Amsterdam-based fintech startup Equip has raised €2 million in a pre-seed funding round. The capital will be used to further develop the company’s platform as it moves forward with its goal of making employer support of team members' financial stability and well-being the norm.

Equip’s €2 million pre-seed round was led by XO Ventures and with the participation of Antler and twelve angel investors hailing from Adyen, ABN AMRO, Secfi, Silverflow, and Van Lanschot Kempen.

You don’t have to look too far to realise that a number of factors including inflation and the ever-increasingly difficult path toward home ownership, a primary driver of wealth accumulation/financial stability have some potentially devastating economic effects in the not-so-far-off future.

In the Netherlands alone, in collaboration with research institute Nibud and Leiden University, recent research presented by Deloitte revealed that in 2022 60% of Dutch households are financially or even unhealthy, especially those under the age of 34. This figure marks a 10% increase from 2021's numbers. "Unhealthy" was defined as those who cannot make ends meet, while "vulnerable" indicates those who can make ends meet but cannot use savings to cover unexpected incidents

The stress of this financial uncertainty is self-evident, with employees two to three times more likely to switch jobs should they see a more compelling offer presented on their plate, losses in productivity, and increasing rates of sick leave. According to Equip, these hidden costs can add up to at least €5,000 per employee per year.

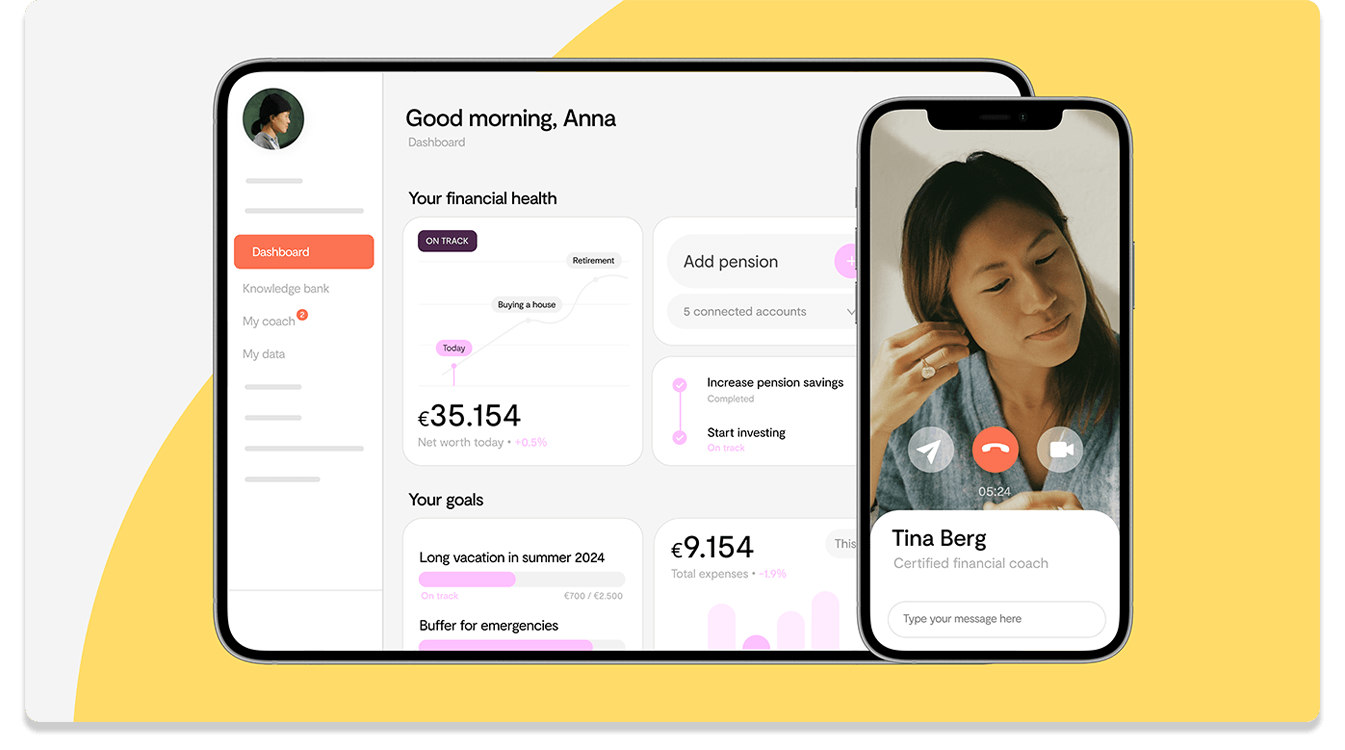

Offering a solution to both employees and employers, former J.P. Morgan executives Toon Peek and Jan Klinkhamer and McKinsey associate Jan Cees van Senden have created Equip, an employer-funded digital financial coach subscription plan that offers a soup-to-nuts set of financial planning tools.

Using a proprietary suite of algorithms to calculate which financial aspects an individual needs to keep their eyes on, as well as access to certified and independent financial planners and coaches, Equip provides employees with suggestions and courses of action to follow in order to meet financial goals, and ultimately help reduce some of the stress associated with today’s financial outlook.

“Supporting financial well-being is the next big frontier for employers towards more satisfied, productive, and loyal employees. In the current economic climate, this support is no longer a "nice-to-have", but a "need-to-have",” explained Peek. "Our mission is simple: we want every employee to experience financial peace of mind, regardless of their income and wealth. Accomplishing this goal not only results in a positive effect on the bottom line of employers; together we're also creating a positive impact on society."

Since launching late last year, the company has garnered the patronage of Dutch clients including War Child, Ticketswap, and Rituals, and now wants to expand this roster well beyond its native borders.

Would you like to write the first comment?

Login to post comments