It's Mobile World Congress (MWC) time again, so it's a great time to be a journalist if you love IoT.

Last month, electronics distributor Avnet Abacus released research that crunched the number of IoT investments in 2022.

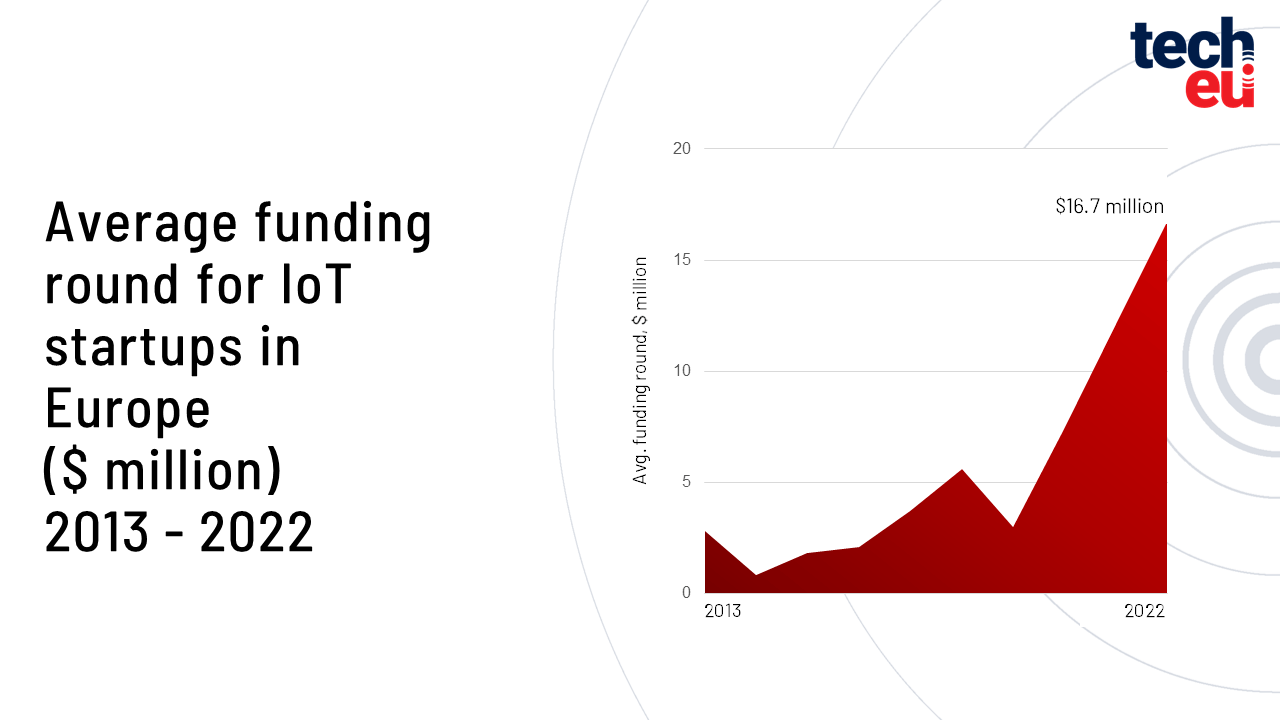

It revealed that the average amount of capital raised by IoT startups in 2022 reached the highest point in over a decade, despite a 22% drop in total funding within the sector and an overall 35% decline in venture capital markets.

In 2022 European IoT companies drew in their highest average funding round ever at $16.7m.

I've been following the world of IoT since about 2012, and people sometimes ásk me "Isn't that over, and all a bit 2017?" In a word, no.

Have we hit 41 billion yet?

In the late 2010s, the International Data Corporation predicted we'd see over 41 billion IoT devices in operation by 2025. The thing is, with the size of the addressable market, I'm not sure who's counting or to what aim – after all, the industry encompasses everything from companies that make IoT to those that use IoT – if it comes with a corresponding app, you're talking IoT.

I've looked broadly at the funding awarded to startups last year. I've intentionally not included mobility for brevity. But here are just a few companies that have caught my eye.

Kinexon (Germany)

Munich company Kinexon provides cloud software that captures, optimises and automates processes in manufacturing, logistics, and sports.

Operating under two core segments, Kinexon Industries and Kinexon Sports & Media, the company's IoT stack combines software with any sensors and connected devices, creating an end-to-end automation solution.

Its software improves productivity in manufacturing and logistics.

In sports, Kinexon's automated real-time content generation enables the analysis of athletic performance and the enrichment of sports broadcasts with novel data, for example, for augmented reality applications. Think live player and ball tracking in FIFA and the NBA to gain real-time insights into conditioning, performance, and game strategy.

Kinexon raised €122.5 million in Series A funding in April 2022.

Naio Technologies

Founded in 2011, Naïo Technologies is a French AgTech company that develops, manufactures and markets autonomous robots for agricultural use cases like farming and grape cultivation.

The robots undertake tasks like weeding, hoeing and seeding, tackling labour shortages, and helping to reduce soil erosion, and the carbon footprint of farming and herbicide use.

The company raised €32 million in Series B funding in December 2022.

Rombit (Belgium)

Rombit develops integrated IoT products like wearables that reduce operational expenses and increase worker safety in logistics, energy, construction, and manufacturing sectors.

Rombit designs multifunctional wearables using sectors for fall, shock, no motion detection, trigger evacuation alerts, and collision avoidance services.

For example, the ONE wearable automatically alerts when a frontline worker is in danger. Integrated with Permits to Work, it restricted worker access to particular areas.

When a permit is issued, Rombit activates a predefined geofence around the work order area. Rombit wearable tracks all entries into the GPS-geofenced zone and confirms the start and end of the work order when the team enters or exits the zone, activating an alarm in case of a non-permitted entry.

In February 2022, the company raised €23.3 million in a Series B funding round.

Sympower (the Netherlands)

Amsterdam-based Sympower has developed a proprietary software platform that helps industrial and commercial customers reduce energy costs by adjusting the energy level of systems, machines, and process power in electrical assets such as steel smelting, paper production, electric vehicles and HVAC systems in response to grid fluctuations.

These demand response solutions create flexible assets that reduce their electricity usage based on user schedules and during peak demand periods, leading to lower costs.

The company sells this service to grid operators, and then divides the profits with its customers (the owners of the flexible assets), whose electricity costs can be reduced by up to 15 percent.

Sympower is active in Finland, Sweden and the Netherlands. The company raised €25 million in Series B funding over two rounds last year, the second in July 2022.

Smartex.ai (Portugal)

Founded in 2018, Smartex has developed hardware-enabled, machine-vision-driven software to detect textile defects in real-time. This automated identification process reduces textile waste, CO2 emissions, energy, water, and capital expenditure.

The textile and fashion industry is notorious when it comes to waste. Up to 15 percent of fabric intended for clothing ends up on the cutting room floor — creating more than 90 million tons of waste yearly.

In response, Smartex uses AI, and IoT combined tailored hardware, vision software & machine learning algorithms to identify defects in fabric manufacturing inside circular knitting machines using computer vision, and machine learning. Machines can be stopped to prevent more material being destroyed.

Smartex raised $24.7 million in a Series A round in November 2022.

Sencrop (France)

Sencrop is focused on weather monitoring and precision farming, helping agricultural businesses receive real-time and predictive information for their plots about micro-climatic information, water stress, plant growth stages, disease and pest development conditions.

Its weather stations record local, precise and reliable agricultural weather data on cultivation areas. A corresponding app enables farmers to identify weather, water stress, pests and disease risks for their crops, including frost episodes and risk of mildew, and act accordingly. This leads to better yields and improved environmental impact.

The company raised €18 million in May 2022 series B funding.

Minut (Sweden)

Minut provides home monitoring solutions for vacation and business rentals that don't include creepy cameras. Following a rather epic journey that began in 2014, the company has created sensors that help over 25,000 hosts protect their homes in over 100 countries.

The Minut sensor monitors noise, occupancy levels, motion and temperature in vacation rental properties, supporting hosts in preventing wild parties and helping them protect their homes.

It integrates with property booking services, scheduled messaging for

automatic check-in and check-out communication flows, and smart lock integration.

The company raised €15 million in Series B funding in March 2022.

Dryad Networks (Germany)

Detecting forest fires is difficult as forests are typically remote in inaccessible areas. The use of satellites or cameras in trees can take up to three hours to detect smoke plumes making early intervention impossible, Dryad Networks has created tech that can not only detect fires but prevent them through the ultra-early detection of forest fires, within their first hour, or even the first 30 minutes.

The company uses solar-powered gas sensors in a large-scale IoT sensor network. Using its IoT network, the sensors can detect wildfires and provide valuable insights into the micro-climate and growth of the forest.

The company raised $10.5 million in August, 2022 from a Series A round.

Naava (Finland)

Founded in 2011, Naava has created a way to bring the benefits of nature indoors using technology. Its smart indoor plant walls combine air purifiers, humidifiers, and plant walls.

Leveraging the research by NASA, the company's air-purifying technology breaks down harmful compounds from the air with friendly microbes living in plant roots.

Naava raised €7 million investment in January 2022

Valpas (Finland)

Visiting a hotel infested with bed bugs is everyone's idea of hell. Valpas has developed a solution — without using pesticides.

The company has developed a smart bed bug trap that actively attracts and traps bed bugs.

Every time Valpas captures a bed bug, it sends a notification via the connected app to help hotels keep track of the problem.

The company raised €1.6 million in seed funding in April 2022.

— Additionally, if we look at the connectivity solutions that make IoT happen, there was also plenty of action. In Germany, EMnify raised $57 million and 1NICE $50 million. Denmark's Onomondo raised $21 million last year.

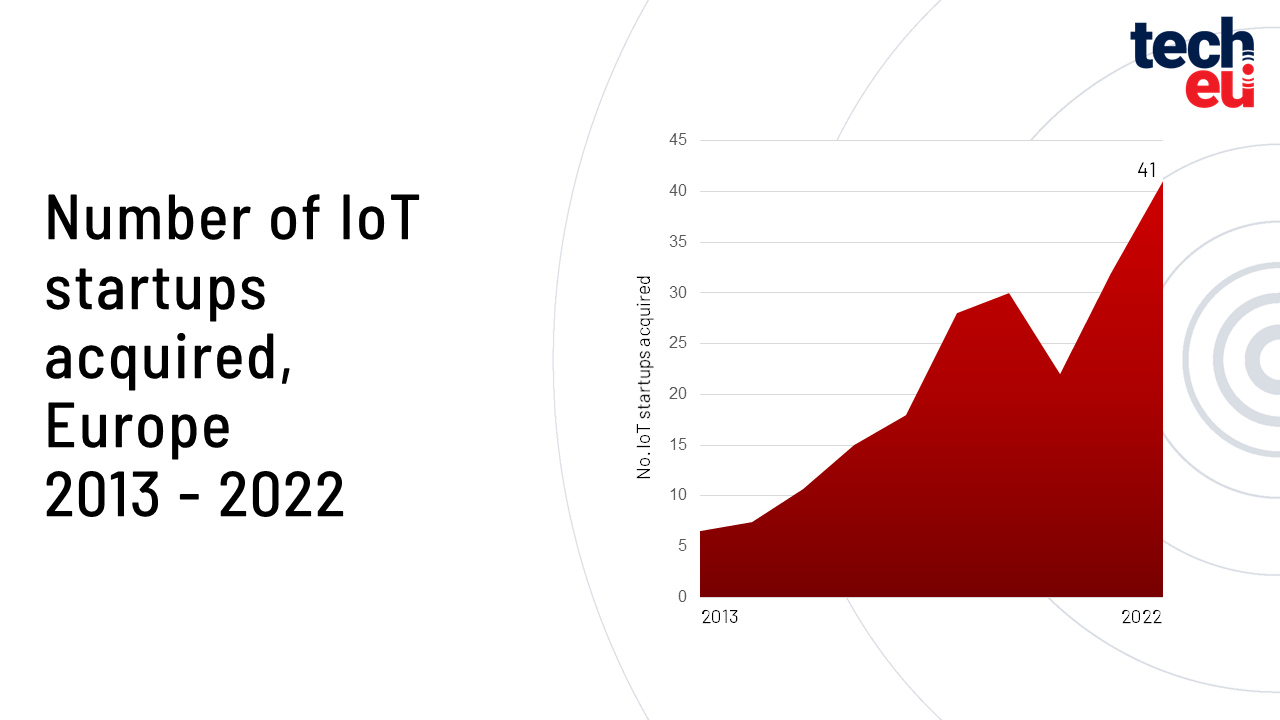

2022: an abundant year of IoT M&A

2022 was also a good year for mergers and acquisitions.

Briefly, we saw Atlantia SpA enter an agreement to acquire Yunex Traffic from Siemens Mobility for approximately €950 million. UnaBiz acquired IoT global network Sigfox for €50 million. Traxens acquired NEXT4. Siemens Mobility acquired rail software provider Squills for €550K. Industrial IoT wearable company ProGlove was acquired by Nordic Capital for an undisclosed (think massive) amount.

2023 is looking good

2023 is already looking good, despite predictions of lower investments this year.

Smart home energy startup Tado raised €43 million in January s of and solar installation startup SunRoof, raised €13.5 million. Connected industry specialists Momenta Launched an Industry 5.0 VC fund for industrial use cases like manufacturing and supply chains.

The relevance of IoT is far from over.

Lead image: Rombit. Photo: Uncredited.

Would you like to write the first comment?

Login to post comments