Medical cannabis accounts for one of the most hyped products in Germany over the last five years, with the development of an abundance of local and international companies poised to service the local medical consumer —people prescribed cannabis by their doctor for serious health problems.

Cannabis is in the news this week, with the German government approving draft legislation on Wednesday to legalise some recreational cannabis use.

But less focus is given to the health of the nearly 200 companies competing for the medical consumer.

I wanted to get an insight into the state of the sector, so I reached out to professional associations, analysts, investors, and the companies themselves.

Most people requested anonymity but shared a dire picture of a sector with the prediction that 80 percent of current startups will fail.

This article dives into how we got here, the challenges for the sector, and what happens next.

Medical cannabis is a tough industry

Stephen Murphy is co-founder and CEO of Prohibition Partners, a B2B media, data and technology cannabis group. He characterised the challenge as:

"Businesses are trying to create something that has never been done before with both feet tied while trying to climb up a hill. It really is exceptionally difficult. And as for first-time founders, it is even harder."

The challenge of getting a prescription for medical cannabis.

Doctors in Germany have been prescribing cannabis to patients since 2017. Yet it still proves challenging. Patients typically need long-term chronic pain unsuccessfully treated by pharmaceuticals such as opioids.

Dr Alessandro Rossoni, co-founder & Managing Director of Nimbus Health, explained:

"Effectively, money is generated for the industry when a doctor writes down your product on a patient's prescription. So if you have a strong brand and a good product, but for some reason, you cannot reach the point of prescription, then you're not selling anything."

Currently, medical cannabis is split between that covered by public health insurance companies and private (self-pay) patients.

And when it comes to the public purse, it's far easier for doctors to prescribe opioids or other pain medication over cannabis. Doctors need to apply for a prescription to be paid for by the public health insurer. Each application can take over an hour, and one in three is rejected.

Rossoni attributes this to an expectation to protect tax dollars against those who are not seriously ill.

A recent survey by the Cannabis Self Help Network in Germany reveals:

- 62 percent can't find a doctor willing to prescribe

- 23 percent have a doctor willing to prescribe cannabis, but the health insurance does not cover the costs

- 11 percent can get cannabis covered by public health insurance and have found a doctor

- 5 percent have a cost commitment from the health insurance company, but can't find a doctor who will prescribe it for me

But it's also worth remembering that it's not always easy to get painkillers prescribed in the first place. It's not uncommon in Germany to give birth with nothing stronger than ibuprofen, and unbelievably homoeopathic treatments are still prescribed by medical doctors and as of 2020, covered by 70 percent of government medical plans.

Therefore it's hardly surprising that half of medical cannabis users are private or self-payers meaning they pay a private clinic such as Canify Clinics in Berlin for their medical consultations and prescriptions.

Several people raised the issue of a subset of longer-term cannabis consumers who switched to prescriptions for ease of purchase. It's unclear whether this group will pivot to recreational cannabis once decriminalised later this year.

An oversaturated market

Everyone I spoke to spoke of an oversupply of local cannabis companies - some German, and some from other countries such as Canada with a local presence. This means a large pool of companies are competing for the same prescriptions.

Rainer Krüger is the Managing Director and Member of the Board of the European Cannabis Association (ECA) He told me: "We now have more than 170 companies for 9.6 tonnes of cannabis."

One industry shared data generated by insurance companies that indicates how much each company has been selling in kilograms through the public health insurance system:

"With over 100 companies, only twelve sell more than 20 kilograms a quarter.

Even being generous, if we imagine eight companies doing more than 50 kilograms a quarter, how can you survive long term, especially if you are a smaller company? It also means that 90 percent of companies are not doing significant sales."

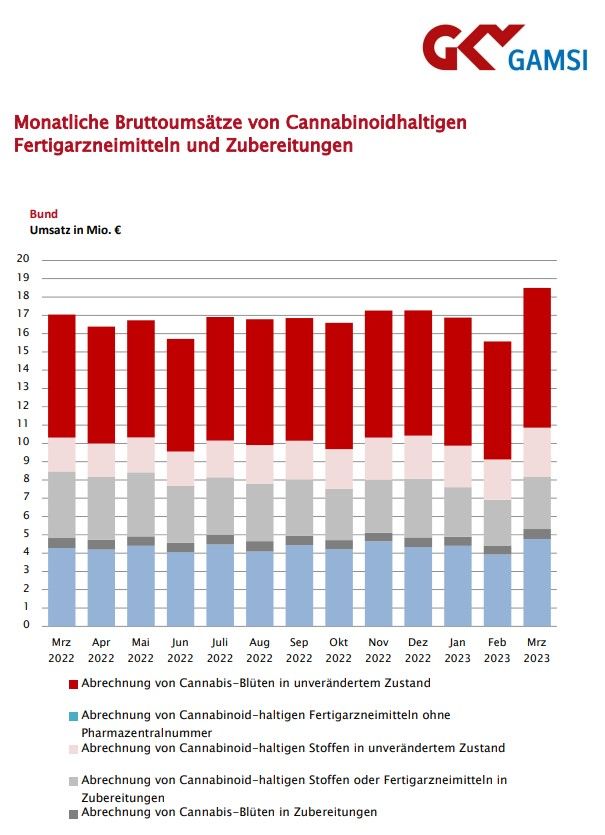

Recently published data by the German National Association of Statutory Health Insurance Funds (GKV-Spitzenverband) demonstrates that public health insurance coverage for medical cannabis in Germany reached €51 million in the first quarter of 2023.

In Q1 2023, the public health system covered almost 100,000 cannabis prescriptions, resulting in an average of €516 per prescription – yep that's expensive – this includes all categories of medical cannabis products.

100,000 prescriptions is not a lot for over 100 companies.

How did we get here?

So how did we get to a situation where there are a lot of companies with cannabis that are not in the hands of patients?

In the German cannabis market, significant funding poured in during 2017 due to the legalisation law, driven by well-funded Canadian companies.

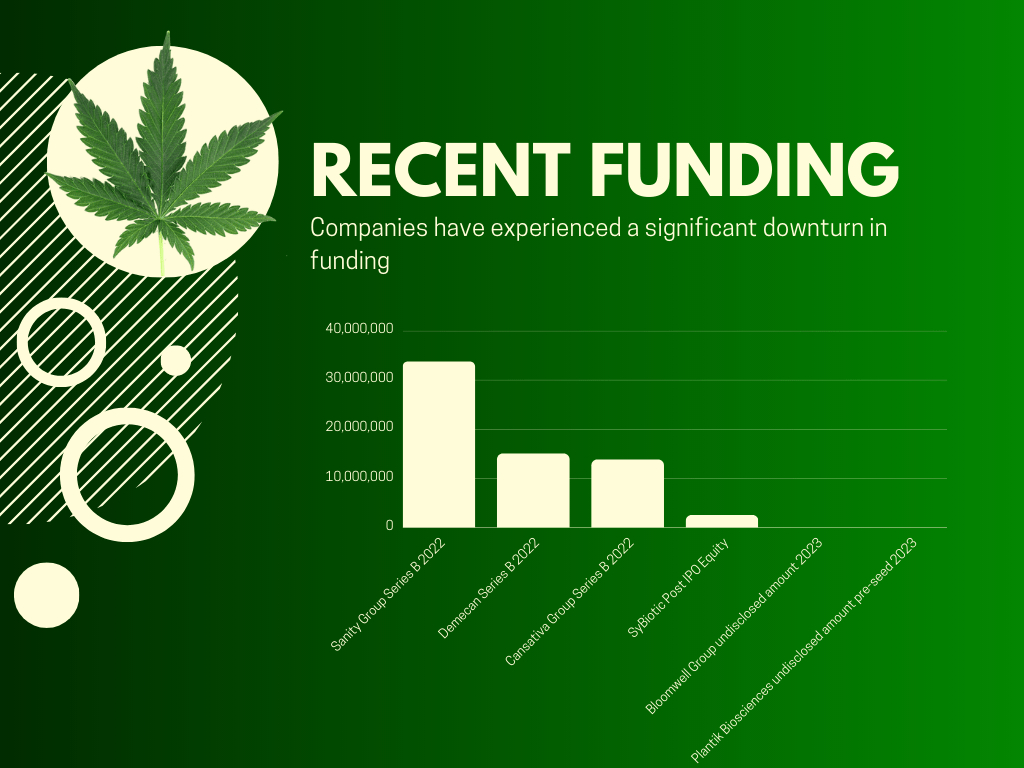

This marked the initial round of funding. Subsequently, the market experienced growth, with numerous companies founded and funded, particularly in 2019 and 2020. However, the pace of cannabis legalisation turned out slower than anticipated, leading to a downturn.

In November 2021, the new government renewed focus on cannabis legalisation, sparking a second wave of funding. Companies previously thought to have limited funding potential managed to raise substantial amounts. Investment had been declining until that point but rebounded.

Being reliant on a single piece of legislation is highly problematic.

Now, with the realisation that full cannabis legalisation won't happen as expected, securing funding has become increasingly challenging. As time has passed, some companies are encountering failure and difficulty obtaining new investments.

Further, many companies placed their bets on selling legalised cannabis and are now trying to adapt to the established and competitive medical cannabis market, as the original vision of widespread recreational use did not materialise.

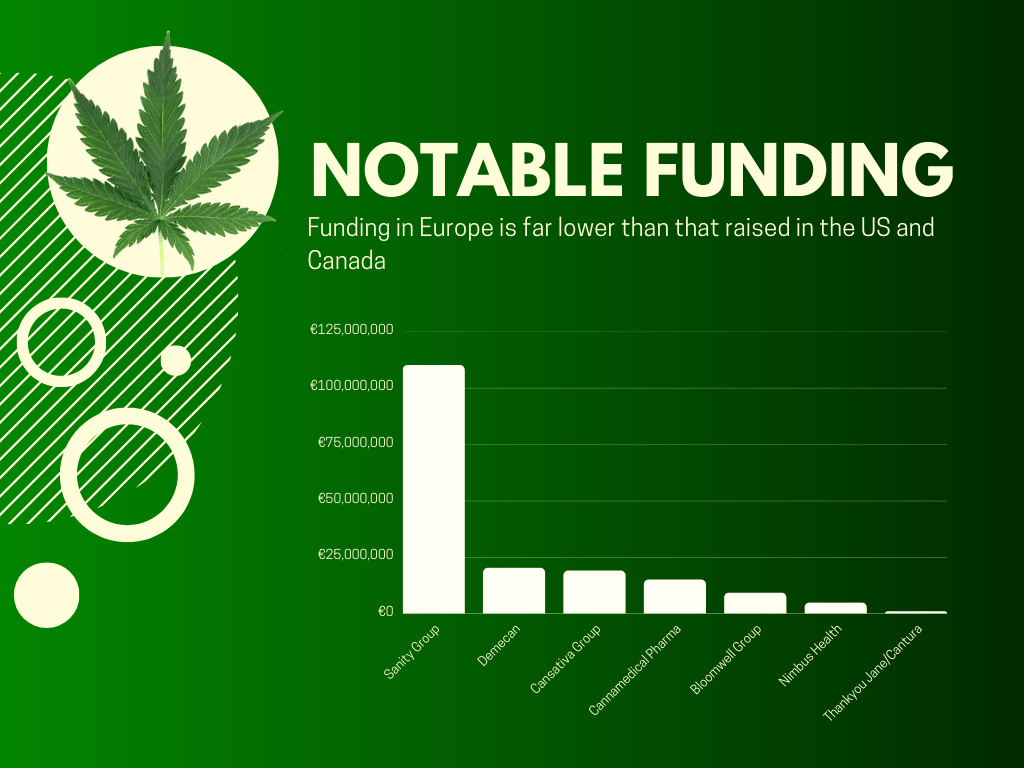

Determining the funding landscape of German medical cannabis companies presents a challenge due to the prevalence of private fundraising efforts, which means a lack of information about both the investors involved and the capital secured. Here's some of what we know:

Murphy notes that "a single LP in Canada has raised five times as much as Europe combined.

"Companies are trying to develop a whole supply chain, refine legislation, and educate doctors, and there's not enough money going in to drive forward the change required."

So back to that 80 percent number…

Let's face it; it's normal for new industries to go through a hype phase, which crashes, then matures and stabilises. The more companies that leave the market, the more helpful in reducing the oversupply.

But as of now, almost everyone I spoke to agreed with the prediction number, with one suggesting it underestimated the reality.

Murphy is a bit more optimistic, pointing to a growing patient base and the opportunity for developing infrastructure:

"So I think there are many things to be exceptionally optimistic about."

One industry insider told me that of the 100-plus companies, maybe only seven had a significant fundraising of over 10 million. All the others are tiny companies.

"And if you started in 2019 and raised two or three million, it's four years later, and you need to have paid for many things, including licences, permits, and supplies. So I doubt there's much left to grow with."

He suggests that even companies with more considerable fundraising burnt through a sizable chunk of money but were buffered by having more to spend.

"There is not a lot of money left to grow as the prices are going down."

Medical cannabis needs to be rooted in science and doctor education is critical

Finn Hänsel, CEO of Sanity Group asserts that a concentrated effort in doctor education is necessary as more patient eligibility will "help the oversupply problem and reduce market pressure.

Everyone I spoke to was highly critical of cannabis companies that make doctor education and scientific research someone's responsibility.

One person told me, "There are a lot of companies today that just come into the market. They don't do the research, they don't do the analysis, they just push additional products into the market."

Another agreed: "These companies are basically treating the medical market as a kind of recreational market in disguise."

Another industry insider told me that the bulk of companies present in Germany don't want to work with experts, or with the mindset "that this is a regulated industry. Laws cover everything.

Instead they are more interested in producing cool marketing campaigns, and engaging with influencers.

It is easy to set up 10 million in the marketing campaign that puts 10 million in developing R&D programs for genetic research or dosage efficacy. Nor are they recruiting top R&D scientists.

It is easier to sit together with champagne and sit on the spree with nice girls."

He's not wrong.

Perhaps the most ostentatious example of this is Juicy Fields, a startup founded in Berlin last year which raised funds from crowd investment.

Part (if not all) Ponzi scheme, it promised investors could double their money, an amount unheard of, in a haze of parties and marketing. It ended up here.

With lawsuits pending, it's alleged that the amount scammed could equal that of the $4 billion OneCoin scam.

What can cannabis companies do right now?

Hänsel highlights the need for valid business models with good differentiation:

"If you don't differentiate yourself by being more innovative or bringing better products or education, then it's a company problem, not a market problem."

I spoke to Falk Altenhöfer from investment firm Cannabis-Startups.com, dedicated to advancing the medical cannabis industry in Germany and beyond.

He suggests that companies must "prioritise product quality, operational efficiency, compliance, and patient education.

Being technology-driven is no longer optional; it's a necessity for scalability and compliance.

I hope all companies are meticulously tracking their financial metrics and have enough runway to sustain operations during this challenging phase."

He further advises startups and scaleups to:

"Focus on compliance and quality. Understand the regulatory landscape deeply and build your business to exceed those standards. Invest in technology that enables efficient operations and rich data analysis.

Cultivate strong relationships with medical professionals and patient groups.

Lastly, be prepared for a long game - regulatory environments can change, and scaling a medical cannabis business responsibly takes time."

Krüger is far more circumspect but blunt:

"Be quiet for the next five years, do your job, make your developments, do the hard work."

The future is pharma cannabis if we can get past the patent problem

Pharmaceutical cannabis is currently a field dominated by a small number of companies producing a small number of medications such as Sativex, Epidiolex, and Dronabinol.

Everyone I spoke to sees this as the long-term future of cannabis in healthcare.

However, one of the main factors holding back research into new treatments with cannabis and cannabinoids (and therefore, the emergence of new cannabinoid treatments) is that it is difficult to patent treatment with medicine which comes directly from plant material because it is challenging to claim that such a treatment is an original, novel creation.

Rossoni explained:

“The problem is you might be able to pattern the plants that you develop, but you're not able to patent the ingredients that are part of the active ingredients. And those active ingredients, you can just basically allocate or distribute to the same way, and then do a copycat of the product.”

Hänsel agreed asserting:

"Because of this, there is no real incentive for companies to develop finished pharmaceuticals right now. And that's the reason why I think it will take a long time.

Krüger (who also works in pharmaceutics) sees a future in personalised medicine:

"The DACH region is full of highly educated people and the highest competence for developing pharmaceutical products. But we need research and data-driven, funded, multi#phase trials. And we need more investors who invest in future projects, not stories."

Nimbus was acquired by pharmaceutical company Dr Reddy's Laboratories in 2022. It has established an internal accelerator to advance scientific teams – who usually struggle to fund the necessary multi-phase research trials.

"We combine regulatory and development experience with the startups mentality and cannabis knowledge network- We've sold directly to market for years as so we're really on the forefront of what's new and happening and we want to onboard protects to get to finished pharmaceuticals before anyone else goes there." explained Rossoni.

Sanity Group subsidiary "Endosane Pharmaceuticals", is currently developing a cannabinoid-based finished drug for post-traumatic stress disorder and anxiety in collaboration with the UCI, California.It's being research in a phase two clinical study.

But how does this all stack up with the incoming legal cannabis I mentioned earlier?

Recreational cannabis is coming

This week the German government approved draft legislation on Wednesday to legalise some recreational cannabis use. The legislation will remove cannabis from the Narcotics Act, where it has been listed as a prohibited substance alongside heroin, LSD, and cocaine. Individuals can grow three female flowering plants at home for personal use and will also be granted the right to purchase up to 25 grams of cannabis at a time, with a monthly limit of 50 grams per person (although this is capped at under 30 grams for those under the age of 21). Cannabis Social Clubs will be authorised to accommodate a maximum of 500 members.

However, despite the progress made, challenges remain, particularly concerning the non-profit nature of the Cannabis Social Clubs, who are limited to a maximum of 500 members.

Nimbus expresses scepticism about the viable business model within the non-profit clubs.

It's also unclear the number of clubs an individual can join simultaneously, as well as the determination of prices for products supplied by non-profits – what will be their ability to compete with the existing black market already abundant in Germany?

The legislation must still be approved by Parliament.

Can or should companies diversify and vertically integrate into key markets? The strongest companies in Europe are those with diverse product offerings, such as delivering their own products while offering their services to other businesses.

How many companies will weather the downturn? When will prescribing increase?

Altenhöfer suggests that the ongoing normalisation of medical cannabis, including efforts to simplify the subscribing process mean "there is a clearer path for startups and investors. The biggest change we observe is the focus on patient profiles, with technology playing a crucial role in ensuring patients get the appropriate strains. As more time passes, cannabis companies increasingly use historical data to provide the right dosage forms for patients.

I see a significant wave of doctors prescribing cannabis, including for private patients who are paying for their treatments out of pocket."

The landscape of medical cannabis in Germany has experienced a whirlwind journey, evolving from a highly anticipated and hyped sector to one grappling with challenges and intense competition.

As doctors increasingly embrace cannabis prescriptions, patient profiles and personalised treatment approaches emerge as pivotal themes for the industry's progression.

While uncertainties persist, a renewed focus on compliance, quality, and patient education, coupled with innovation, holds the potential to reshape the trajectory of medical cannabis in Germany.

Would you like to write the first comment?

Login to post comments