Parisian staking-as-a-service platform Kiln has raised €17 million in a Series A funding round. The startup is building a staking infrastructure aimed at enterprise-grade clientele, allowing them to offer staking directly to institutional customers or as a staking product for companies to integrate these services into their offerings. The new capital will be used to further develop and add to Kiln’s expanding product range.

With upwards of $500 million of assets staked under management, Kiln’s €17 million Series A round funding was led by Illuminate Financial with GSR, Kraken Ventures, Consensys, Leadblock Partners, Sparkle Ventures participating alongside existing investors Alven, BlueYard Capital, 3KVC, SV Angel, and other undisclosed parties.

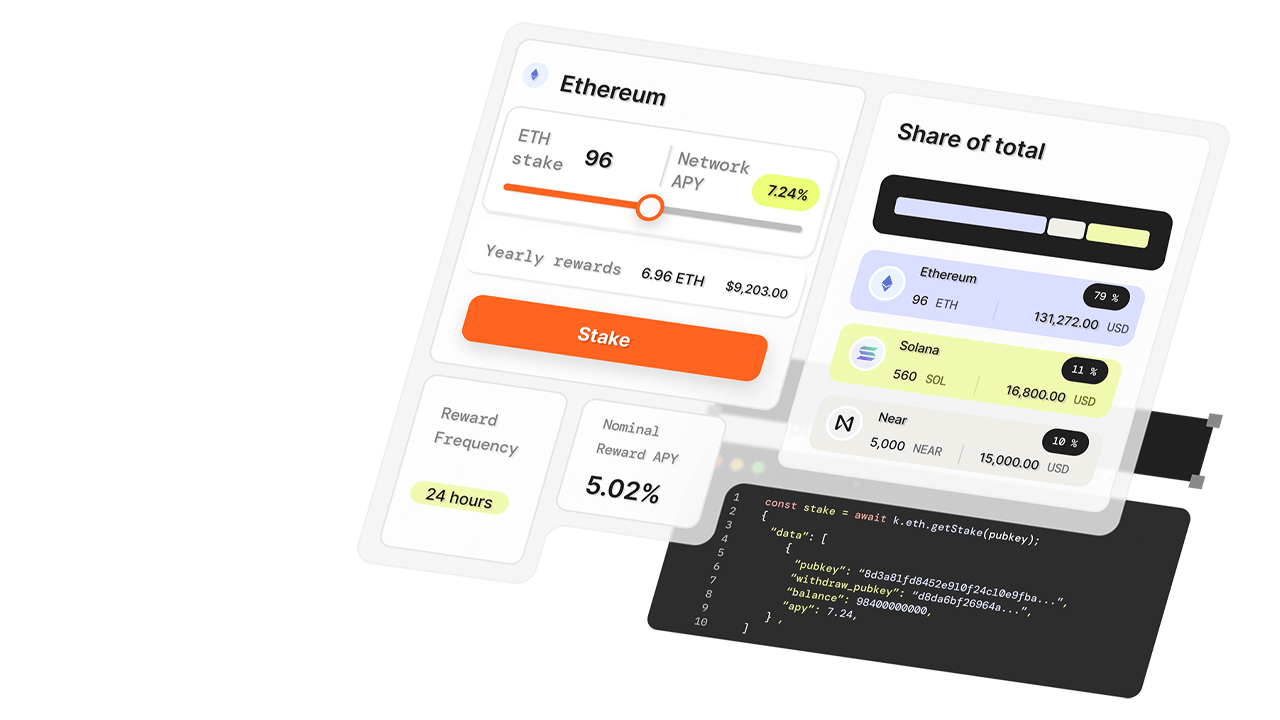

Following the Ethereum network’s transition to a Proof of Stake consensus, aka “The Merge” back in September, Kiln is banking on the demand for staking ETH to grow exponentially. At present, Currently, only 12.5% of ETH supply is staked, compared to 50-80% for other PoS assets. Add in the fact that ETH offers an annual percentage yield of around 6-7% since the Merge, and Kiln maths starts to add up.

“We believe it is critical to provide enterprise-grade infrastructure to institutional users, that in turn enables our customers to create new opportunities for their users.” - Kiln co-founder and CEO Laszlo Szabo

Why stake? Well, not only does the process help secure the blockchain through validation and proposing blocks, but there’s zero counterparty risk, as opposed to when lending. Likewise, the risk is all but eliminated when dealing with a third-party intermediary such as a centralised exchange.

Where Kiln fits into the picture is by providing customers such as Binance US, GSR, and Ledger with the ability to offer their customers staking services via a suite of tools all aimed at making the staking process as easy and painless as possible.

“Having used Kiln’s infrastructure to stake our own treasury, in the future to offer to our clients, our company’s missions are perfectly aligned. We are delighted to be able to participate in the next stage of Kiln’s development and to contribute to making staking easier and more accessible to everyone,” commented GSR’s Benoît Bosc.

On the investment, Illuminate Financial’s Rezso Szabo commented, “We are witnessing a once-in-a-generation shift in the institutionalisation of digital assets. The rise of sophisticated users and institutions underlines the need for enterprise-grade infrastructure. As a thesis-driven investor backed by traditional financial institutions, we believe the Kiln team has demonstrated they can build key infrastructure that is critical for both digital assets native institutions and will also serve as the future rails for financial services infrastructure.”

Would you like to write the first comment?

Login to post comments