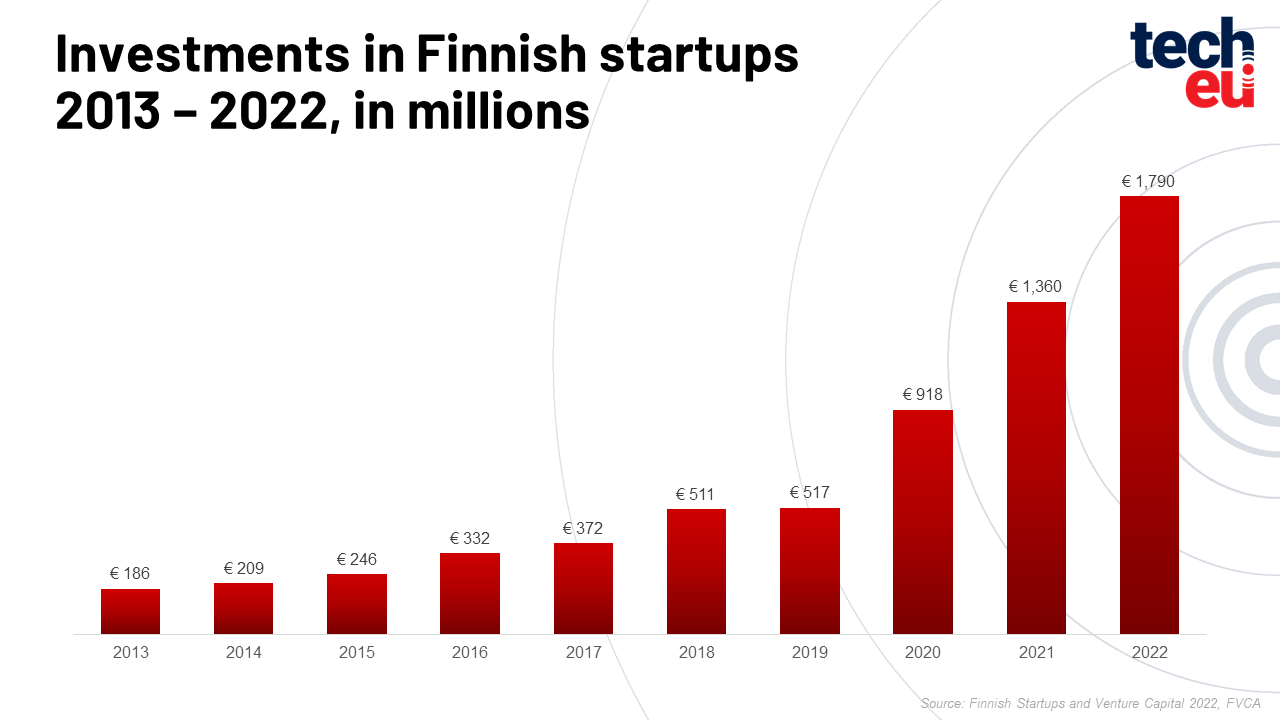

The Finnish Venture Capital Association (FVCA) has released its report on the state of the Finnish startup and VC ecosystem, aptly titled “Finnish Startups and Venture Capital 2022”. According to the report, over the last couple of years, the amount that Finnish startups are raising continues to grow, highlighted by the fact that over the past decade, this amount has increased tenfold.

And in 2022, Finnish startups raised a record amount of money, totalling €1.8 billion (which represents a growth of 32% compared to the previous year).

As in previous years, most of the funding (over €1 billion) came from venture capital and growth investors. Foreign investors accounted for 75% of the investments received by Finnish companies in 2022. Of the amount invested in 2022:

- €280 million came from domestic VCs and growth investors

- €753 million came from foreign VCs and growth investors

- €597 million came from other foreign investors, such as corporates and LPs and

- €160 million came from domestic investors

The biggest deal among Finnish companies in 2022 was Relex Solutions, the company that helps retailers and brands avoid food waste and tackle disruptions in global supply chains, which raised €500 million, following open-source software champion Aiven which raised $210 million, and deep tech startup IQM Quantum Computers (IQM) which raised €128 million. Additional deals of note include Molten Ventures-backed designer, maker, and operator of the world’s largest synthetic-aperture radar (SAR) constellation, ICEYE, which raised $136 million as well as Swappie, a startup that buys, refurbishes and sells iPhones, which collected a $124 million.

"The largest funding rounds are often led by foreign investors. Financing of tens or hundreds of millions cannot be done by Finnish efforts alone, and for our startups to compete with the global leaders, we need to also be able to attract international capital," comments Anne Horttanainen, Managing Director of the Finnish Venture Capital Association.

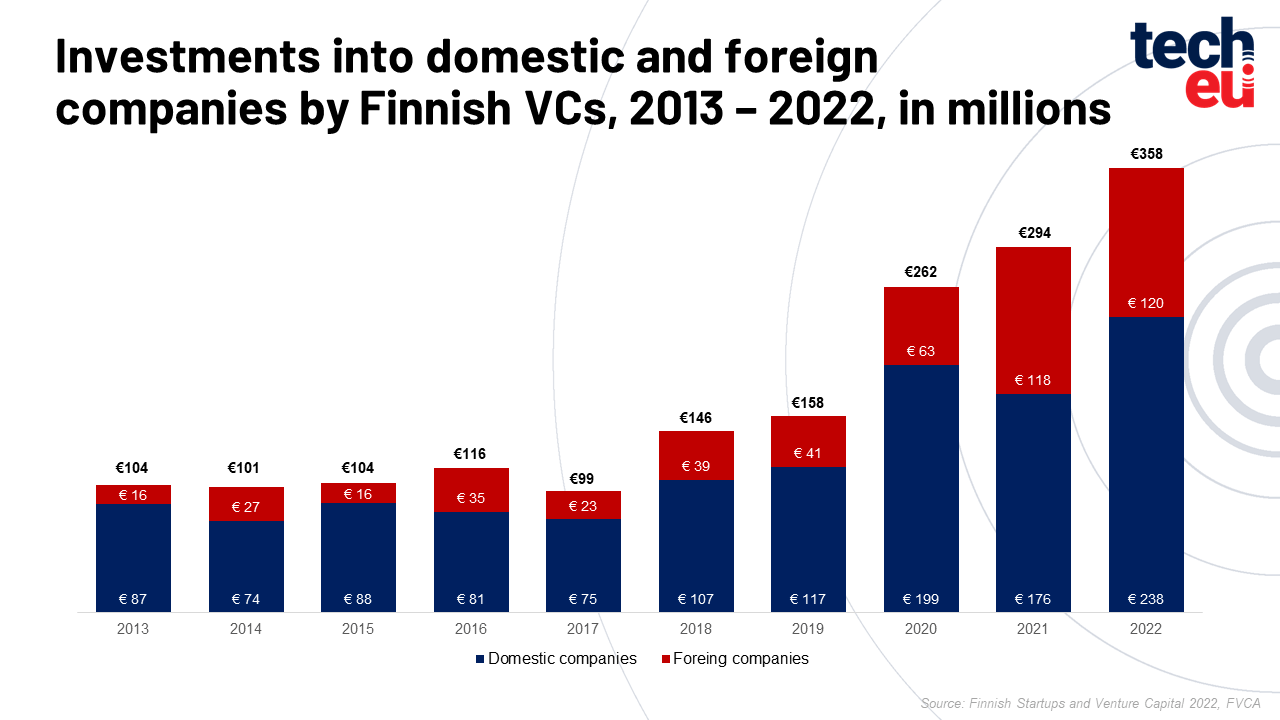

Finnish venture capital investors

Progress is evident not only in startup companies but also in the case of Finnish venture capital investors, who in 2022 made a total of €358 million in investments (where €238 million were invested in Finnish companies and €120 million in foreign companies ). What is more important is that Finnish venture capital funds have been investing more and more in foreign startups in recent years, thus strengthening internationalisation, a vital procedure in any market, but particularly so in smaller markets such as Finland.

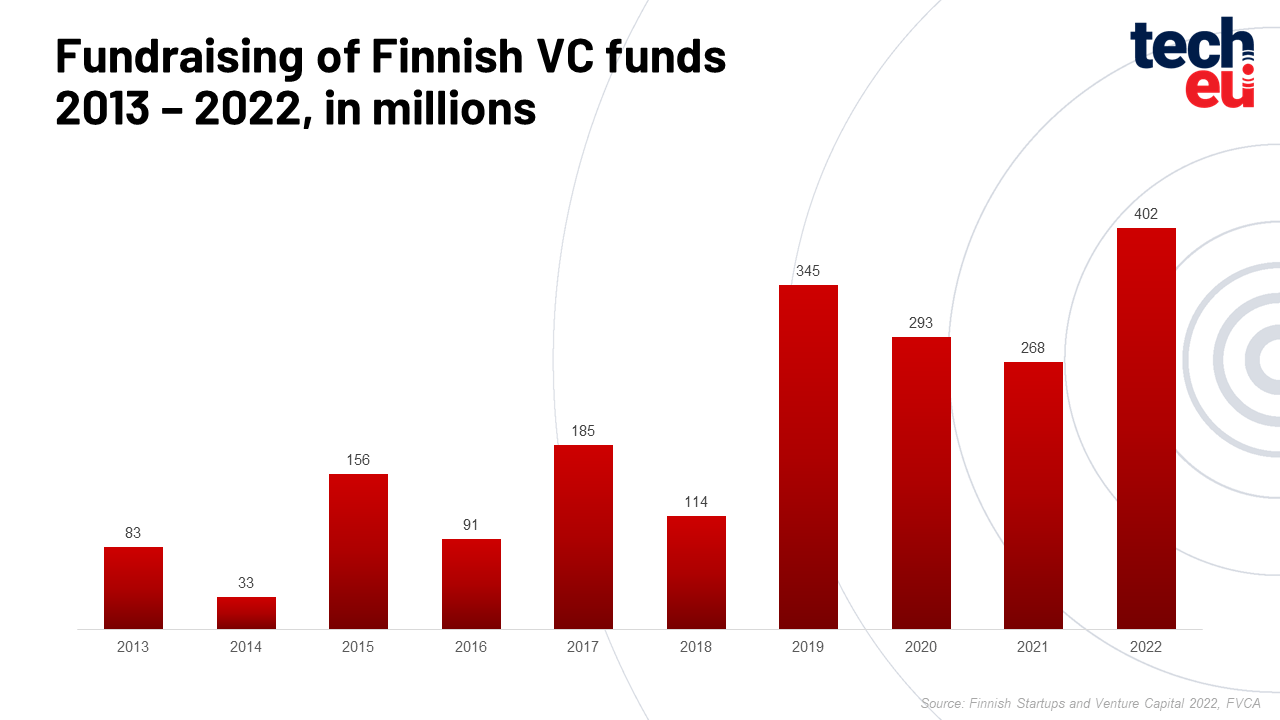

Providing further proof of 2022 being a successful year for the Finnish ecosystem is shown in the data on the fundraising efforts of Finnish venture capital funds, totalling €402 million. This figure indicates a growth of almost 50% compared to the previous year. And adding just a few more cherries on the sundae, in 2022 new funds were launched by FOV Ventures and Innovestor Life Science.

"The general economic uncertainty naturally creates challenges for this industry as well,” says Horttanainen, adding that “now is the time to make sure that unnecessary obstacles to fundraising are removed to secure the availability of funding for Finnish startups in the future.”

The startup capital increase, examples of successful companies that have outgrown the local market, and a significant share of funds raised by VCs, confirm the continuous growth that the Finnish VC and startup ecosystem has recorded in recent years.

However, it is questionable how long this growth will last. The data shows that investment activity in Finland is still at a good level, even in the second half of 2022 when both Europe and the US had already begun to record significant reductions and slowdowns. For better or for worse. And, naturally, the decreased number of startups being established is worth noting.

"The development of the venture capital industry and the entire ecosystem is the result of the long-term work of many players.”, says Horttanainen in her statement, concluding that “to ensure that this good development does not suffer a setback, cooperation to promote growth and entrepreneurship must continue”.

Lead image: Joakim Honkasalo

Would you like to write the first comment?

Login to post comments