London-based B2B receivables and mini-bonds fintech Bondaval has raised $15 million of series A funds led by Talis Capital, bringing its total raised to more than $25 million.

The round also features a slate of Bondaval's existing investors, namely Octopus Ventures, Insurtech Gateway, TrueSight and Expa, as well as its new partners Talis, FJ Labs and Broadhaven Ventures.

Bondaval was founded in 2020 by Sam Damoussi and ex-England Rugby 7s captain Tom Powell. The startup's fintech product allows B2B financiers to rationalise credit and insurance underwriting, processing and cost.

The funding will support a recruitment drive to extend Bondaval's existing 20-person team, located across its branch offices in London and Austin, Texas. Proceeds will also help Bondaval enter more sectors and use cases, while refining its core fintech IP.

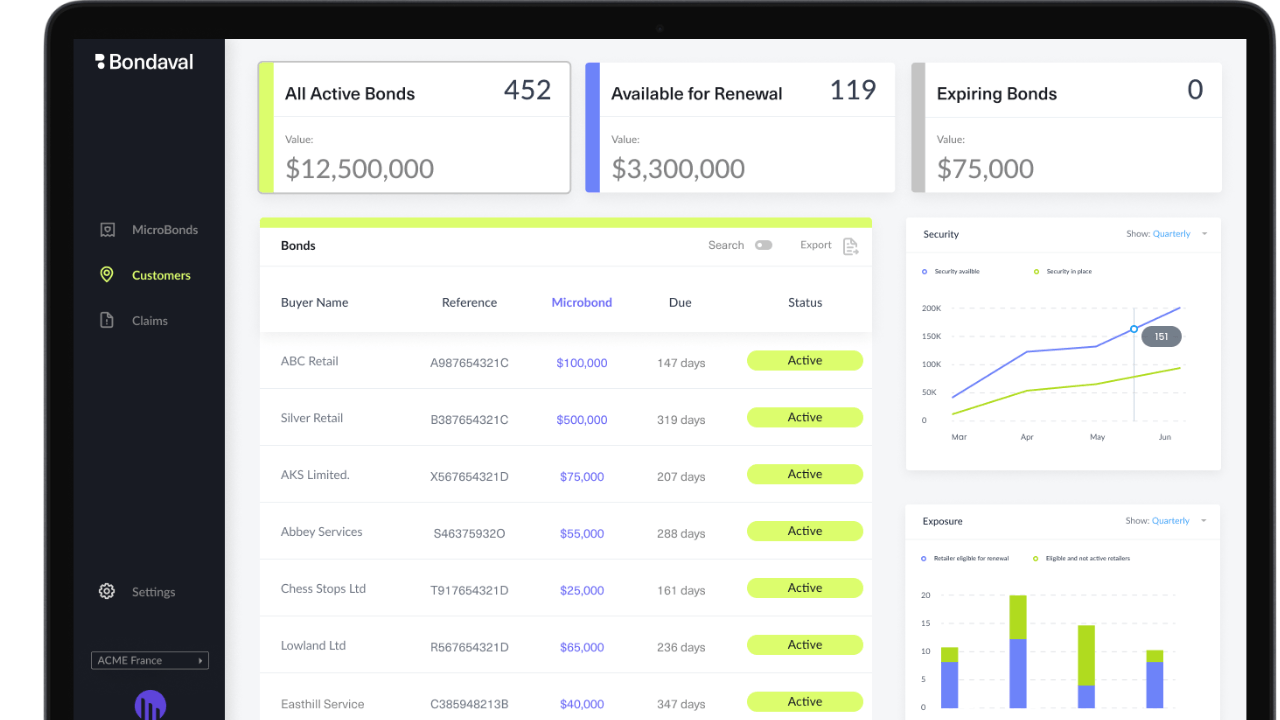

Bondaval's services include MicroBond, a no-cancellation financial instrument wholly underwritten through its digital platform without the customer putting down collateral. MicroBond is used by blue chip FTSE 100 and S&P 500-listed companies including oil majors Shell and BP to provide receivables coverage.

Following the series A raise, Octopus Ventures investor Tosin Agbabiaka predicted Bondaval would become a "category-defining" credit and insurance B2B platform. Talis Capital's GP Thomas Williams will join the board of directors.

"We continue to be impressed by Bondaval’s ability to develop this innovative solution, drive value to some of the largest companies in the world, and continue building an exceptional team," Agbabiaka said, "Therefore, our decision to double down on supporting the company in this next stage of its journey was a no-brainer.”

Would you like to write the first comment?

Login to post comments