The United Nations predicts that by 2050 the world population will rise to almost 10 billion. With such a large number of inhabitants, in addition to issues related to education, living space, availability of basic services, etc., the question of how to provide a sufficient amount of food also arises.

We should not forget that food production brings with it some other problems that need to be solved. For example, about a quarter of global greenhouse gas emissions come from food farming, and it is necessary to control and reduce it in order to achieve Net Zero. That's why in recent years there are a lot of initiatives among Agritech companies focusing on the development of technologies to sustainably meet the demand for high-quality food.

On the importance of dealing with these questions, GovGrant conducted research titled "Is there enough AgriTech investment to feed the world?" which covered Agritech companies around the world that received investment over the 2000-2021 period.

According to their report, global investment in Agritech is growing, almost doubling to £100 billion between January 2020 and January 2021. Globally, 1,773 companies received investment in the research period, while 474 of them are headquartered in Europe (with almost 20% of European companies from the UK).

The research showed that companies headquartered in the UK and mainland Europe attracted over 43% of global investment in Agritech, collecting around £80 billion in Europe (and £866 million solely in the UK).

Also, 5 top segments of Agritech that collected the biggest investments were recognized, and they are:

- Agri Biotech

- Indoor Farming

- AgriFinance & eCommerce

- Precision AgriTech and

- Animal AgriTech

Although Agri Biotech is the top segment for investment in all geographical breakdowns, the UK has, according to the report, a comparative specialization in Indoor Farming and Animal AgriTech. Together these account for almost 40% of UK investment in this sector, whereas globally or Europe-wide these are under 10%. This represents a growth and differentiation opportunity for the UK Agritech sector.

Investors

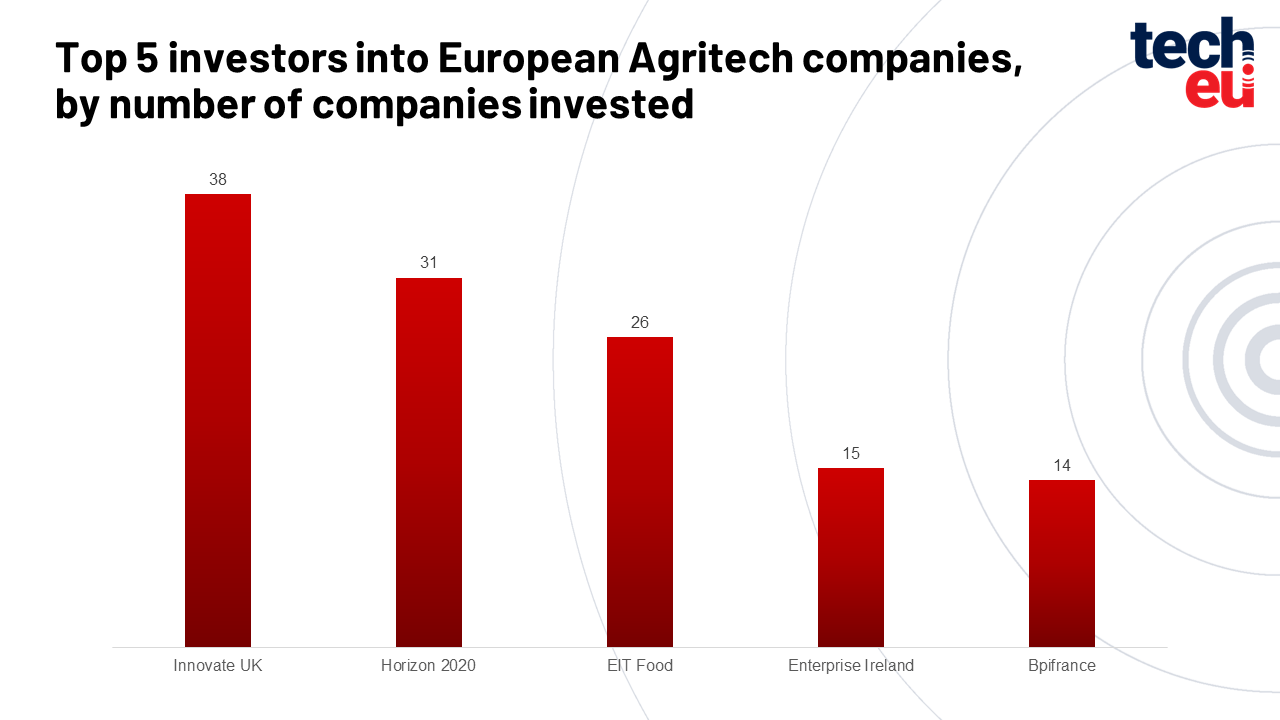

Globally, over 6,000 investors invested in Agritech. In the case of the UK, 361 investors invested in this sector. Even though it looks like a small number (6% of all investors), it should be highlighted that government-backed Innovate UK is one of the top global investors also on the European level (and globally shares first place with Horizon 2020 and SVG Ventures – THRIVE). This is a clear indication that the UK has an important stake in the sector.

Investment trends

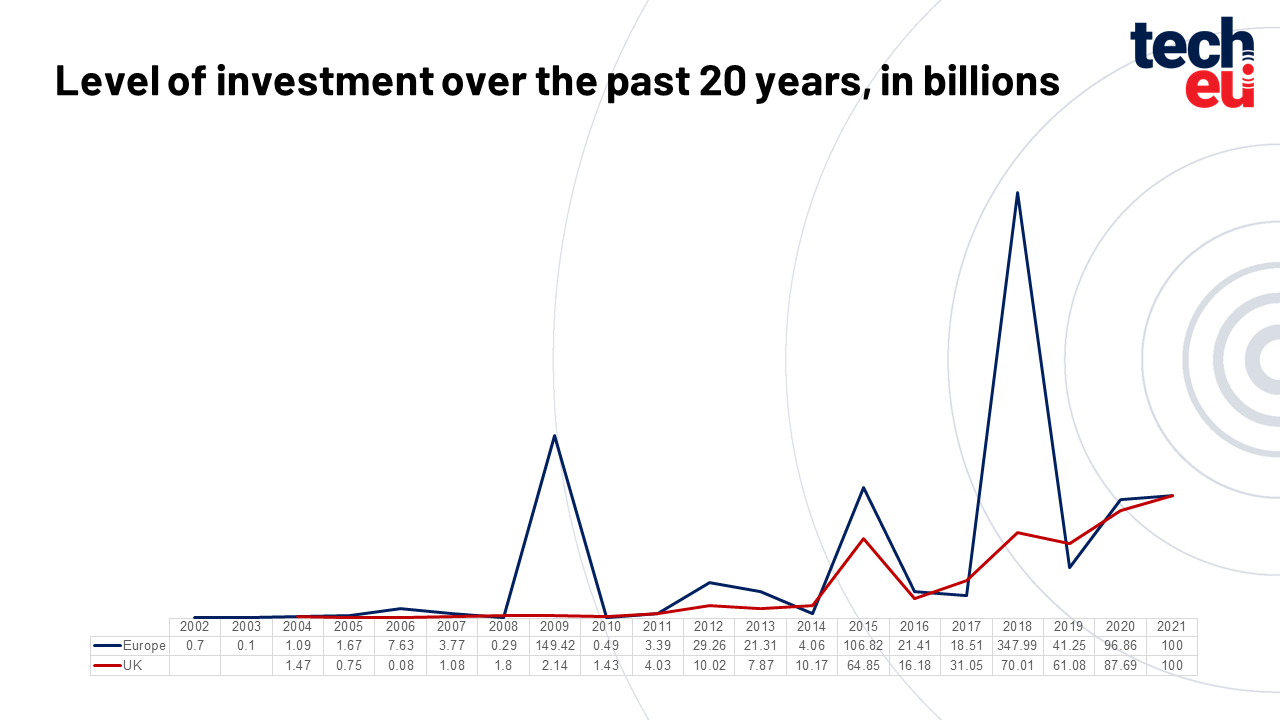

For the period of the last 20 years, which is covered by the research, it is evident that investments in Agritech are growing.

Investments have grown especially in recent years, compared to the period before 2011. In addition, as emphasized in the report, a significant jump in investments in Europe in 2009, 2015 and 2018 was due to specific M&A activities.

Globally, Venture capital deals are the most numerous sources of funding for AgriTech businesses – funding almost 80% of all deals, while Private Equity and Corporate/M&A activity make up on average around 9% and 12% of all deals respectively.

Are we goint to have enough food?

Data on investments in Europe show that there is great interest in investing in Agritech companies and strengthening this sector. For example, in 2020, the Belgian firm Astanor Ventures raised a $325 million impact fund to back Agrifood tech startups, while in 2022 Paris-based Capagro unveiled a €200 million fund to back Agritech startups in Europe.

In the UK, in 2022, London-based Vertical Future raised the largest Series A ever for a European indoor farming company, at £21 million.

So definitely there is a growing trend when it comes to investments in Agritech in recent years and it is expected that this trend will continue as long as there is a demand for food but also attempts to reduce gas emissions associated with food production.

As stated in the report, it is expected that venture capital will continue to make up the majority of investments, especially when it comes to companies in the early stages of development. Likewise, the expectations are that in the coming years, there will be an increasing number of public market debuts in this sector.

"The rise in agritech investment in recent years is nothing short of remarkable. And as the world faces surging food demand, it's also becoming increasingly urgent to curb emissions from food production. This combination of factors only makes the case for agritech more compelling, so we can expect even more investment." Adam Simmonds, Research Associate at GovGrant

Would you like to write the first comment?

Login to post comments