Former Investor Team Lead at Slush and Investment Analyst at Innovation Nest Konrad Kordowski has reviewed some 1,400+ VC jobs that were announced in 2022, uncovering that when it comes to working in VC, London and Berlin are where it’s at.

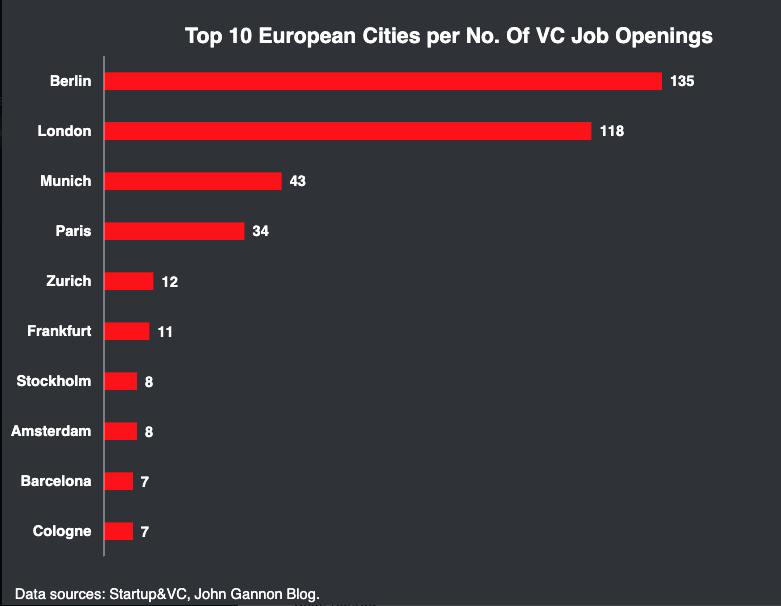

With 135 job openings found in Berlin, and 118 in London, between the two capital cities, they garnered just over half of all available positions. Rounding out the list, Munich and Paris took places three and four respectively, with Zurich advertising 12 positions, Frankfurt 11, Stockholm and Amsterdam offering 8, and Barcelona and Cologne rounding out the top 10 with 7 positions on tap.

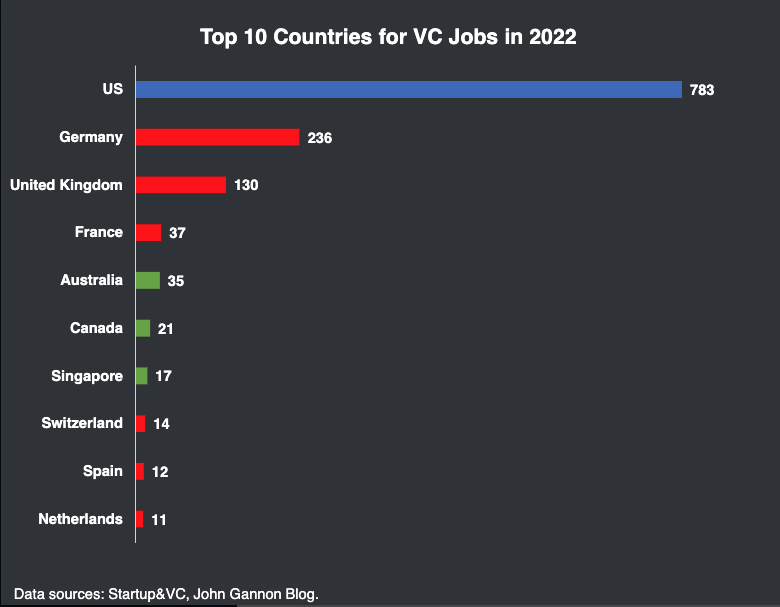

Zooming out to a global perspective, it should come as no surprise that the US accounted for 55.7 percent of all positions available in the VC world, with Germany, the UK, and France filling spots numbers 2, 3, and 4.

Notably, and perhaps a harbinger of news to come, Australia took the number 5 slot with 35 available jobs on offer, despite the fact that their domestic VC market was only 10 percent the size of its European counterpart in terms of funding in Q4 2022.

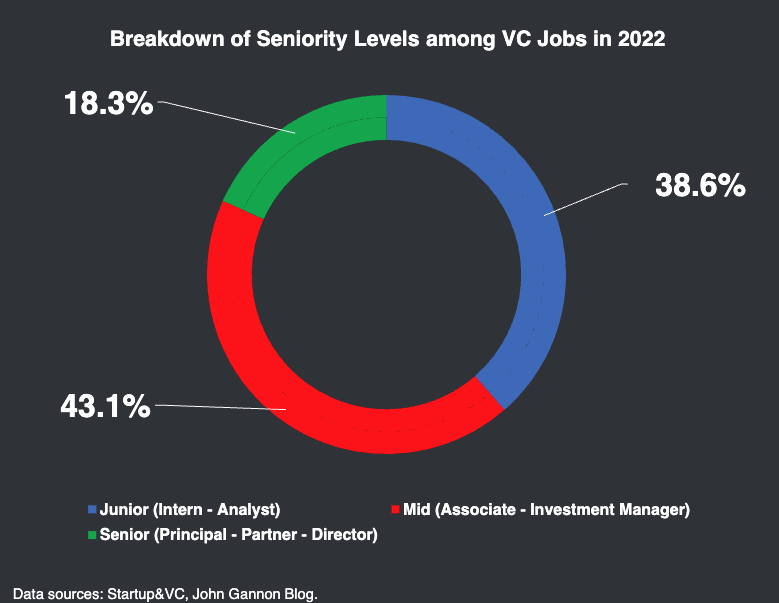

Falling in line with trends noted in Europe of home-growing talent and promoting from within, the 2022 VC job market was rife with Junior (Intern and/or analyst) and Mid-Level (Associate/Investment Manager) opportunities, making up 38.6 percent and 43.1 percent respectively. In terms of Senior (Principal/Partner/Director) positions, the 2022 VC job market saw only 18.3 percent of positions advertised/available.

As Kordowski notes in his analysis, the high percentage of entry-level positions, “could be attributed to a high turnover rate of such opportunities, with some VC firms frequently hiring new interns or analysts every 3-6 months.”

Kordowski’s data involved 1,407 unique job openings from 805 VC firms in 35 countries that were publicised on two publicly available VC-related job boards: Startup&VC and John Gannon Blog. He also notes, “Due to the private nature of some hiring processes in VC, it was not possible to gather information from every VC firm.”

Would you like to write the first comment?

Login to post comments