Today Digital Food Lab released its sixth annual report on the state of FoodTech investment in Europe. The analysis spreads across several key verticals:

- Delivery

- Supply chain

- Agtech

- Food science

- Foodservice

- Consumer tech

It shows investor interest in many facets of food tech, specific to verticals, regions, and countries, including M&As and notable corporate involvement.

It's a sizable report and worth a read in its own right, but I'll aim to break down some of the interesting findings.

What do the numbers say?

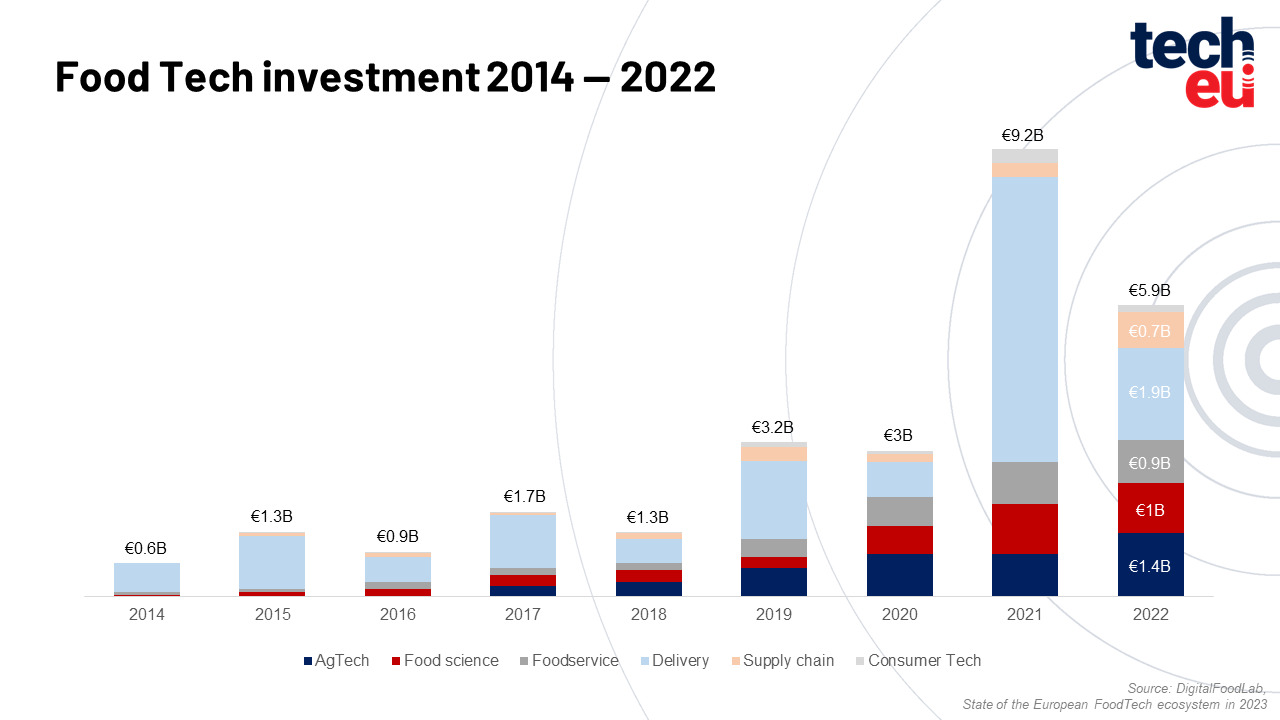

After a boom year, FoodTech investments decreased by 36% between 2021 and 2022.

Still, €5.9B were invested in European FoodTech startups in 2022, almost twice as much as in 2019 and 2020.

Significant deals still happened, although unsurprisingly, startups that had already raised more than €1 million received less funding in 2022 than in 2021. Only 17% of them raised, while it was 25 a year before.

This means that companies looking for additional funds found it harder to raise money than newer startups.

A reckoning for grocery and food delivery?

Few could deny that during the pandemic, 2021 was a bumper year for grocery and food delivery companies. Gorillas and Flink became unicorns.

But the vertical was the hardest hit in FoodTech, in 2022 with investments in delivery startups compared to 2021. 2022 saw a 68% decrease in the amount invested in delivery startups compared to 2021.

But let's face it, 2021 was a tough act to follow. In April, Glovo raised €450 million and acquired a bunch of Delivery Hero brands in Central and Eastern Europe as well as the Ehrana delivery platform in Slovenia.

In September, Amsterdam-based online supermarket Picnic raised €600 million. The year rounded off with Flink raising $750 million in a Series B funding round

Berlin-based Gorillas and Flink both attained unicorn status in 2021.

The following year, things were mixed.

In May 2022, Gorillas laid off roughly half of its headquarters staff and pulled out of several markets, including Italy, Spain, Denmark and the Netherlands. Flink acquired Cajoo, a French competitor, in May 2022 for €100 million.

At the end of 2022, Turkish competitor Getir closed a deal to acquire Gorillas for $1.2 billion, bringing forth a massive merging of dark stories throughout Europe. Flink is the only delivery startup, not 100% owned by another company. Swedish grocery delivery company Oda raised €145 million.

In February this year, Yababa became insolvent. Last week Swedish online grocer Mathem acquired Kavall.

What we do know is that food profit margins are narrow, with consumers sensitive to rising prices. There's also the issue of warehouse closures, with Amsterdam banning inner city operations – it's unclear whether riders will be expected to ride further or services will be limited to outer urban areas. I know in my street, a Gorilla's warehouse relocated after only a small number of complaints.

The research authors note that discounting would be a grave mistake for established retailers.

"Innovation and disruption is still coming for them. If we take a long view, we can see that 2021 was an anomaly and that investments are going back to a more reasonable trajectory of growth."

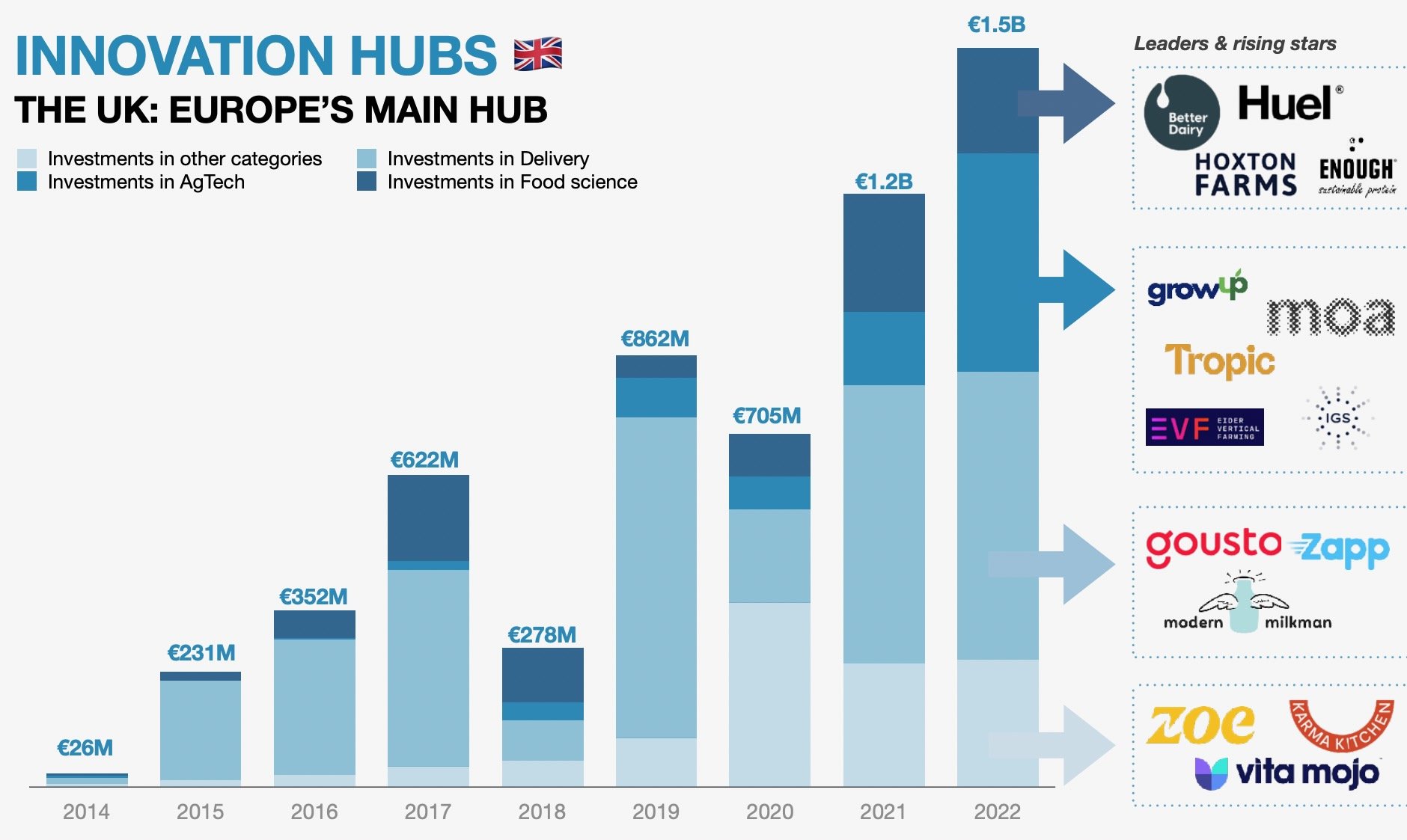

The UK reigns supreme

The UK makes up 24 % of food tech investments and remains Europe's leading food tech hub. Britain's FoodTech kept growing in 2022 and is sustainable as it is not based on one or two startups as in other countries.

Interesting companies abound. There's Mimica, who is developing a temperature-sensitive cap or tag providing an accurate, real-time indication of food freshness.

Ace Aquatec is a technology company that uses science and innovation to drive sustainable, welfare-focused aquaculture practices.

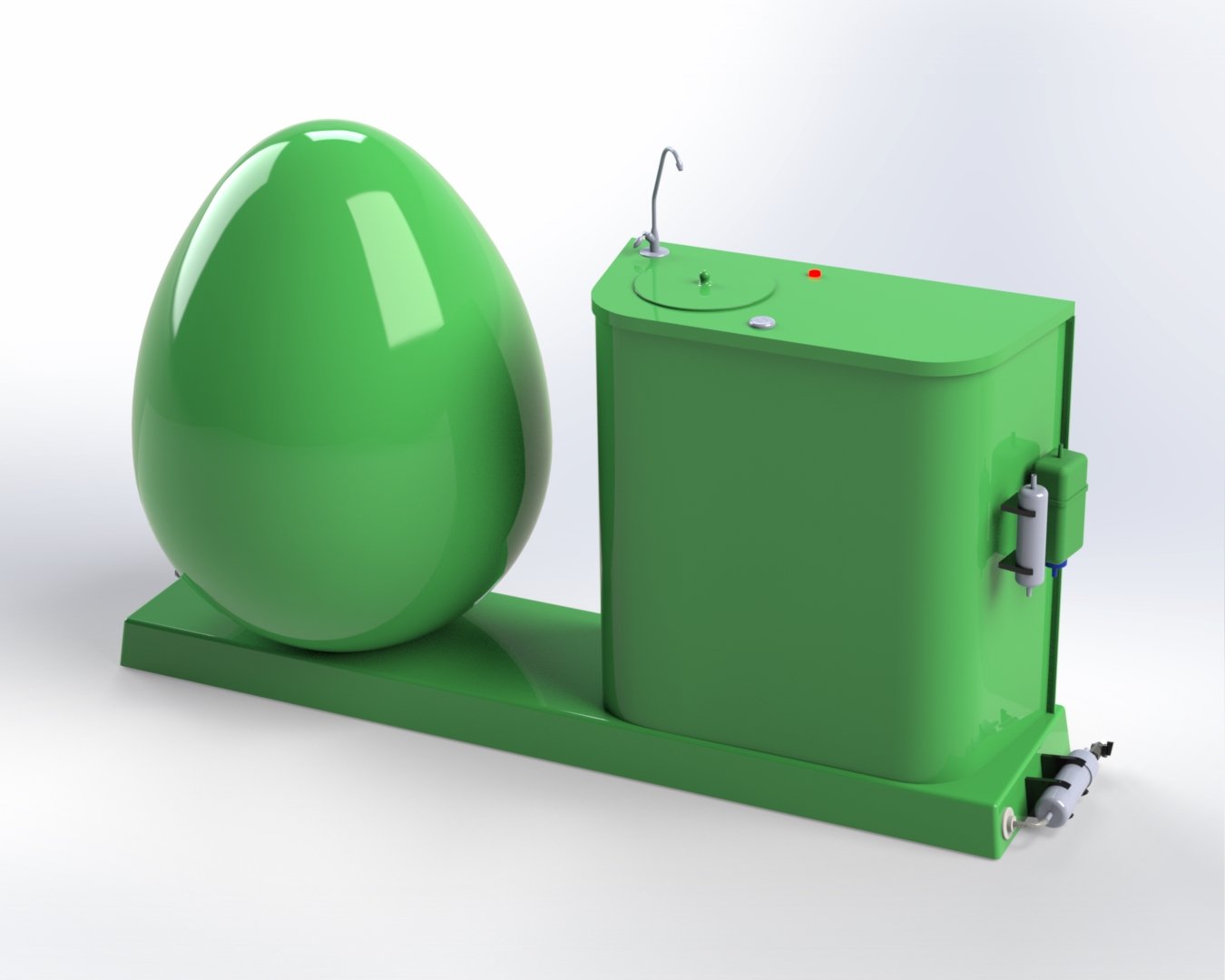

Irish startup MyGug has developed a micro-scale anaerobic digester that turns food waste into a green renewable energy source, suitable for homes and small food businesses.

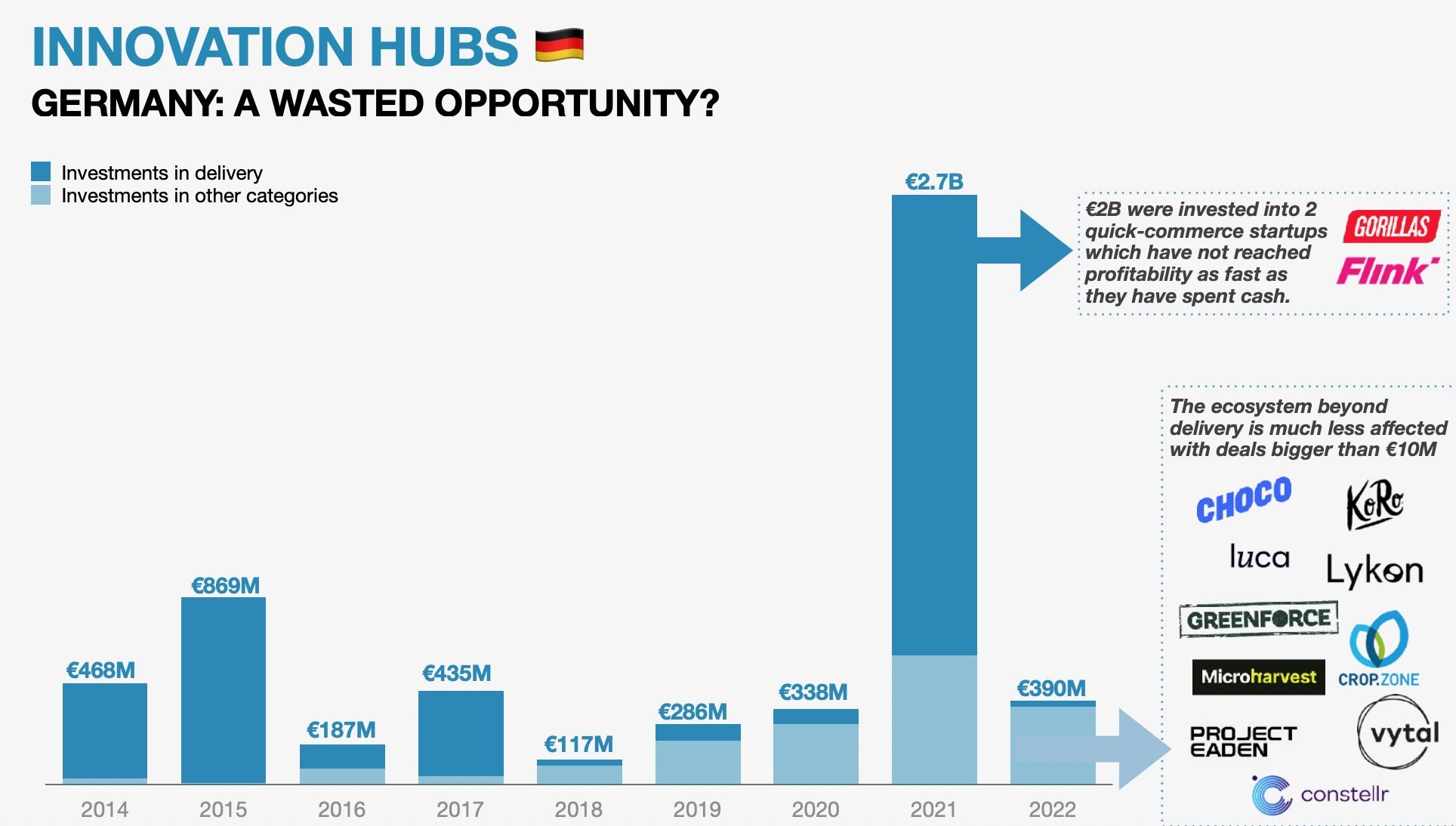

Things are becoming wurst in Germany

However, investments in German startups were severely affected, with a decline of almost 90%.

The research notes that billions were poured into Germany's quick-commerce startups in 2021.

"However, these startups have been either partially or fully acquired, mostly by non-European companies. If eventually quick-commerce becomes a sizable and profitable business, the added value may well leave Europe."

Fortunately, Germany still is a place where interesting FoodTech startups continue to emerge.

While Germany is home to Unicorns like Flink and Gorillas, its reach extends to newer businesses like Koln reusable packing company Vytal.

The company raised $12 million in Series A funding in 2022. Its value will rise as Germany has made it mandatory to supplement disposable tableware in canteens, restaurants and delivery services with reusable alternatives.

And there's plenty of emerging innovation – Germany's FarmInsect creates feedstock from insects. (In 2022, Animal feed investment increased by +175%). Lykon (who the Food Tech researchers classify as "other food tech" offers DNA analysis to aid people with weight loss.

Investments are only part of the story

It's easy to focus on the wins without deeper thought into what the losses mean for innovation, new markets, changing customer needs, and broader sustainability goals.

Take indoor farming, the most invested agtech category in 2021. In 2022 investments had dropped by 12%.

The result is a legacy of companies struggling to profit against rising costs.

In 2022, Berlin vertical farming company InFarm laid off over half its workforce (around 500 employees) in response to increased inflation, rising energy prices and other costs, as well as supply chain disruptions. This was despite raising $604.5 million in funding over ten rounds.

In February this year, the company announced closure of operations in the UK, France, the Netherlands and Japan.

French go-local farm Agricool was placed in receivership in March 2022 and later sold to VIF Systems.

Future Crops was registered for bankruptcy in January this year despite a $30 million investment in March 2022.

Glowfarms in the Netherlands closed after two and a half years in November 2022.

Compare this to the UK's GrowUp Farms, which has grown restaurant-quality greens for almost a decade. Their latest vertical farm in Kent is powered by renewable energy, using electricity and waste heat from the bioenergy plant next door. This makes it possible to grow salad year-round in the UK at affordable prices.

The authors of the report assert that Europe lags behind other regions when it comes to specialisation and national focus for investors, asserting

"Europe's FoodTech hubs compete more with each other than with the rest of the world. Additionally, investors are much more focused on the startups in their own cities or countries than… elsewhere in Europe."

They suggest that the political and public endorsement of FoodTech is lacking and, with the exclusion of the Netherlands, "a total absence of national strategies around this ecosystem and its promise."

One trend I am keeping a close eye on is Food biotech companies, especially spin-offs or startups associated with established manufacturers.

Take Onego Bio, a Finnish spin-off from VTT founded in 2022 which uses precision fermentation to develop a sustainable replacement for chicken egg white protein powder.

The company aims to roll out its first product Bioalbumen™ as a food ingredient for the food industry soon and later enter the consumer market with its own branded products for baking and cooking.

Also worth keeping an eye on is Mylkcubator, an incubation program launched by Pascual Innoventures that aims to support innovative projects developing technological advances in cell cultures and fermentation techniques that are generating a disruption in the agri-food system.

Lead image: Pixabay.

Would you like to write the first comment?

Login to post comments