The Landbanking Group has raised $11 million in Seed funding. The round was led by BonVenture and André Hoffmann and included participation by 4P Capital, Vanagon, Planet A, the SUN Institute of the Deutsche Post Foundation and angel investors and family offices such as Prince Maximilian of Liechtenstein, Alexa Firmenich, Jan-Hendrik Goldbeck and Fabian Strüngmann.

Founded in 2022 The Landbanking Group has grown into an international team of 40 experts in ecology, ecosystem modelling, data science, AI, engineering, financial engineering, and business building. The Munich-based eco-fintech proves natural capital data through earth observation, digital in-situ data, machine learning and decentralised ledger technology.

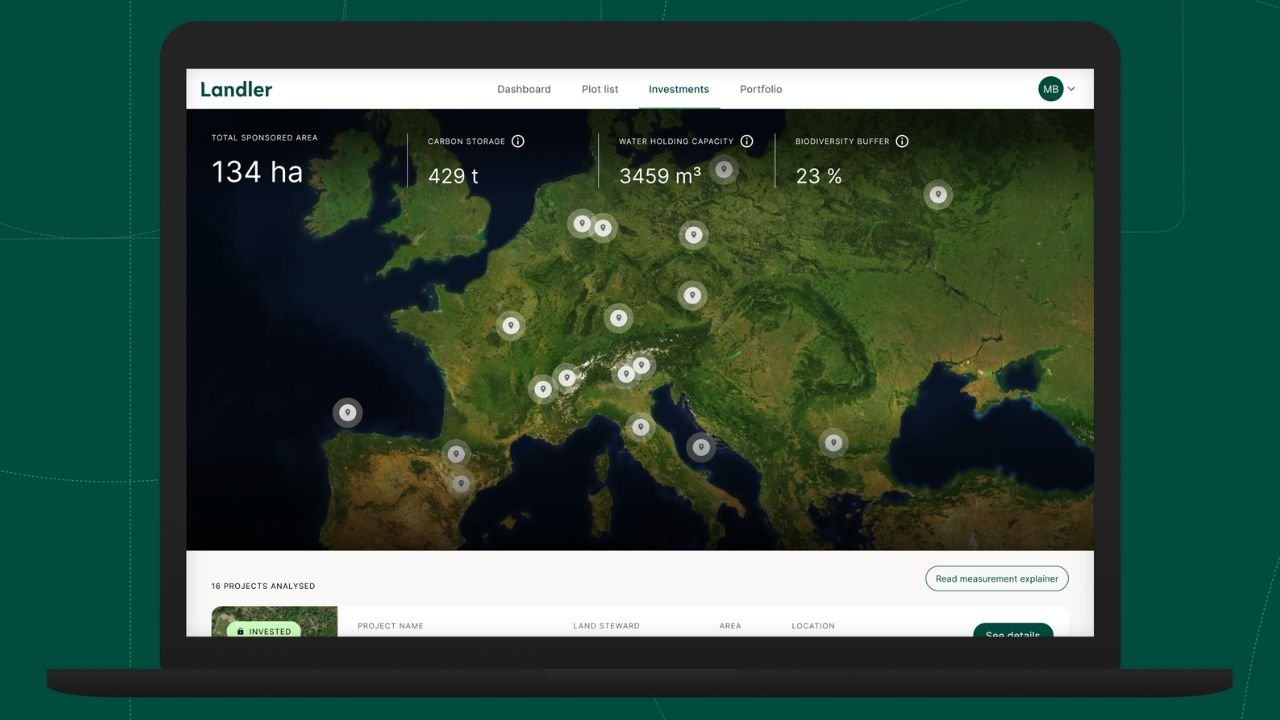

It provides balance-sheet grade nature equity assets aimed at agri-food, energy, resource or infrastructure companies, and also increasingly for insurance providers and financial institutions. It has just launched its natural capital platform Landler.

“As a high-impact investment fund we consider nature and biodiversity as critical for our common future. The Landbanking Group has developed a market-innovating platform to monitor nature in a trusted and transparent way. Through our investment we want to be part of this exciting journey from the beginning,” says Dr. Erwin Stahl, Managing Partner at BonVenture.

Lead image: via The Landbanking Group. Photo: Uncredited.

Would you like to write the first comment?

Login to post comments