As in every industry, the use of tech innovations in the field of insurance is common in order to create the most efficient business model possible (insurance + technology = insurtech).

Today we're highlighting 10 European insurtech companies that you should be paying special attention to. In particular, INZMO Founder and CEO Meeri Savolainen and Qover co-founder Jean-Charles Velge will be joining us in Brussels on 24 May at the Tech.eu Summit. If you haven't already, now is the time to grab your ticket!

Flock

This UK-based company wants to make the world quantifiably safer with connected fleet insurance that enables and incentivises safer driving. Flock specialises in insurance for commercial drone operators, using real-time data to provide policies that are tailored to individual flights. Founded in 2015, Flock raised $38 million in a Series B funding round led by Octopus Ventures and has raised just over $59 million to date.

Descartes Underwriting

Descartes Underwriting specialises in climate risk modeling and data-driven risk transfer. The Parisian startup is specifically helping corporate customers mitigate their exposure to climate-related and emerging risks through a number of parametric insurance products. Founded in 2018, the startup has raised over $140 million since early 2019. In January 2022, the company raised $120 million in a Series B funding round.

Alan

French unicorn Alan offers health insurance policies to individuals and companies. In May 2022, the company added €183 million in a Series E funding round, with the aim of broadening the offer and becoming the de facto one-stop health partner to 3 million people.

Wefox

Founded in 2015, this German company sells various insurance products through a combination of in-house and external brokers, bypassing the direct-to-consumer model and thus allowing users to compare and purchase insurance policies online. In July 2022, the company collected $400 million ins a Mubadala Investment-led Series D funding round, reaching a valuation of $4.5 billion (at the time).

Inzmo

Founded in 2015, INZMO is an end-to-end digital insurance platform and one of the fastest-growing neo-insurers in Europe focusing on covering individual's homes and belongings. In January 2021, the company raised over €3 million in a seed round led by Change Ventures, and according to the company, they are the number one insurtech providing zero-deposit solutions for EU renters.

Join us at the Tech.eu Summit on May 24th in Brussels to discover how and why they can make this claim and what the future holds in store for Inzmo.

Zego

Zego is a commercial motor vehicle insurance company that provides opportunities for businesses - everything from self-employed drivers and riders to entire fleets of vehicles. This UK-founded insurtech closed a $150 million in a Series C funding round in March 2021 that was led by DST Global.

Qover

Another company that you'll have the opportunity to meet and talk to at the Tech.eu Summit is Qover.

This Belgium company was founded in 2016, with the purpose of enabling any company to embed insurance as a native component of or add-on to their core product or service. In doing so, the goal is to help customers increase their opportunities to grow and decrease the cost of insurance as the business scales.

Today, Qover is a leader in embedded insurance orchestration, aiming to create a global safety net of insurance for all. In April 2021, the company raised $25 million in Series B funding round that was used to fuel global expansion efforts.

Shift Technology

Parisian startup Shift Technology was founded in 2013 and delivers AI-powered fraud detection and claims automation solutions that benefit the global insurance industry and its customers. Their products enable insurers to automate and optimise decisions ranging from underwriting to claims, resulting in improved customer experiences, increased operational efficiency, and reduced costs. Shift Technology's most recent funding round saw the addition of $220 million, bringing their total funding to date to $540 million.

Hedvig

Launched in Sweden in 2018, today Hedvig is present in all Scandinavian countries and is an EU-licensed carrier providing home, contents, accident, travel, "clumsiness", and car insurance. The company's main focus is on a younger demographic, and found success via word of mouth marketing due to their reputation and lightning-fast claims service. In September 2021, the company raised $45 million in a Series B round, and has garnered just shy of $100 million in funding to date.

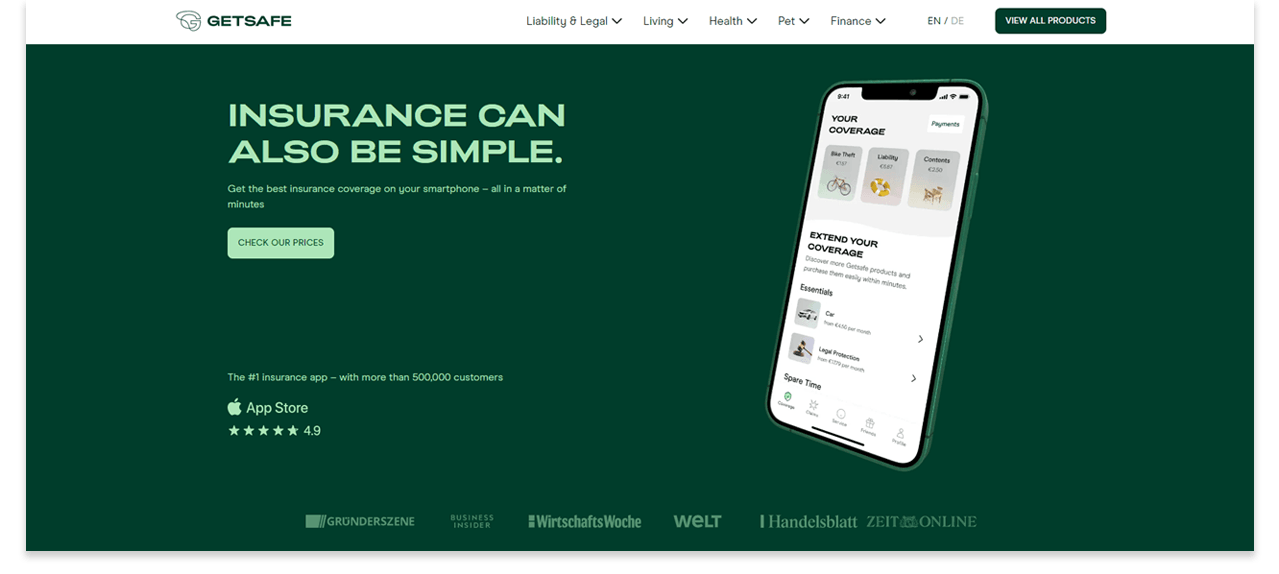

Getsafe

Getsafe is a Heidelberg-based digital insurance platform that offers a range of insurance products, including home, health, and liability insurance. Founded in 2015, the company raised over $100 million to date. Their latest funding round was a $93 million Series B in October 2021 and is backed by notable VC firms including Cherry Ventures, and CommerzVentures. Earlier this year, the company expanded beyond its existing markets of Germany, the UK, and Austria, and added France to its collection.

Would you like to write the first comment?

Login to post comments