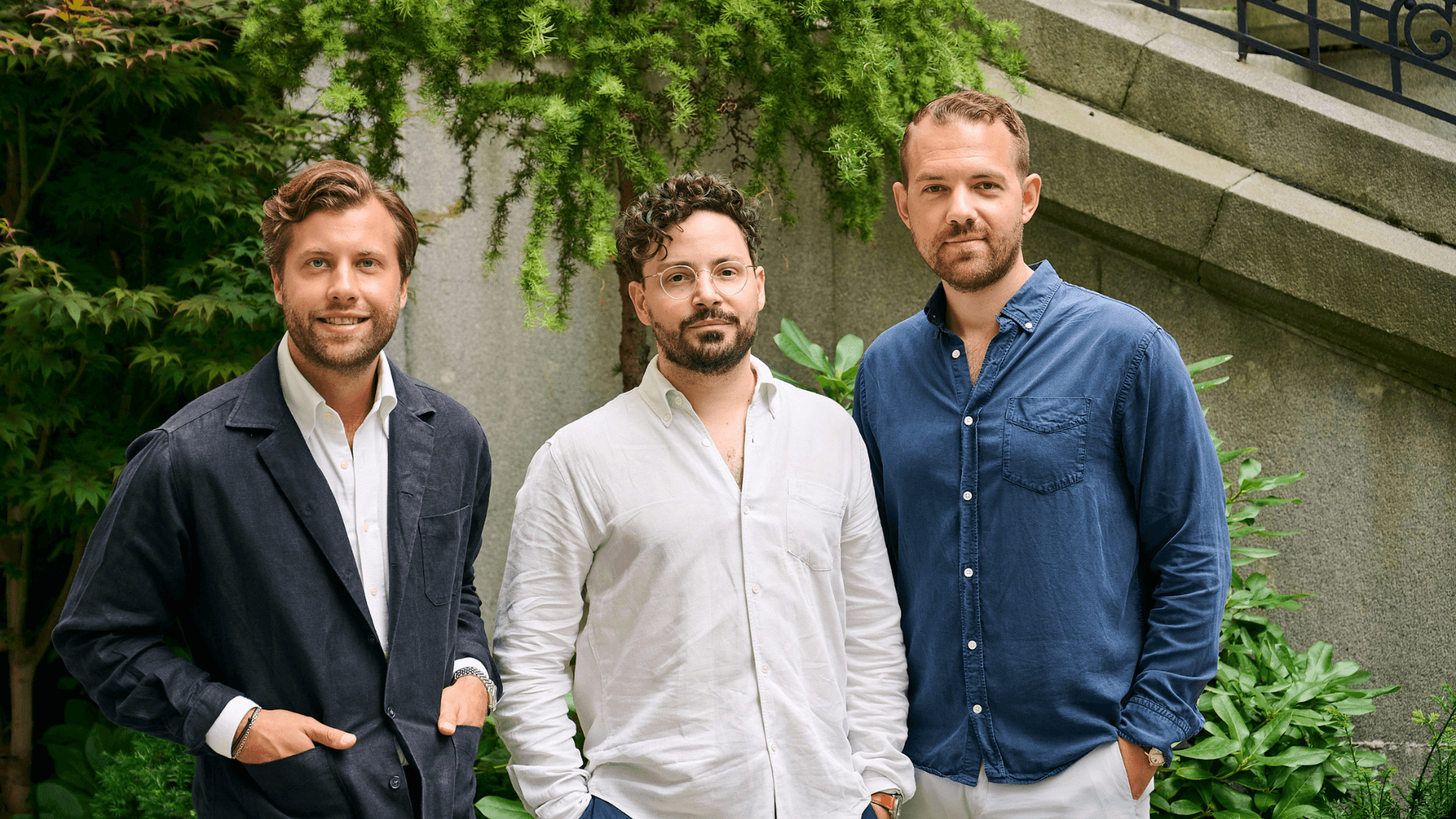

Founded by Jonatan Klintberg, Robin Lantz, Fredrik Eriksson, the platform both orchestrates and automates the management of other fintechs’ infrastructure providers with a low-code experience. By using Bits, fintech companies — namely, their product and developer teams — all over the world can securely manage and optimise the integrations that are needed for their solutions. In doing so, Bits will make fintech’s product development and go-to-market timelines far faster and more efficient.

Jonatan Klintberg, co-founder and CEO added: “With the Bits platform, fintech companies will be able to shorten their development time by connecting to these external service providers through one single integration, allowing them to focus on what they actually care about – building excellent financial products that their customers love.”

Sophia Bendz, partner at Cherry Ventures added: “We are driven to back founders who are simplifying and improving the customer experience. Bits is helping fintechs create financial services products with ease. First step is that they’re creating a platform that automates the management of other fintech infrastructure providers. This leads to shorter lead times and a faster rate of expansion, which benefits the entire ecosystem.”

Would you like to write the first comment?

Login to post comments